-

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

The agency reported signs of stress on the credit quality in residential loans serviced by seven large banks as a result of the COVID-19 pandemic.

September 23 -

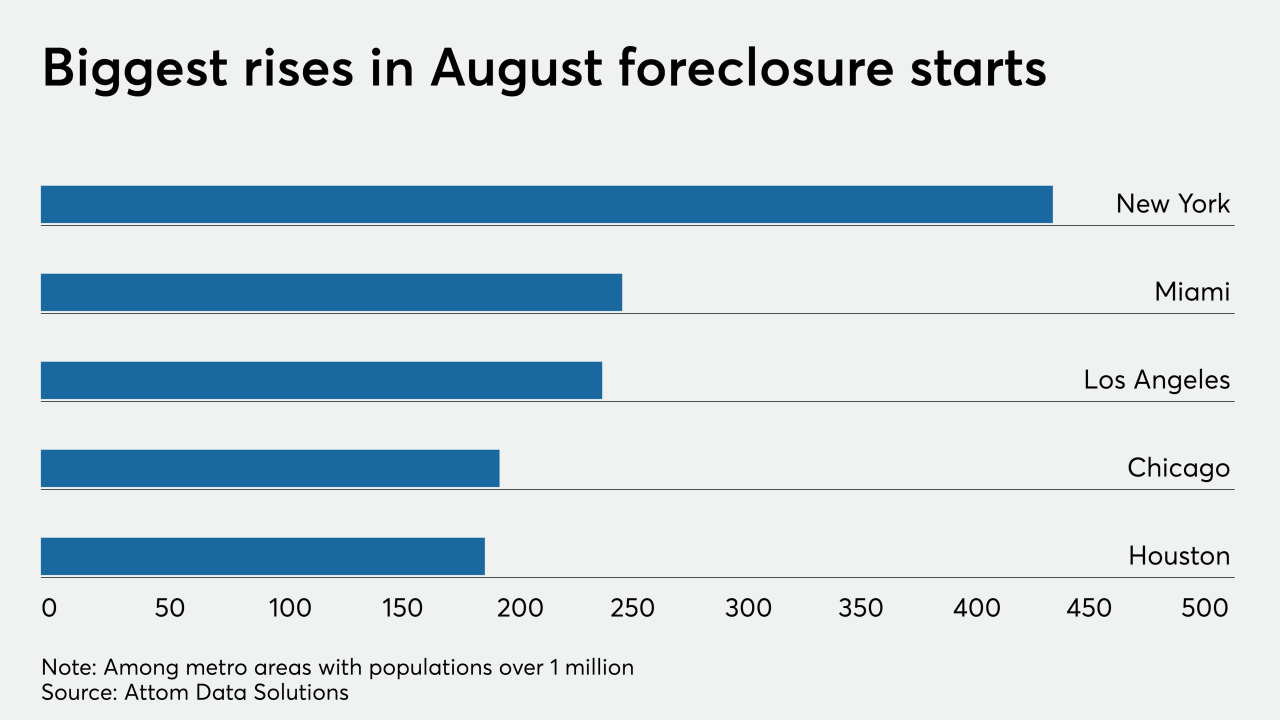

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

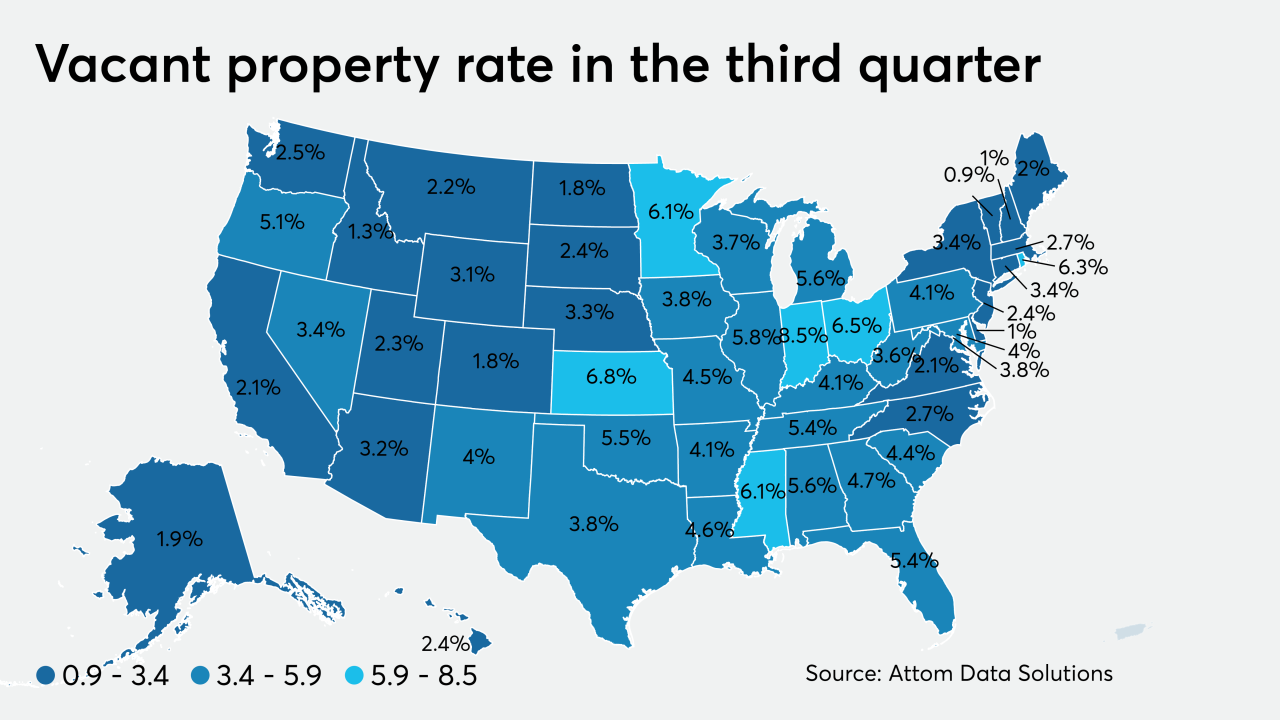

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

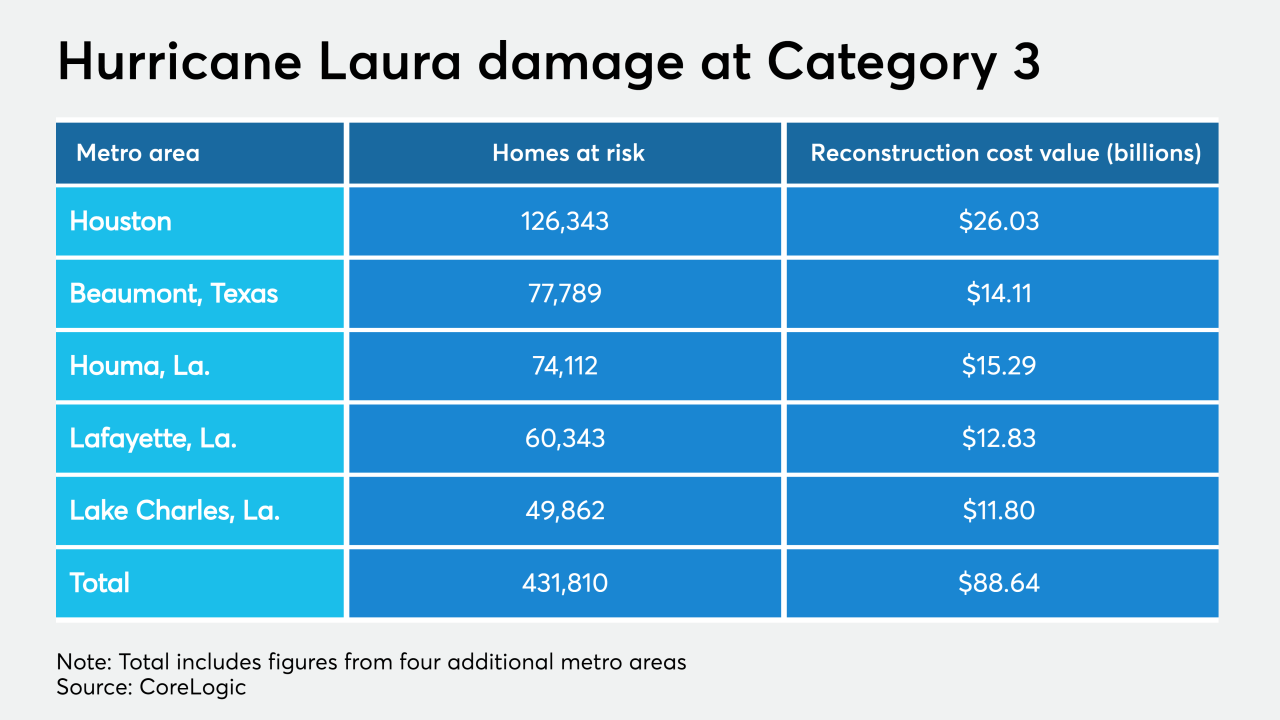

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Rather than letting zombie properties sit vacant, selling them to new owners and getting them reoccupied, creates the desired outcome.

August 21 Auction.com

Auction.com -

More homeowners in Florida and nationwide became delinquent on their mortgage payments in the second quarter compared to the first, according to the Mortgage Banker Association.

August 19 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 17 -

The former attorney general for the state went her own way on the national servicing settlement, but critics claim she let OneWest off easy.

August 17 -

Federal Housing Administration mortgages — the affordable path to homeownership for many first-time buyers, minorities and low-income Americans — now have the highest delinquency rate in at least four decades.

August 17 -

Travel restrictions have left hotels like Miami Beach's Fontainebleau struggling to repay their mortgage loans.

August 17 -

The Tri-COG Land Bank, a multicommunity effort to get abandoned and blighted properties back on the tax rolls, has sold its first property.

August 14 -

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

Late home payments increased in this community that hosts the Masters, according to a California-based real estate analytics firm.

August 13 -

Mortgage delinquency rates in May were even higher in some Texas markets.

August 12

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)