-

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

Foreclosures on Metro Orlando homes are up 23% from July 2017, though the numbers are still well below the peak of the recession, and local sales agents say there's not much impact in the market yet.

August 21 -

The new policy, meant to assist borrowers in Puerto Rico and the U.S. Virgin Islands, will let servicers evaluate borrowers using pre-disaster payment information.

August 16 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

Foreclosures, short sales and other troubled properties continue to dwindle in central Ohio, according to a report from the Columbus Realtors trade group.

August 13 -

The Fed's order targets affidavits prepared by employees of CitiFinancial in connection with the company's exiting the mortgage servicing business.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

Sen. Brian Schatz, D-Hawaii, said it is hard to imagine how Wells Fargo's $8 million remediation plan would correct a mistake that led to 400 wrongful foreclosures.

August 9 -

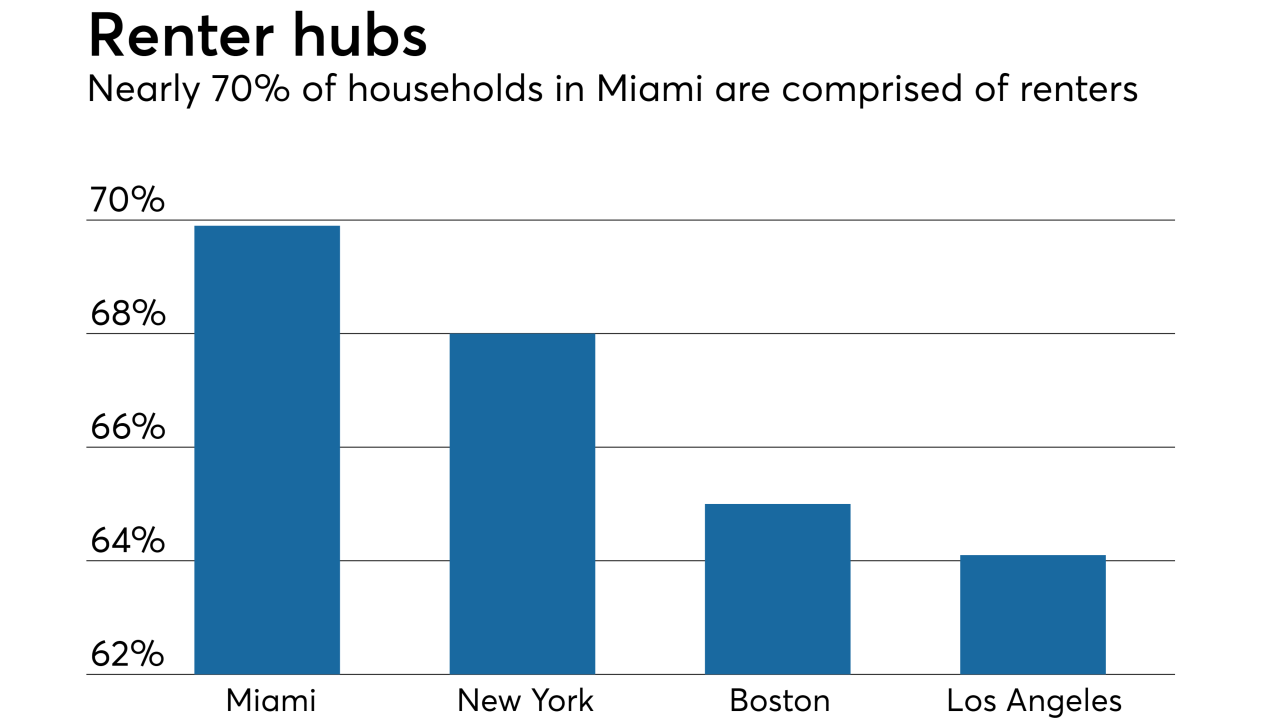

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

The priciest house for sale in the Tampa Bay, Fla., area could soon become its biggest foreclosure.

August 7 -

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

Baltimore had the highest share of distressed home sales of any city in the country, according to Attom Data Solutions.

July 27 -

Just 5.1% of the $91 million of liens backing the transaction are vacant, down from 9.2% of the prior deal; this allowed the sponsor to borrower more heavily against the value of hte collateral.

July 26 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

Mortgage foreclosure starts and active foreclosures were at their lowest level in over a decade although there was an increase in new delinquencies in June, according to Black Knight.

July 24 -

Continued favorable loss development trends allowed MGIC Investment Corp. to beat analyst estimates for the second-quarter earnings report.

July 18 -

Fewer Dallas-area homeowners are behind in their mortgage payments than at any time since the Great Recession.

July 16 -

Connecticut entered July with the fifth-highest rate of residential mortgages under foreclosure in the nation, according to a study of more than 360,000 foreclosures nationally over the first six months of the year.

July 13 -

Foreclosure filings plummeted in the first half of the year, but 40% of local markets saw foreclosure starts increase, with the last housing bubble no longer to blame for the growth, according to Attom Data Solutions.

July 12 -

Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

July 10