-

While the new employment numbers bode well for housing and loan performance in the short term, concerns abound regarding how the unemployment rate and furloughs could affect prospects for the business later.

July 2 -

For potential higher-end homebuyers, the pandemic was merely a pause, but for those seeking affordable properties — often people of color — it created yet another barrier.

June 23 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

Nonbank mortgage hiring inched down when overall employment plunged in April. The subsequent recovery in overall jobs suggests the housing-finance industry is still bearing up well despite coronavirus-related strain.

June 5 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

March 6 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Unexpected rate drops and other factors drove a surprising rebound in nonbank mortgage hiring during what is usually a slow season.

February 7 -

The estimated number of mortgage professionals employed by nondepository institutions inched down in November 2019 following a surge in the previous month.

January 10 -

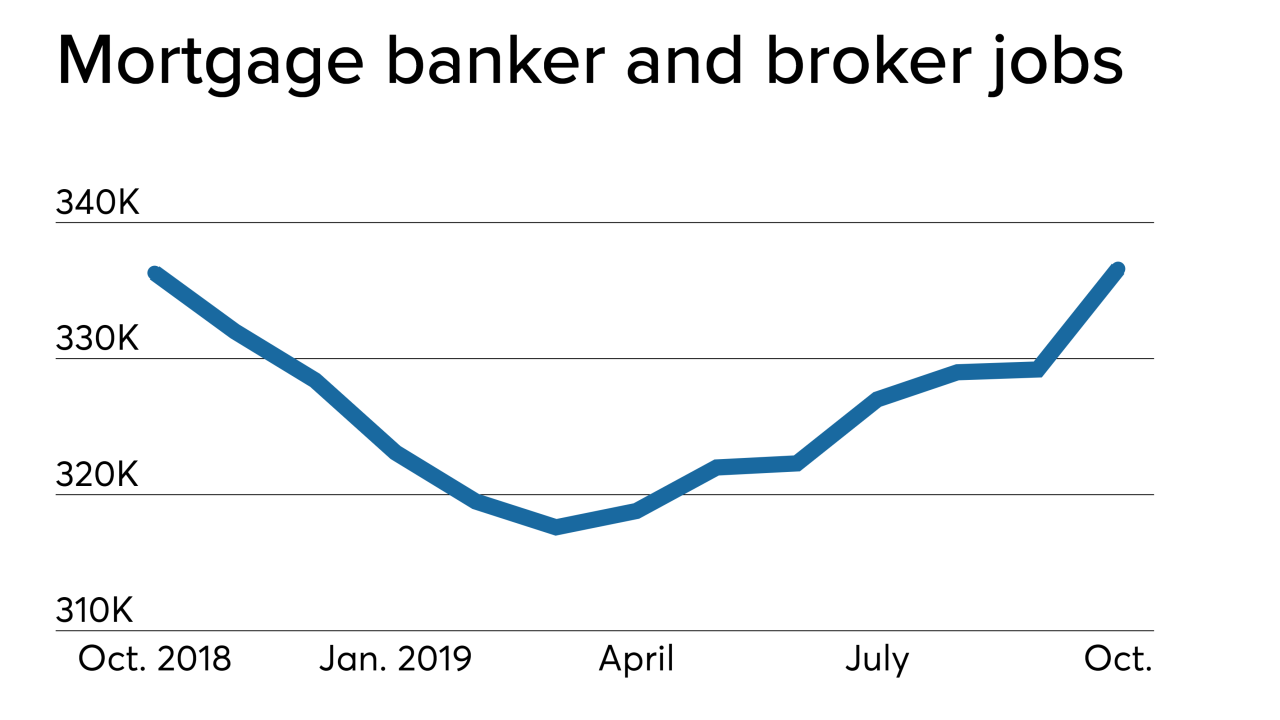

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

June employment by nondepository mortgage bankers and brokers was little changed from the previous month, but later numbers could prove stronger given some influential lenders' interest in staffing up.

August 2 -

From the Carolinas to the Sunshine State, here's a look at the cities offering the biggest job growth over the past five years.

July 19 -

Bolstered home equity gains from rising prices put owners in a stronger position should another housing bubble be on the horizon, according to CoreLogic.

July 18 -

After months of backsliding followed by a modest increase in April, nondepository mortgage companies added 3,200 workers in May, as the overall job market gained steam.

July 5 -

After a sustained downward trajectory, nondepository mortgage companies added 1,200 workers in April, a modest boost for lenders during prime season for the housing market.

June 7