-

Prepayment speeds were lifted to a 12-month high in June thanks to historically low interest rates, according to Black Knight Financial Services.

July 27 -

New York's State Assembly has passed legislation that seeks to address problems related to preforeclosure vacant and abandoned properties.

June 3 -

Servicers are taking a much-needed hard look at the full range of customer touch-points that they operate, and NMN's 10th annual Mortgage Servicing Conference promises to offer an engaging agenda of hottest trends and topics.

March 8 National Mortgage News

National Mortgage News -

Wells Fargo & Co., the largest U.S. home lender, agreed to pay $1.2 billion to resolve claims related to its Federal Housing Administration mortgage practices.

February 3 -

SingleSource Property Solutions in Canonsburg, Pa., has merged with iMortgage Services in Pittsburgh.

December 16 -

Stewart Information Services Corp., a Houston-based title insurance underwriter, has launched a companywide rebranding effort to support other growth initiatives.

October 7 -

Investor expectations for preparing real estate owned properties for conveyance vary wildly and demand a tailored approach from servicers.

October 7 Superior Home Services

Superior Home Services -

Servicers should make some simple requests of their tech vendors to tailor compliance systems to their needs and avoid the headaches of overhauling compliance systems.

September 18 RES.NET, USRES

RES.NET, USRES -

LRES in Orange, Calif., and OSC in Kennesaw, Ga., have partnered to broaden their offerings of real estate services.

September 16 -

Real estate owned managers can differentiate themselves and earn more business by bringing focus back to distressed property rehabilitation.

August 31 Fay Servicing

Fay Servicing -

Mortgage Contracting Services will close the Utah office of its MCS Valuations subsidiary and consolidate its operations into three offices nationwide.

August 19 -

Green River Capital has rolled out a new surveillance service for single-family rental properties called Retail Asset Management & Performance.

July 29 -

The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

July 24 -

Stewart Mortgage Information Systems is pulling the plug on its delinquent mortgage services business.

July 23 -

Two mortgage servicers have agreed to join a group of peer institutions in following a series of guidelines to address zombie properties in New York State, Gov. Andrew Cuomo announced Thursday.

July 9 -

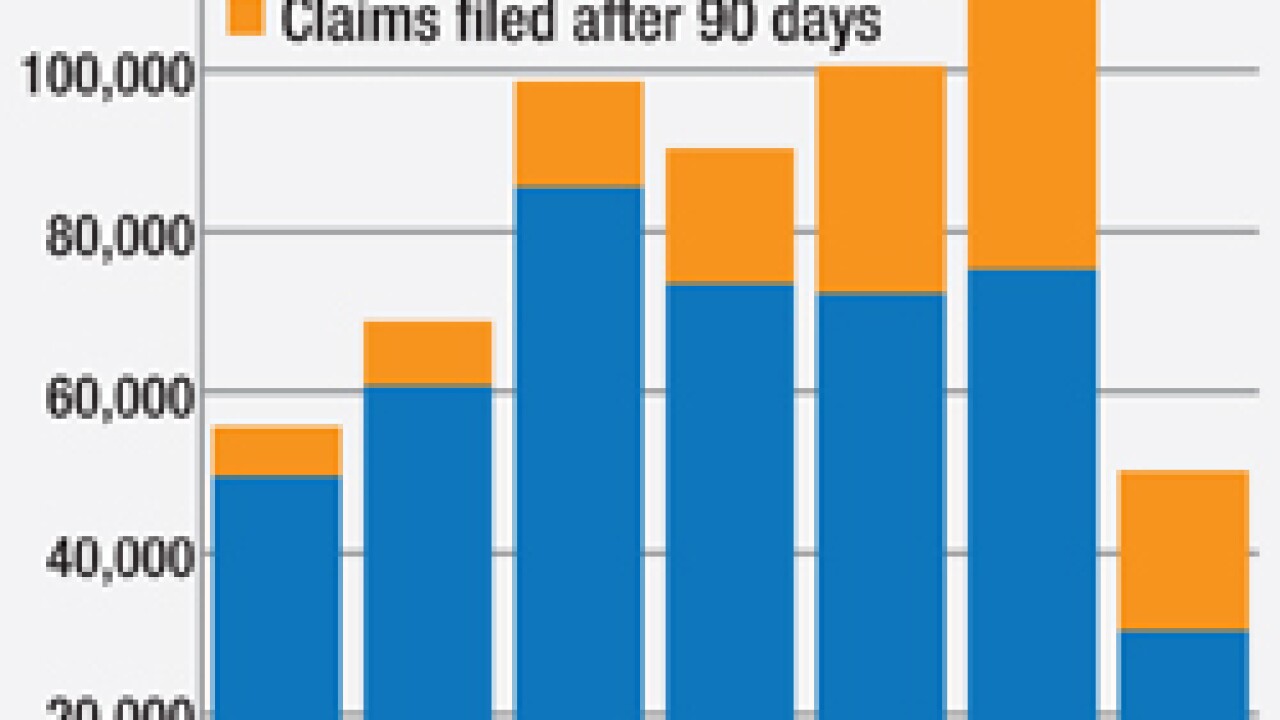

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

Senate Democrats are urging regulators to investigate potential discrimination in how banks and other financial institutions handle and market foreclosed homes.

June 24 -

When the next wave of REO activity hits, it will be heavily influenced by some of the leftover problem loans from the last downturn, as well as new defaults from more recent originations.

June 18

-

Banks and mortgage firms representing 70% of the New York market will adopt a set of best practices to combat the "zombie properties" afflicting communities throughout the state, New York Gov. Andrew Cuomo announced Monday.

May 18 -

A new CoreLogic service aims to help servicers and mortgage investors keep tabs on properties in states that give homeowners' associations super lien status.

April 29