-

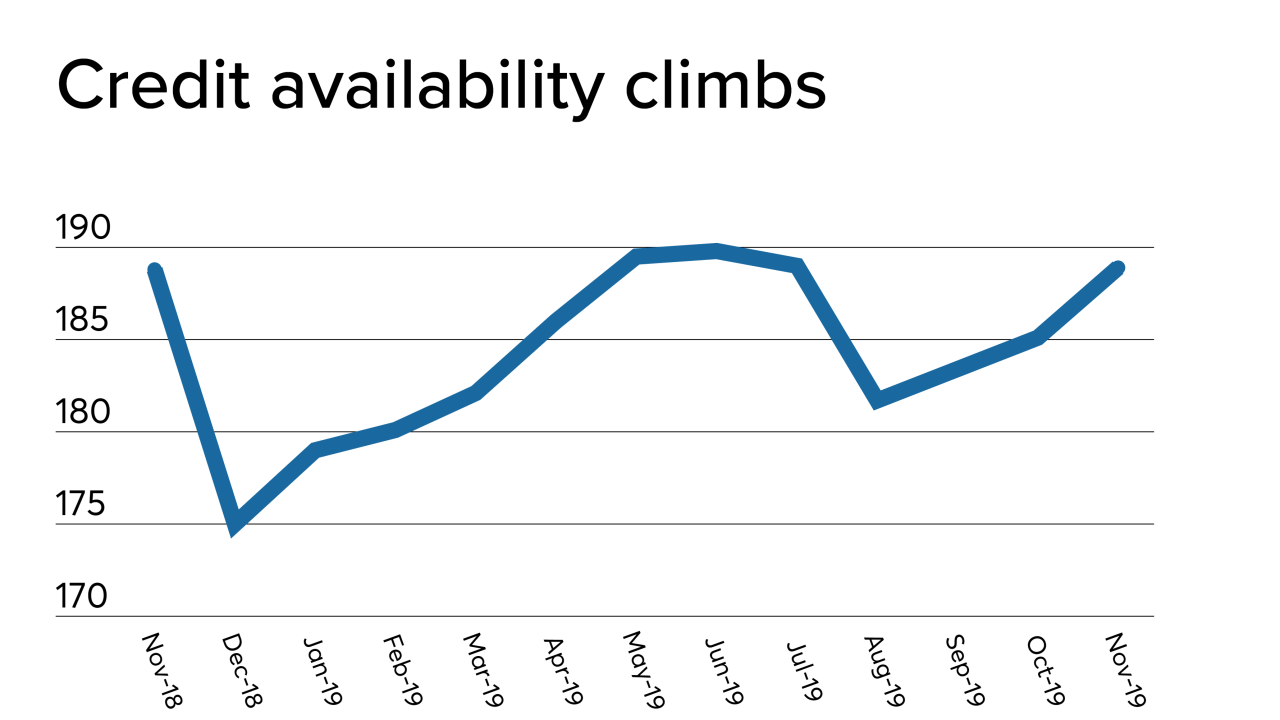

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

The U.S. Supreme Court may soon decide if it will intervene in a high-stakes fight over the government-sponsored enterprise net worth sweep.

January 10 -

Mortgage rates fell to their lowest level since October as the financial markets reacted to rising tensions caused by the U.S. government's killing of an Iranian general, Freddie Mac said.

January 9 -

Federal Housing Finance Agency Director Mark Calabria discussed the possibility of having Fannie Mae and Freddie Mac operate under a consent order to allow the government-sponsored enterprises to be able to raise capital.

January 8 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 7 -

Borrower education stands as a barrier to homeownership for younger consumers and Freddie Mac is trying to change that.

January 6 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

If the first weekly Freddie Mac report of the year is any indication, there could be far less volatility for fixed mortgage rates in 2020 than there was in 2019.

January 2 -

Polls showing an upswing for President Trump's re-election chances against top potential Democratic candidates favor housing finance and mortgage giants Fannie Mae and Freddie Mac, according to Height Capital Markets.

January 2 -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies' regulator executes plans for their release into the private sector.

December 27 -

Freddie Mac reduced its origination forecast for 2020 to under $2 trillion, now projecting $184 billion less in refinance volume compared with its November outlook.

December 24 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

Democrats on the Senate Banking Committee are pressuring Federal Housing Finance Agency Director Mark Calabria and Treasury Secretary Steven Mnuch to provide more details on administration plans to end the conservatorships of Fannie Mae and Freddie Mac.

December 17 -

The Federal Housing Finance Agency has proposed a plan that would exempt the Federal Home Loan Banks from conducting stress tests.

December 16 -

Freddie Mac launched a groundbreaking multifamily structured pass-through deal that includes a class of floating rate bonds indexed to the Secured Overnight Financing Rate for the first time ever.

December 13 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5