-

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

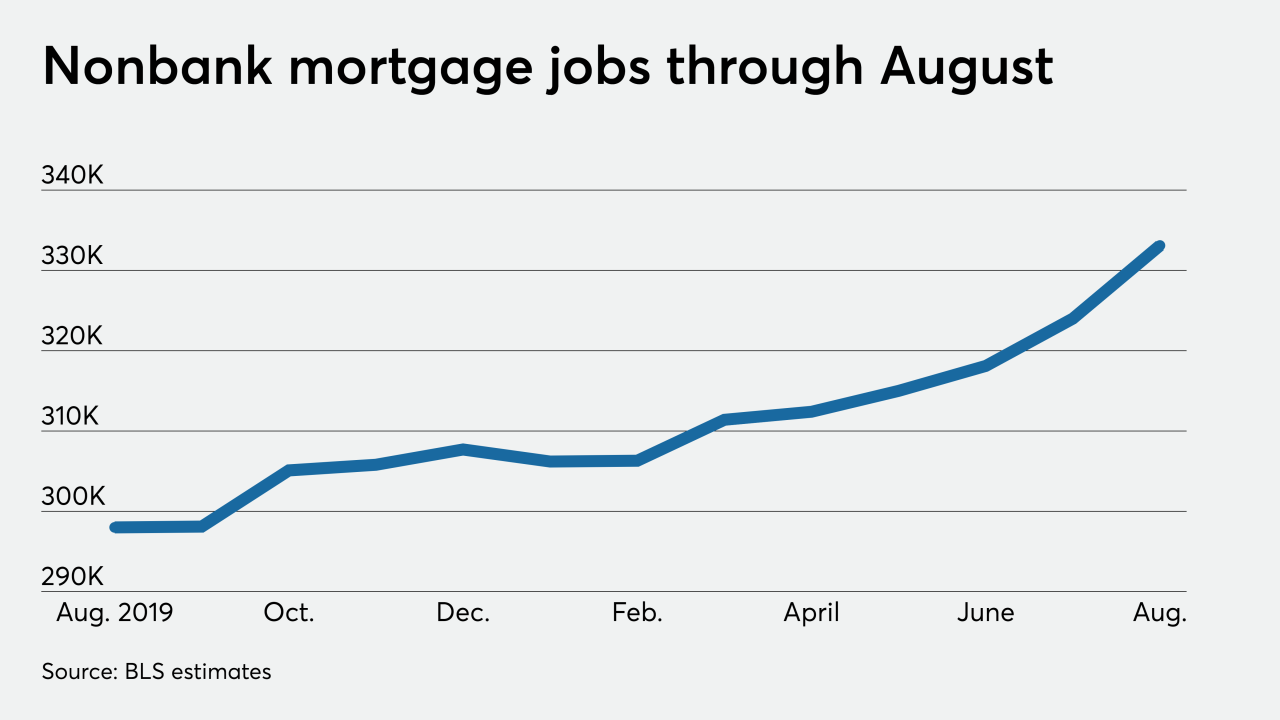

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

The relatively small addition of 266,000 positions to the broader market in April suggests that income uncertainty, which could impact some borrowers’ ability to qualify for or pay loans, could become a concern among lenders and brokers.

May 7 -

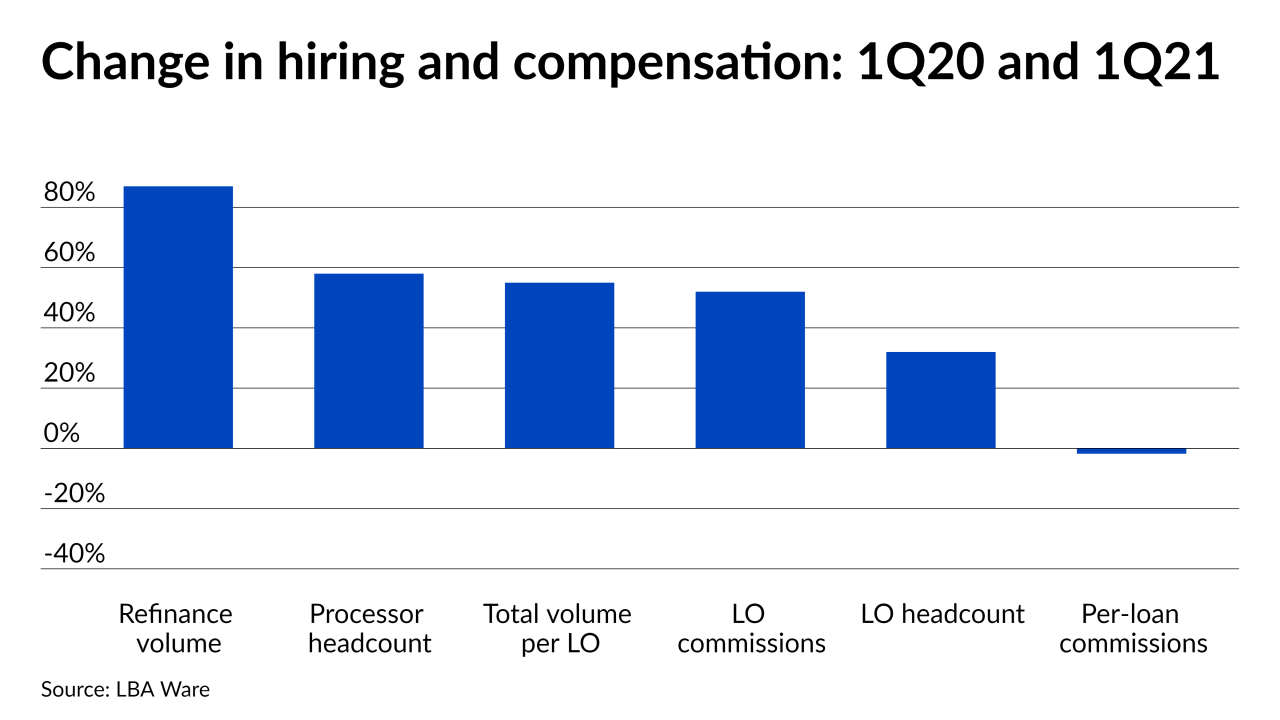

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

A cross-training strategy that hasn’t been widely used since the Great Recession is coming back into vogue among outsourcers.

March 5 -

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

The estimates in the Bureau of Labor Statistics latest numbers were only marginally higher than the previous month, which may reflect more deliberate hiring and a preholiday slowdown.

January 8 -

Even with a slight downward revision to September’s numbers, employment in the industry remained incredibly high through October as home-loan refinancing continued to surge.

December 4 -

With the coronavirus cutting employment or wages in 32% of households, the number of potential homebuyers could shrink and cause home price growth to hit its inflection point, analysts say.

November 13 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 9 -

A number of unknowns about the election and the coronavirus response kept consumer confidence in check, according to Fannie Mae.

November 9 -

The new record in third-party originator hiring numbers adds to indications that some lenders have been leaning harder on the wholesale channel to address capacity issues amid the origination boom.

November 6 -

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

With infections resurging, consumer confidence in the housing market hit a snag in July, but sellers are feeling better about their prospects, according to Fannie Mae.

August 7 -

The rising number of positions appears to reflect an ongoing need to adjust capacity to address rate-driven demand.

August 7