-

Increased purchase lending and added pressure from Fannie Mae and Freddie Mac’s new loan limits should drive the likelihood of borrower misrepresentation.

August 6 -

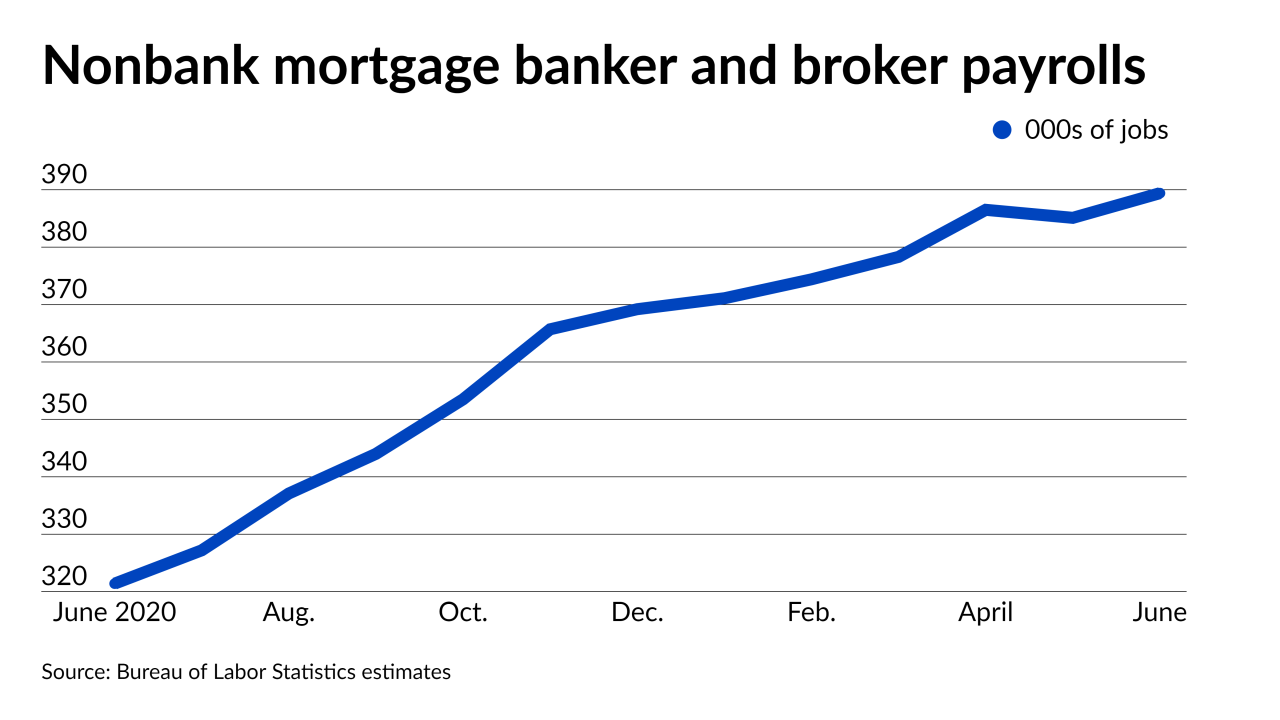

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The hot hot real estate market has pulled homeowners out of a debt trap that many had been stuck in since the great financial crisis more than a decade earlier.

August 6 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

The proposal should be withdrawn or reworked around the needs of small players they impose a disproportionate burden on, the Community Home Lenders Association said.

July 30 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29 -

The government-sponsored enterprise's single-family credit reserve release caused earnings to spike.

July 29 -

A hike in guarantee fees charged to lenders for the companies’ backing of loans was due to expire this year, but lawmakers now want to extend it to raise $21 billion for the bipartisan package.

July 29 -

While federal regulators attempt to overhaul the Community Reinvestment Act for banks, Congress has shown little interest in applying it to other lenders. But recent moves in Illinois and New York have given some stakeholders hope that state lawmakers will pick up the slack.

July 26