-

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

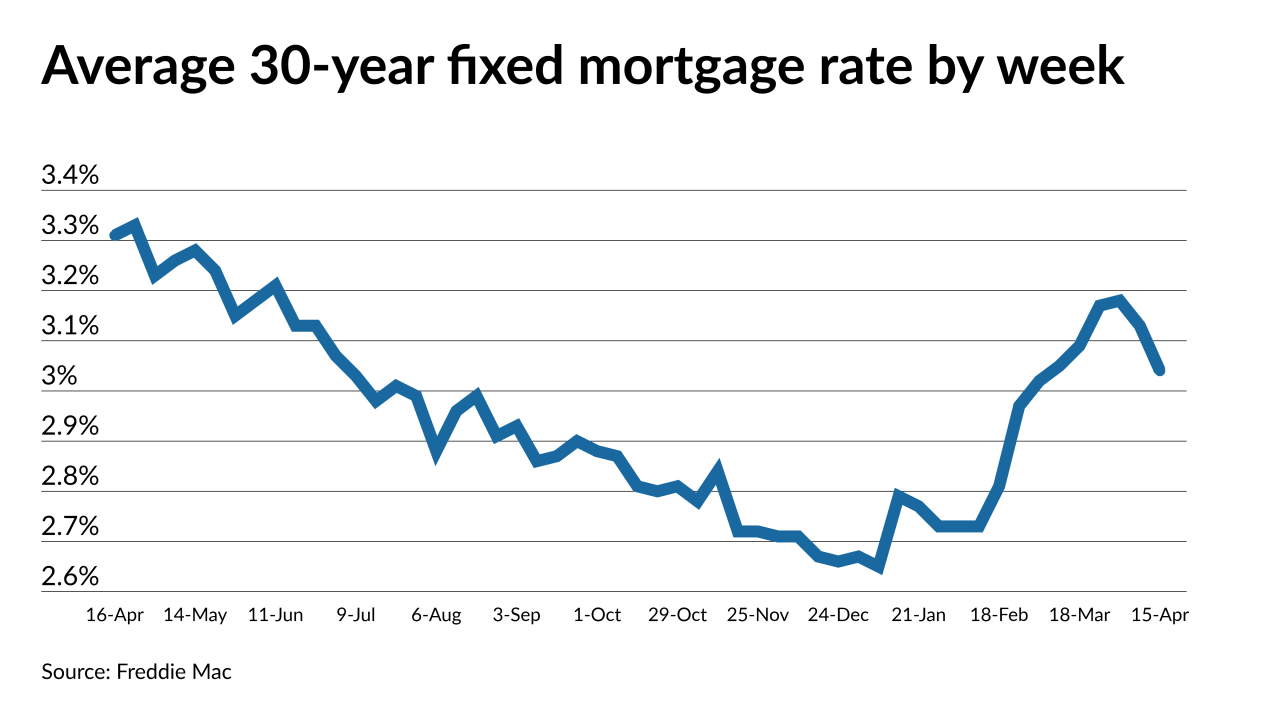

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

Long-term home-based operations are more likely than they were prior in March of last year, but some origination and servicing professionals will return to the office, a recent survey suggests.

April 20 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

While home sales have softened since October, they are still above pre-pandemic levels, indicating that construction activity will remain strong for some time.

April 16 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The markets and the Fed are not on the same page about the future of inflation. Luke Tilley Senior Vice President and Chief Economist at Wilmington Trust will discuss the economy and inflation.

-

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The development bodes well for outcomes on distressed loans backed by major government-related mortgage investors Fannie Mae and Freddie Mac.

March 26 -

The FHFA’s forbearance extension to September is forcing nonbank servicers to buy out more delinquent loans. It's also upended loss estimates for investors and made racial and income disparities in the mortgage market worse.

March 25 -

Stuck between local zoning hurdles and a lack of ideal federal financing, ADUs could be an important aspect to unlocking much-needed inventory.

March 24 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23