-

With the coronavirus cutting employment or wages in 32% of households, the number of potential homebuyers could shrink and cause home price growth to hit its inflection point, analysts say.

November 13 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 9 -

A number of unknowns about the election and the coronavirus response kept consumer confidence in check, according to Fannie Mae.

November 9 -

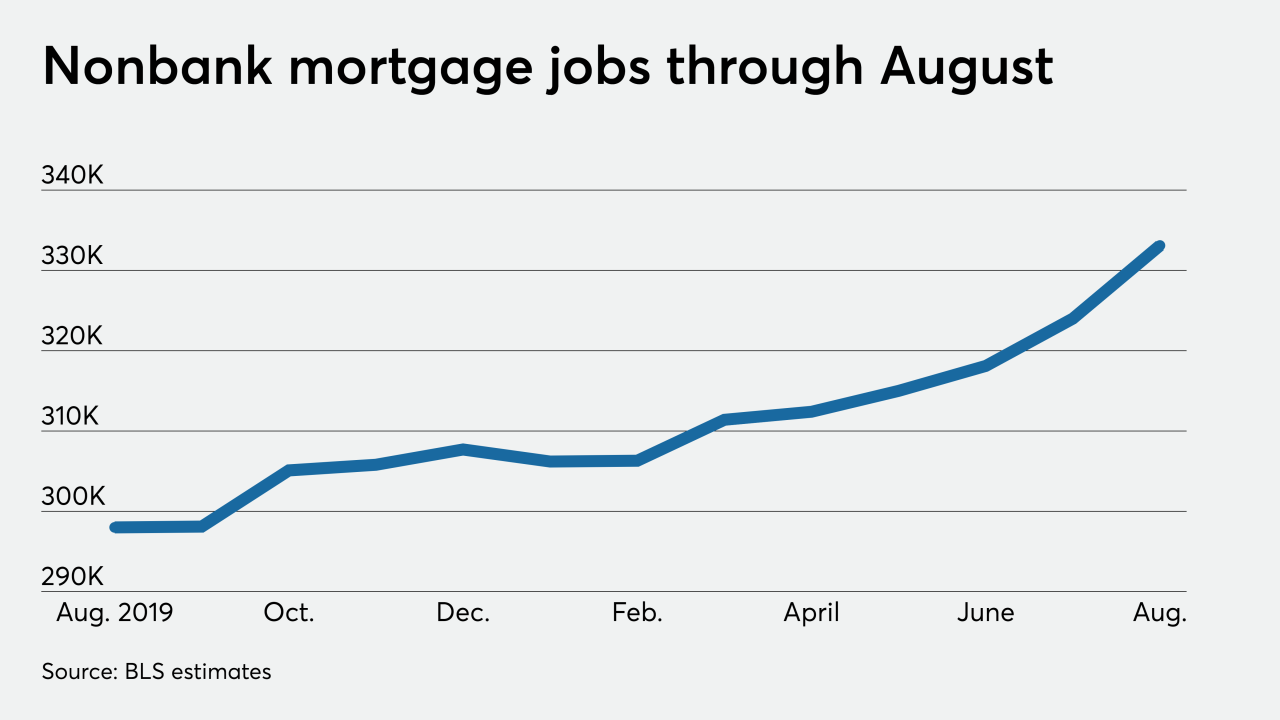

The new record in third-party originator hiring numbers adds to indications that some lenders have been leaning harder on the wholesale channel to address capacity issues amid the origination boom.

November 6 -

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

With infections resurging, consumer confidence in the housing market hit a snag in July, but sellers are feeling better about their prospects, according to Fannie Mae.

August 7 -

The rising number of positions appears to reflect an ongoing need to adjust capacity to address rate-driven demand.

August 7 -

While the new employment numbers bode well for housing and loan performance in the short term, concerns abound regarding how the unemployment rate and furloughs could affect prospects for the business later.

July 2 -

For potential higher-end homebuyers, the pandemic was merely a pause, but for those seeking affordable properties — often people of color — it created yet another barrier.

June 23 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

Nonbank mortgage hiring inched down when overall employment plunged in April. The subsequent recovery in overall jobs suggests the housing-finance industry is still bearing up well despite coronavirus-related strain.

June 5 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

March 6 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Unexpected rate drops and other factors drove a surprising rebound in nonbank mortgage hiring during what is usually a slow season.

February 7