-

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 24

-

In light of the Federal Housing Administration's strong financial performance, now is not the time to "reduce the FHA's footprint," but rather to broaden the critical access to credit role it plays.

December 3 Kellum Capital Group and Kellum Mortgage

Kellum Capital Group and Kellum Mortgage -

Private mortgage insurance now has almost matched the government's Federal Housing Administration program in market share, having gained approximately eight percentage points in the past five years, Keefe, Bruyette & Woods found.

November 26 -

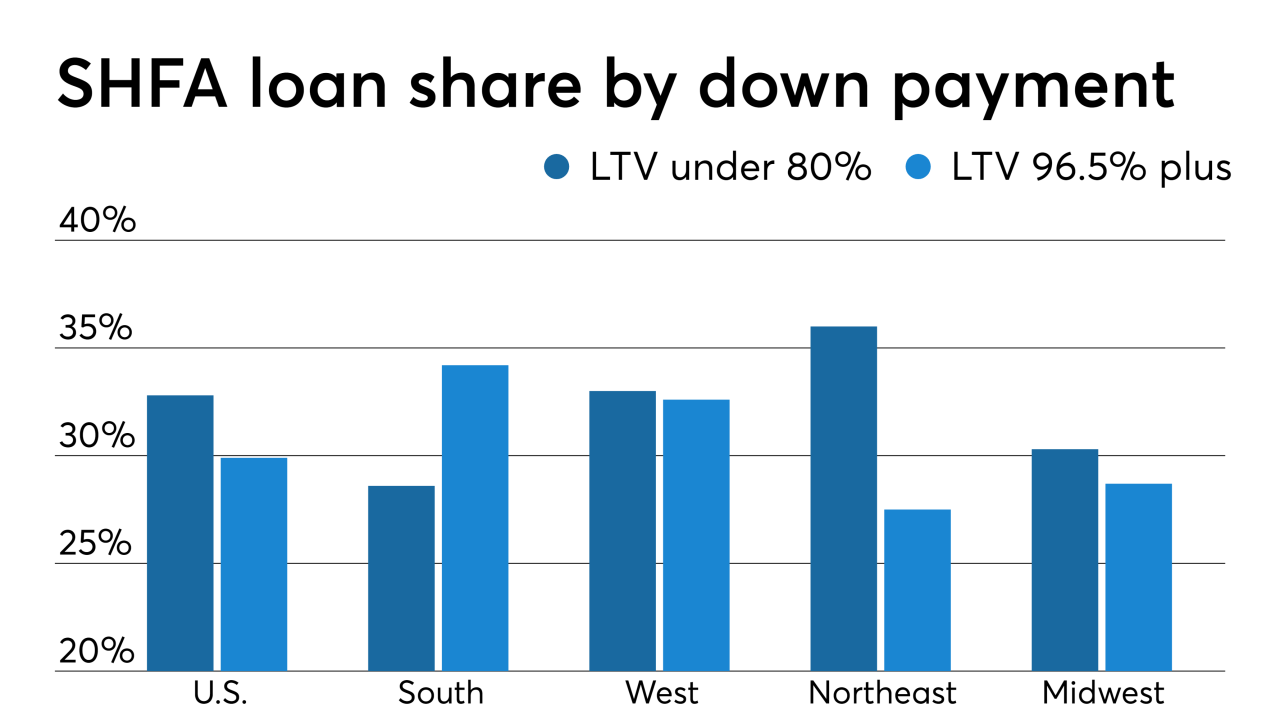

It was long believed down payment assistant programs were recipes for poor loan performance and future delinquencies, but that's not the case, according to a new report.

November 12 -

Faced with higher property prices and piles of student debt, Americans are getting older and older before they buy a home.

November 8 -

Gentrification and rapid home price growth have intensified the loss of wealth the African-American community experienced post-crisis, widening the chasm between what white and black borrowers can afford, Redfin found.

October 17 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4 -

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

From the Lone Star State to the beaches of Florida, here's a look at the top 15 housing markets with the largest influx of VA purchase loans between 2015 and 2018, according to Veterans United.

August 9 -

The Federal Housing Administration program insured three-quarters of the mortgages obtained by millennial homebuyers as most had trouble saving up for a 20% down payment, a LendEDU study found.

August 6 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Through the first half of the year, there have has been 2,000 single-family homes sold countywide, a 6.45% decline from the comparable period last year when 2,138 homes were sold.

July 22 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

An expanding gap between sharp home price appreciation and relatively feeble income growth dating back to 1960 brewed America's affordability crisis, according to Clever Real Estate.

July 17 -

Taking aim at the racial wealth gap in the U.S., Democratic presidential candidate Kamala Harris proposed a $100 billion program to help black families and individuals buy homes.

July 8 -

A Bay Area real estate agent has been indicted on charges of fraud and money laundering after allegedly promising home loans to clients then taking their money.

July 5 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4