-

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

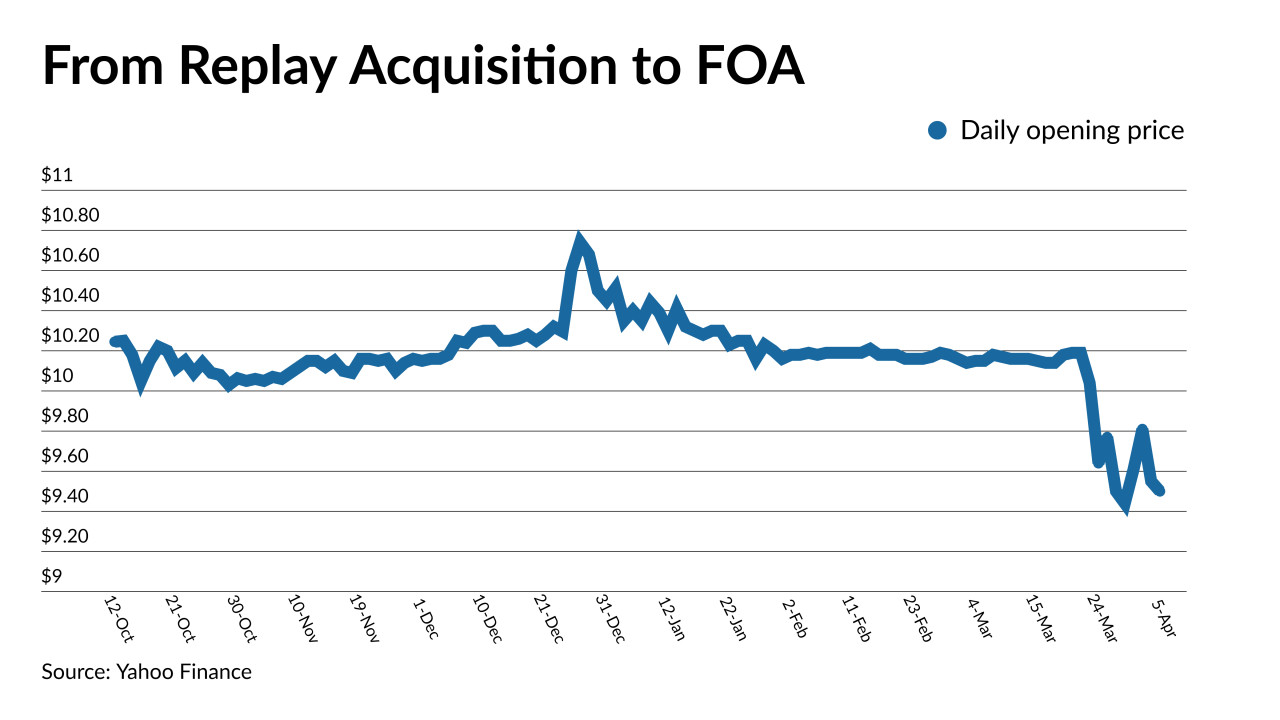

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

Relying on retained earnings alone, it would be until at least 2036, if not longer, before government control of Fannie Mae and Freddie Mae might end.

March 18 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

Bond bears appear to be having more than just a moment here at the start of 2021, with Treasury yields finally busting out of long-held ranges to levels last seen in the early days of the pandemic.

February 22 -

Just because the Fed is staying put doesn’t mean that mortgage rates, and prices of MBS, are staying put as well, writes Vice Capital Markets Principal Chris Bennett.

February 19 Vice Capital Markets

Vice Capital Markets -

Today, the mortgage players who most actively hedged — Fannie and Freddie, real estate investment trusts and large bank servicers — have significantly reduced their need to to do so, analysts said.

February 19 -

After they reopened on Tuesday, Treasury 10-year yields rose four basis points to touch 1.25% — the highest since last March — while the 30-year equivalent pushed above 2%.

February 16 -

The best mortgage bonds to buy now may be the ones the Federal Reserve is purchasing, because the securities might benefit the most if macro optimism fades.

February 12 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11