-

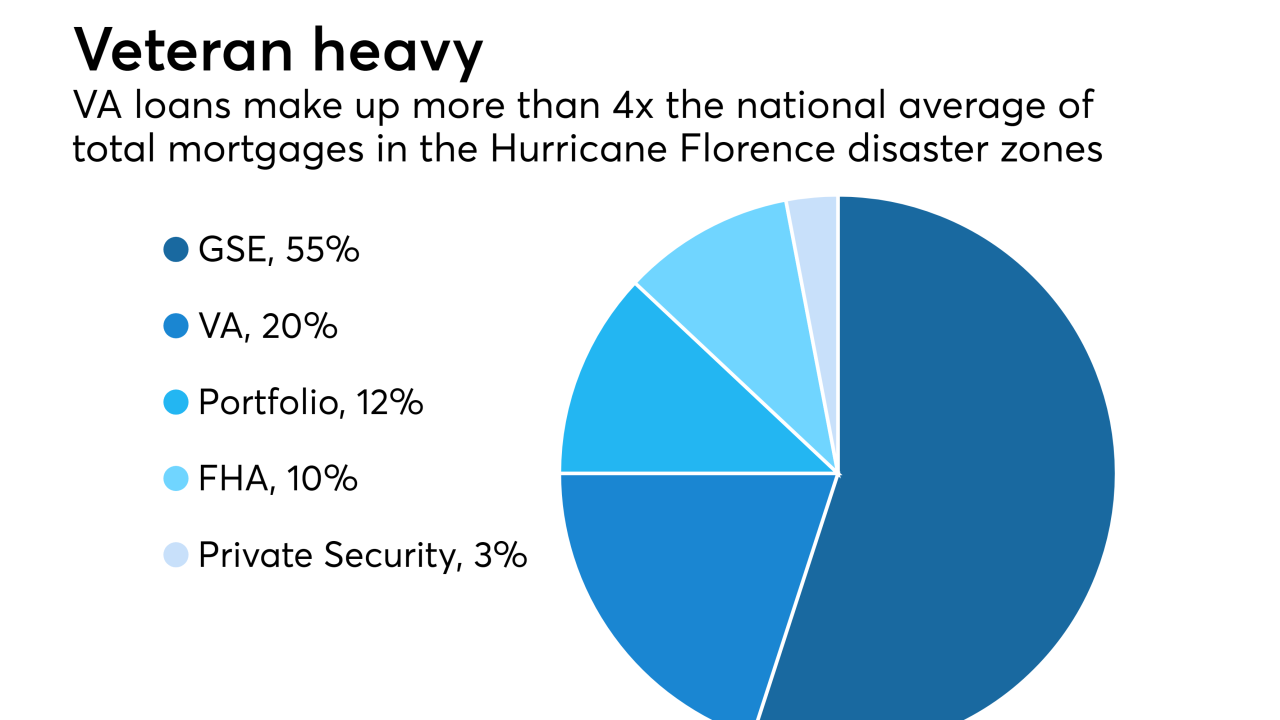

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

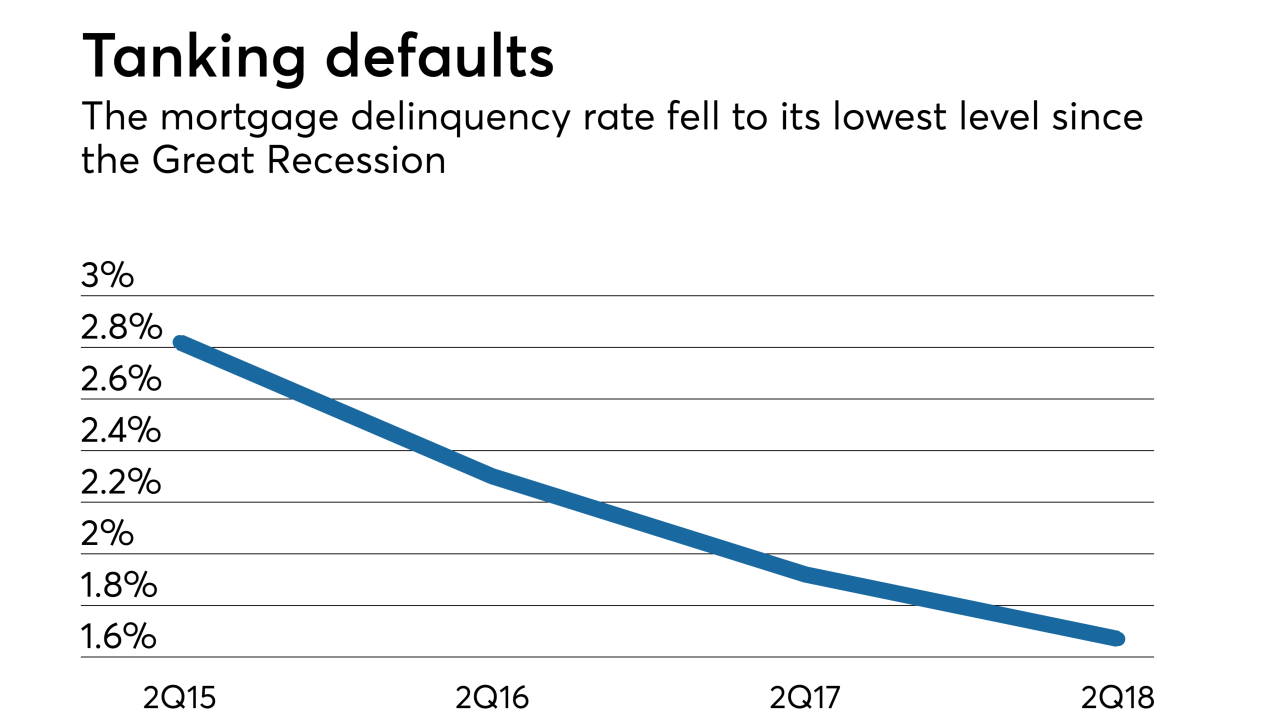

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

A Jacksonville, Ill., church facing foreclosure has a new lease on life after months of fundraising.

September 20 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

More flip-and-fix property buyers seek financing for their purchases as fewer distressed homes come on the market and sales margins narrow, said Attom Data Solutions.

September 6 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

Tax foreclosure filings in Philadelphia have skyrocketed 1,200% since 2010, so the city is promoting its homestead exemption to keep people in their homes.

August 31 -

A decade after a collapse in the housing market triggered the 2008 Great Recession, South Florida still has many homeowners who owe far more money than their property is worth.

August 29 -

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22