-

But recent rate drops in response to the Ukraine invasion and increases in broader employment suggest another uptick in housing finance payrolls is not out of the question.

March 4 -

Employment numbers suggest that interest in home purchases is bearing up well despite some limits on consumer spending and normalization in the mortgage market after two banner years.

February 4 -

Total U.S. jobs came in below consensus estimates in December, according to the Bureau of Labor Statistics.

January 7 -

But the latest employment report also reveals that if construction hiring remains sufficiently strong, home purchase originations are on track to grow to $1.7 trillion from $1.6 trillion next year.

December 3 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

Plans to taper rate stimulus could further dampen industry employment, depending on the extent to which decreased volume is offset by staffing needs driven by the shift to work-intensive purchase loans.

November 5 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The tool is designed to help lenders adjust their underwriting to address the growing faction of non-W2 employees, which is expected to make up half of the workforce by 2027.

July 29 -

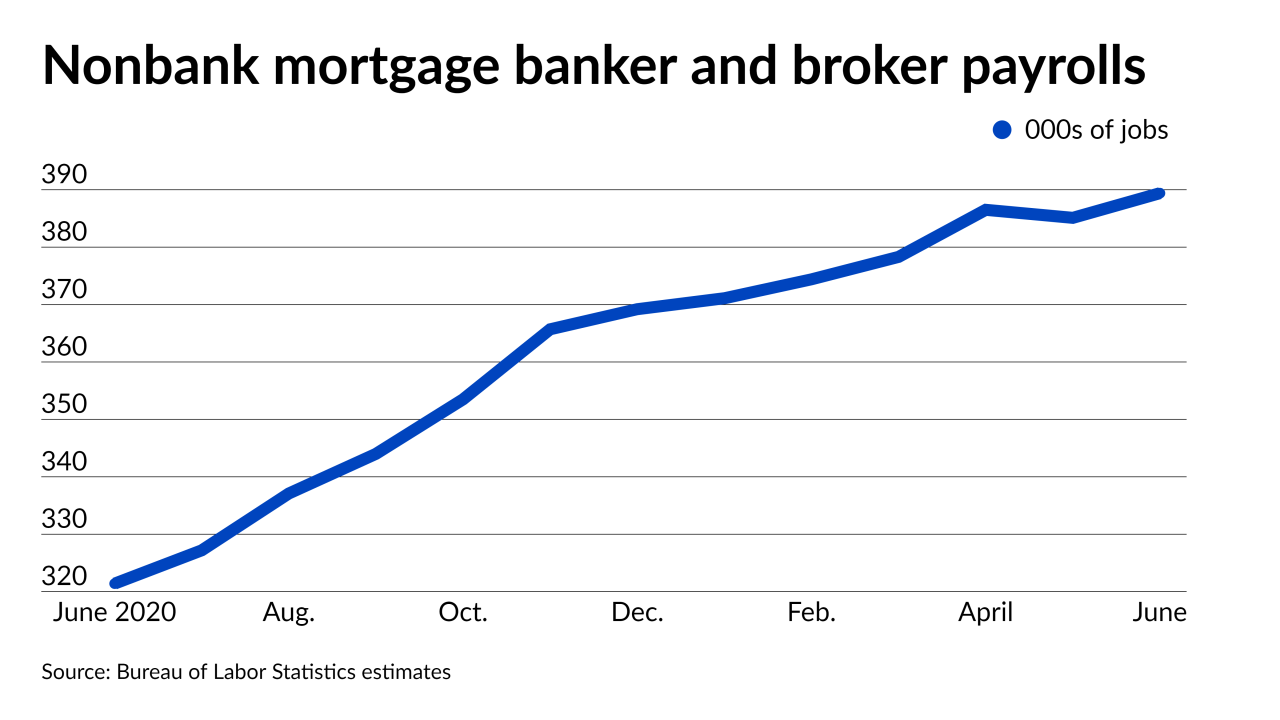

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

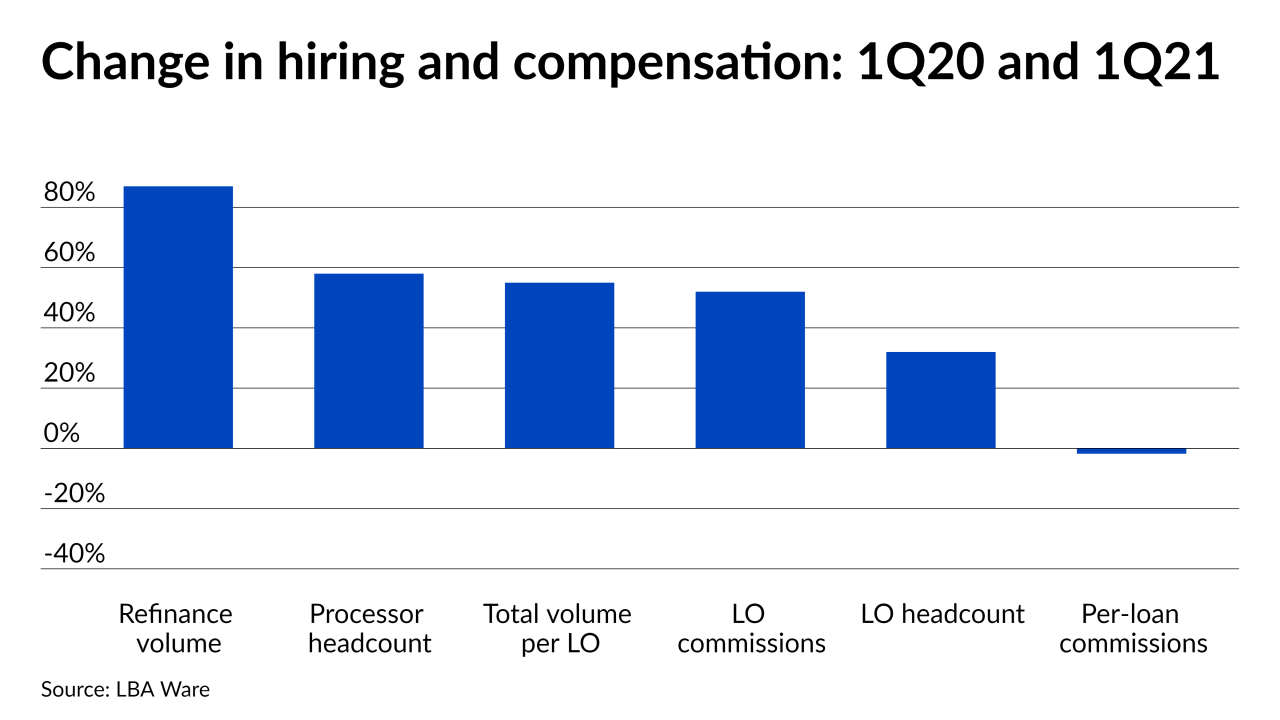

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

The relatively small addition of 266,000 positions to the broader market in April suggests that income uncertainty, which could impact some borrowers’ ability to qualify for or pay loans, could become a concern among lenders and brokers.

May 7 -

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

A cross-training strategy that hasn’t been widely used since the Great Recession is coming back into vogue among outsourcers.

March 5 -

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

The estimates in the Bureau of Labor Statistics latest numbers were only marginally higher than the previous month, which may reflect more deliberate hiring and a preholiday slowdown.

January 8 -

Even with a slight downward revision to September’s numbers, employment in the industry remained incredibly high through October as home-loan refinancing continued to surge.

December 4