-

The proposed reforms of Fannie Mae and Freddie Mac have gotten all the attention, but the administration also wants to scale back the Federal Housing Administration, expand its capital cushion and adopt risk-based pricing. Some of the ideas have former agency officials concerned.

September 19 -

Sales of previously owned homes rose in August to the highest in more than a year amid lower borrowing costs and sustained income gains, adding to signs the housing market is breaking out of a slump.

September 19 -

Atlanta home prices have been rising for seven years — and lower mortgage rates could fuel a new run-up.

September 10 -

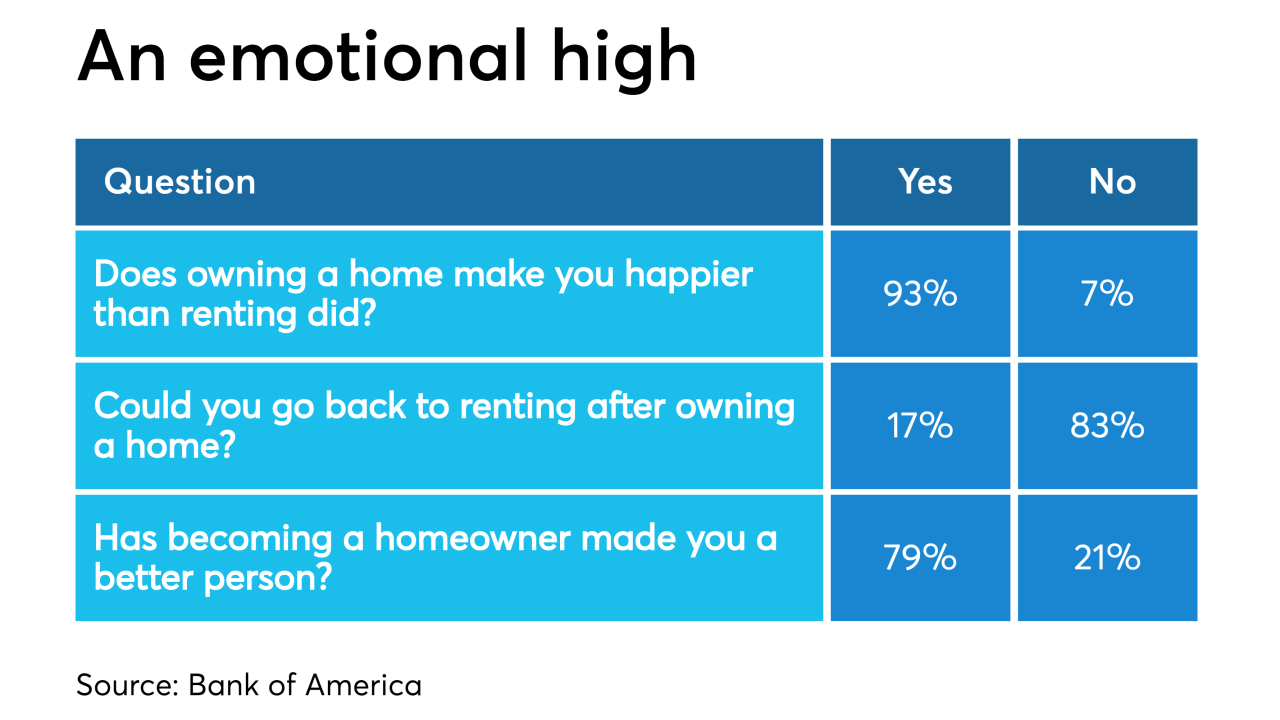

Homeownership creates happiness for Americans through an emotional attachment to their property as well as an improved lifestyle, a survey from Bank of America found.

September 5 -

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4 -

For New Orleans-area homebuyers, the suburbs are calling.

September 4 -

Strong home purchase activity — especially by millennials — pushed up annual price appreciation in July after a disappointing June, according to CoreLogic.

September 3 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Here's a look at five perspectives from potential homebuyers, from their plans to purchase to how they view the current real estate market.

August 28 -

While affordability continues to affect homebuyers, rising income combined with descending interest rates and decelerating housing values boosted the purchase market, according to First American.

August 27 -

To boost its presence in affordable housing, Synovus Bank is devoting considerable resources to training its loan officers.

August 26 -

Millennial mortgage debt is on pace to reach levels higher than any other generation, according to Experian.

August 23 -

Mortgage debt hit an all-time high, but the share of homeowners with financing has fallen to a low not seen in 13 years, according to the Urban Institute.

August 21 -

Sales of previously owned homes increased in July to a five-month high, underscoring stability in the residential real estate market that may be starting to get a boost from falling borrowing costs.

August 21 -

Here's a look at 12 of the nation's most affordable housing markets, based on the lowest shares of median local income needed to buy a house in the area, according to Redfin.

August 20 -

July's low mortgage rate environment encouraged new homebuyers to overcome their fears about the direction of the economy that kept them out of the market in June, according to the Mortgage Bankers Association.

August 15 -

From the Lone Star State to the beaches of Florida, here's a look at the top 15 housing markets with the largest influx of VA purchase loans between 2015 and 2018, according to Veterans United.

August 9 -

Millennials jumped to take advantage of low mortgage rates by refinancing at an increased share of 6 percentage points in June, according to Ellie Mae.

August 7 -

Even as digital mortgage availability make it easier for Americans to navigate the process, many would-be buyers are struggling to afford a home.

August 6 Williston Financial Group

Williston Financial Group -

Weak home sales put a speed bump in the way of accelerating house values as price growth slowed to a pace not seen since the start of the decade, according to CoreLogic.

August 6