-

The estimated number of mortgage professionals employed by nondepository institutions inched down in November 2019 following a surge in the previous month.

January 10 -

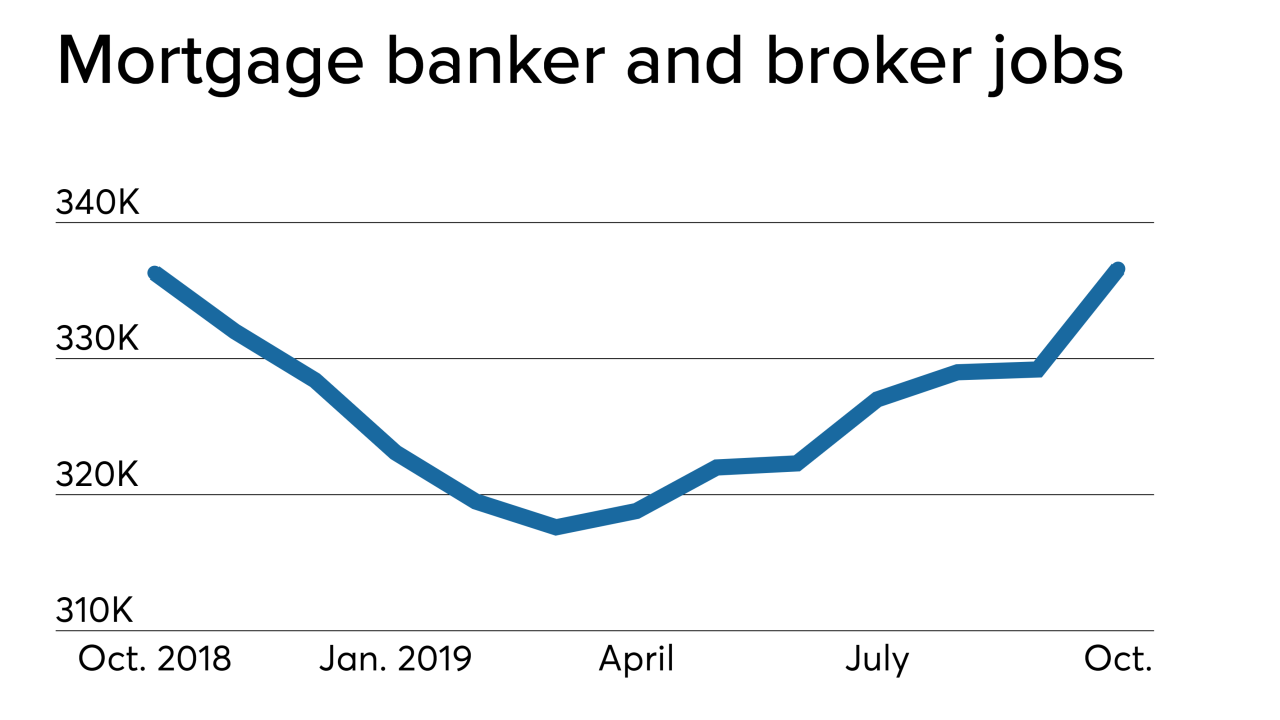

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

June employment by nondepository mortgage bankers and brokers was little changed from the previous month, but later numbers could prove stronger given some influential lenders' interest in staffing up.

August 2 -

From the Carolinas to the Sunshine State, here's a look at the cities offering the biggest job growth over the past five years.

July 19 -

Bolstered home equity gains from rising prices put owners in a stronger position should another housing bubble be on the horizon, according to CoreLogic.

July 18 -

After months of backsliding followed by a modest increase in April, nondepository mortgage companies added 3,200 workers in May, as the overall job market gained steam.

July 5 -

After a sustained downward trajectory, nondepository mortgage companies added 1,200 workers in April, a modest boost for lenders during prime season for the housing market.

June 7 -

Nondepository mortgage companies cut another 1,500 workers in March as the housing market's peak season got underway, suggesting that even with business potentially picking up, lenders remain cautious about hiring.

May 3 -

Nondepositories in the mortgage business cut 2,900 more jobs in February, bringing industry employment to its lowest point in nearly three years.

April 5 -

As 2019 got underway, weakness in the housing market drove the number of workers employed by nondepository mortgage companies down to a low not seen since August 2016.

March 8 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Employment at nondepository mortgage companies dropped considerably in November, as the combined effects of lower volumes and seasonal slowing reduced hiring needs.

January 4 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5 -

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

October 5