-

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

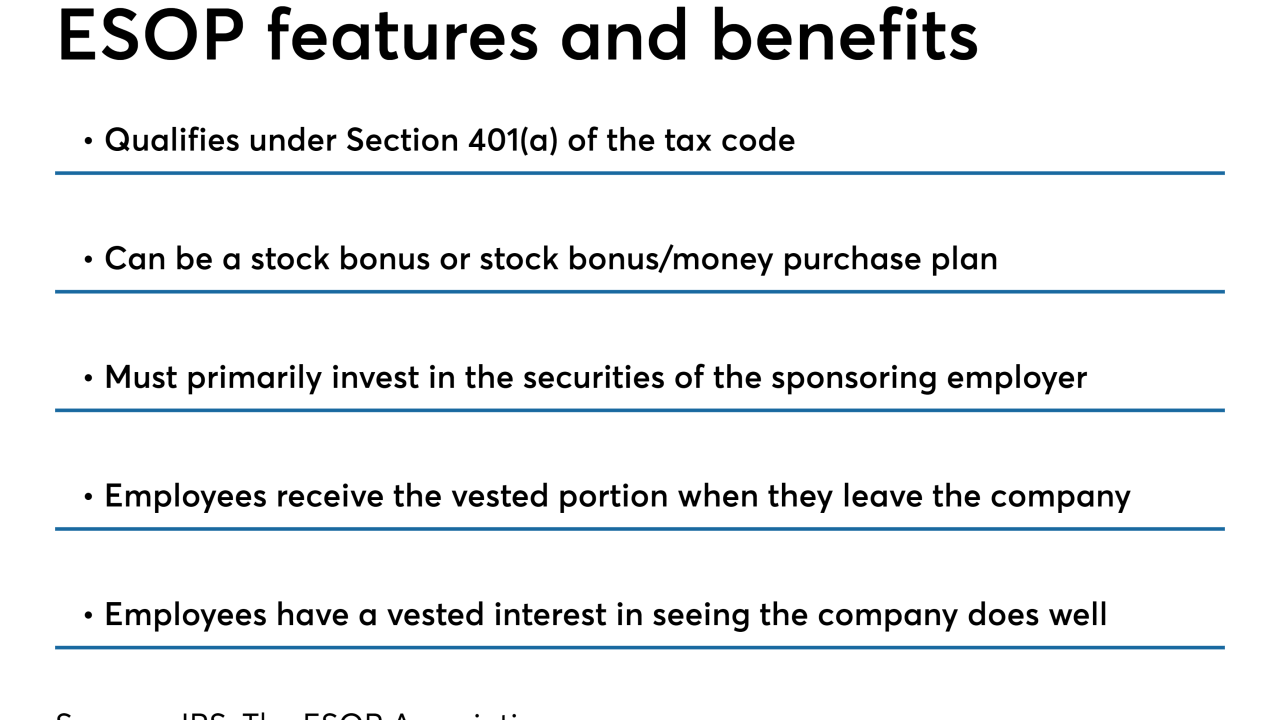

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

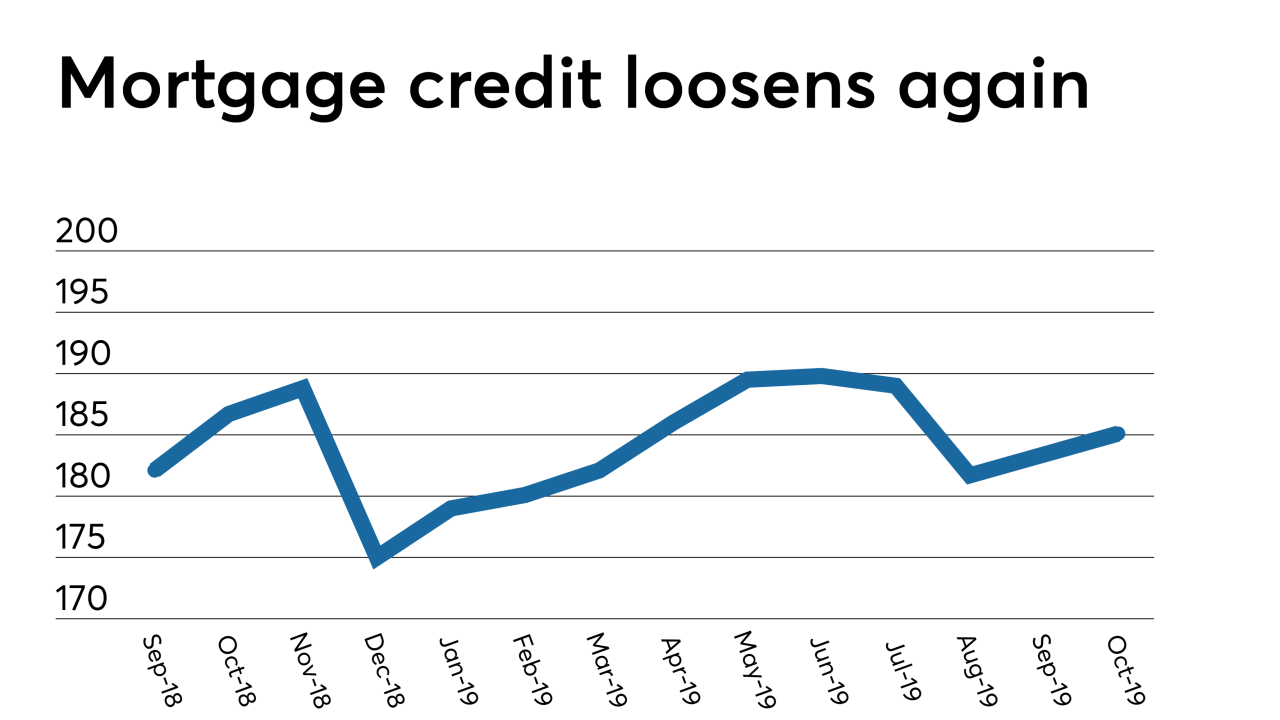

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Though still comparatively