-

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

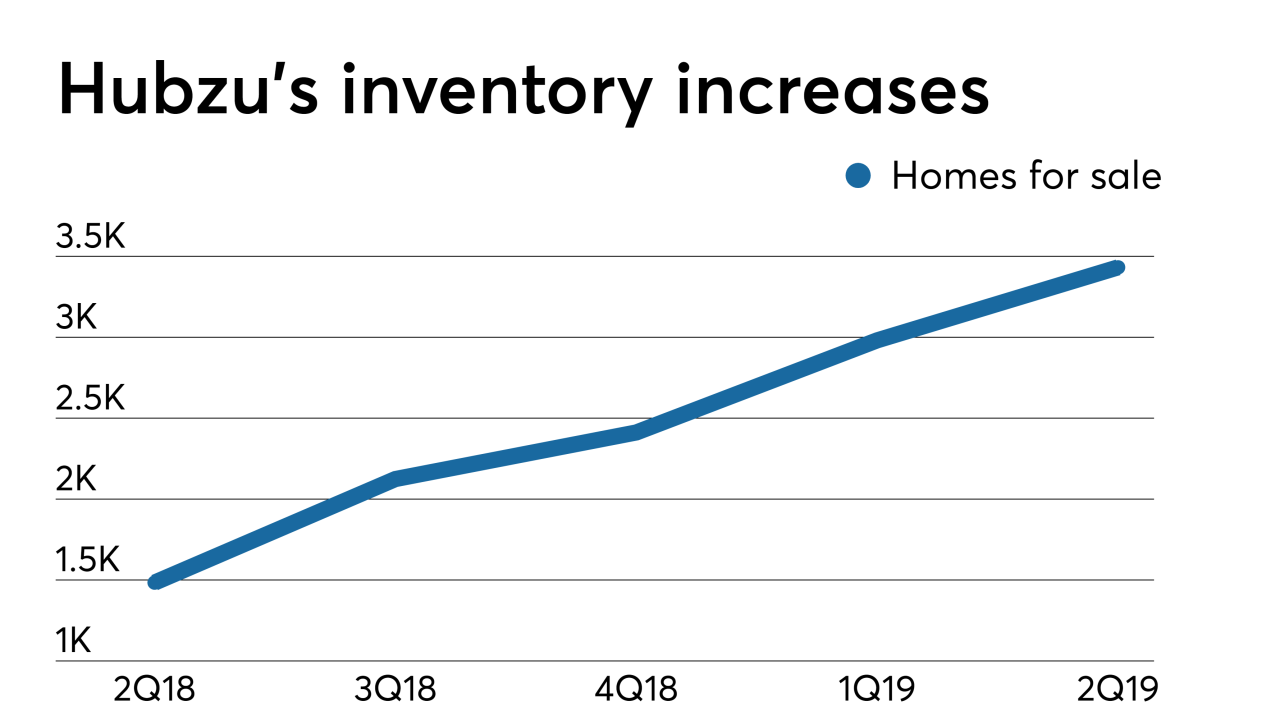

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

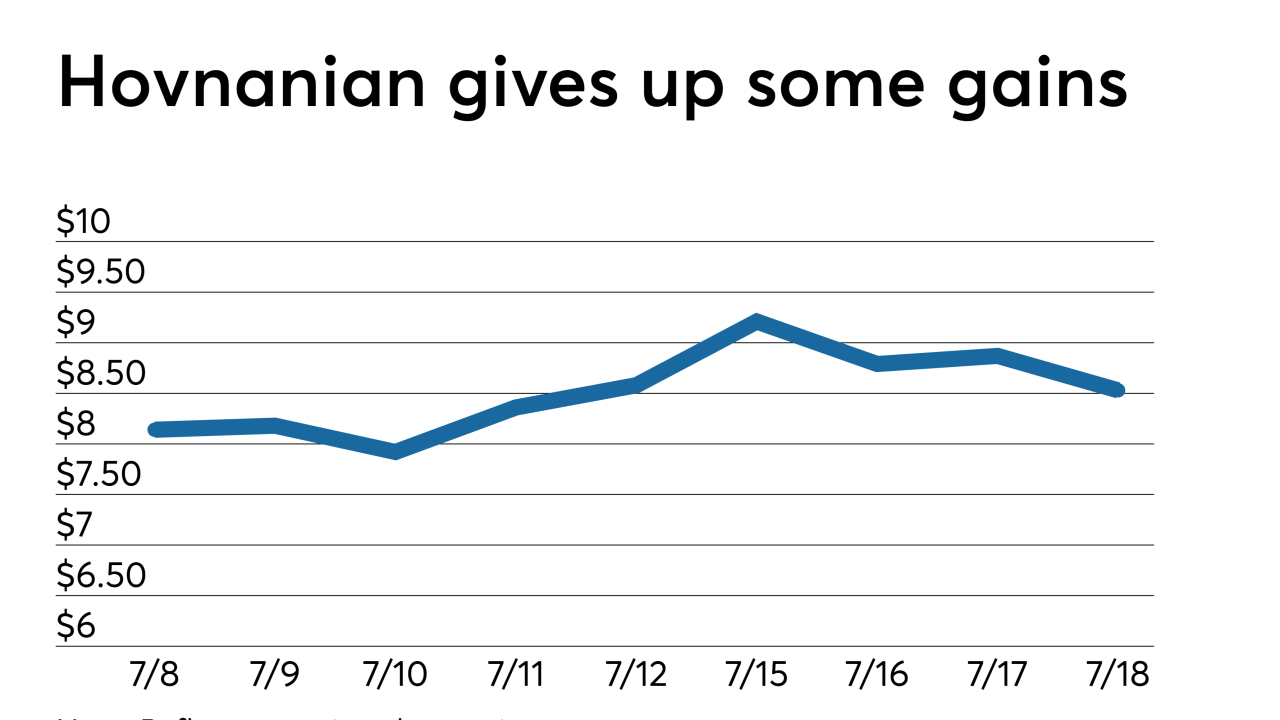

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8 -

Mortgage rates ticked up slightly this week with opposing trends in the stock and bond markets fighting for dominance, according to Freddie Mac.

July 3 -

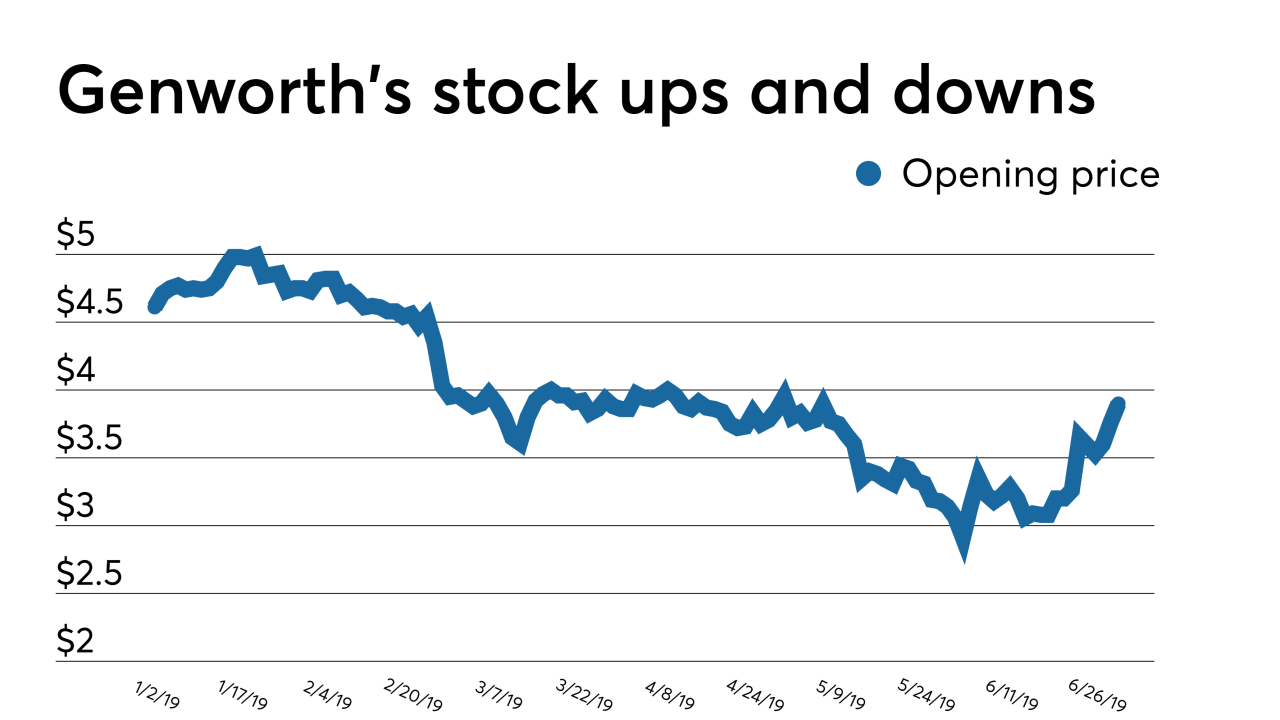

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

A long list of "preparatory steps" means that any potential Fannie Mae and Freddie Mac initial public offerings are at least three to four years away, according to Raymond James.

June 6 -

First American Financial Corp. tumbled the most in nearly eight years amid concerns that a security flaw at the title insurer may have allowed unauthorized access to more than 885 million records related to mortgage deals going back to 2003.

May 28 -

Zillow's mortgage division experienced better customer demand in the first quarter than it expected, but its revenue was outweighed by expenses that led to a pretax loss of $9.6 million.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Intercontinental Exchange's proposed acquisition of Simplifile will enhance its MERS unit's growing presence in handling electronic notes.

May 2 -

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23