strong, consumer confidence in the housing market dropped again in October in response to economic uncertainty and lack of affordability, according to Fannie Mae.

November 7 -

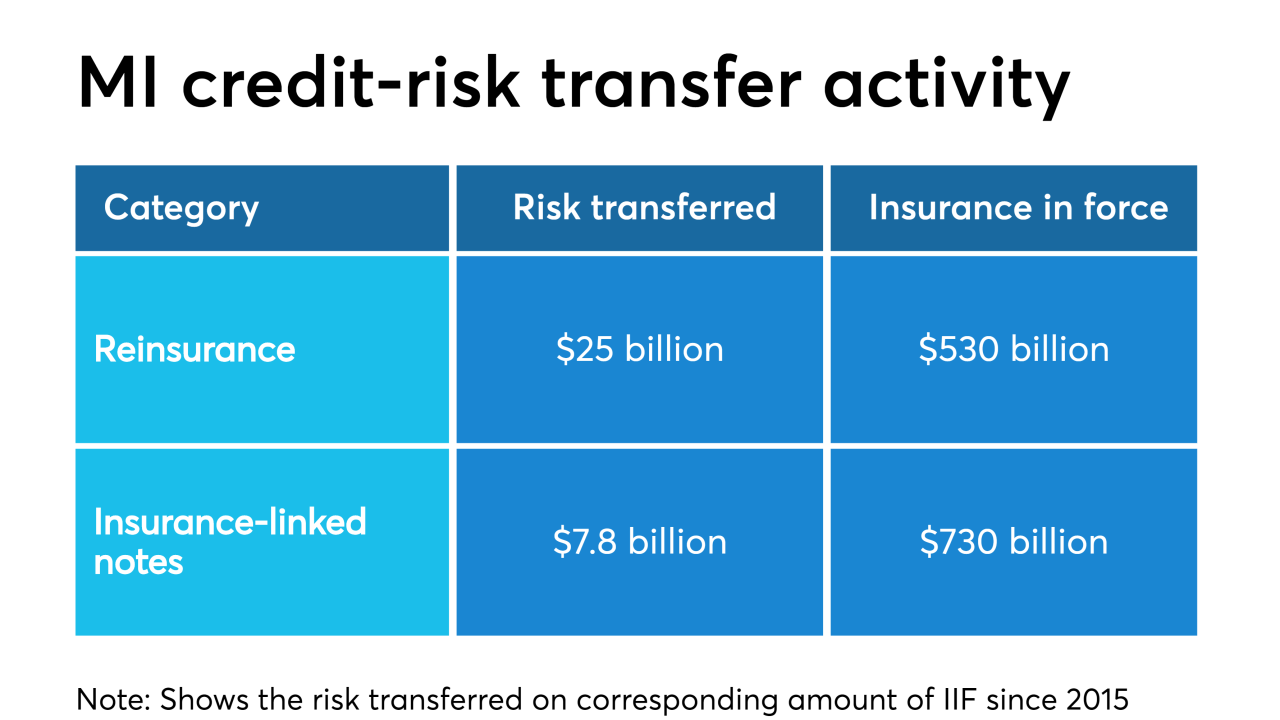

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4