-

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The agency said it is aligning policies for Fannie Mae- and Freddie Mac-backed loans in forbearance so that servicers are only responsible for advancing four months of missed payments.

April 21 -

Fannie Mae and Freddie Mac's regulator is confronting a fresh crisis for the U.S. housing market: The companies won't buy recently issued loans that were made to borrowers who already can't afford their monthly payments because of coronavirus.

April 21 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

At issue is whether the U.S. should step in now to save nonbank mortgage servicers to head off damage to the housing market.

April 13 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Forbearance requirements under the CARES Act raised immediate concerns about servicing advances and performance, but experts suggest there are other outcomes to brace for, too.

April 9 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

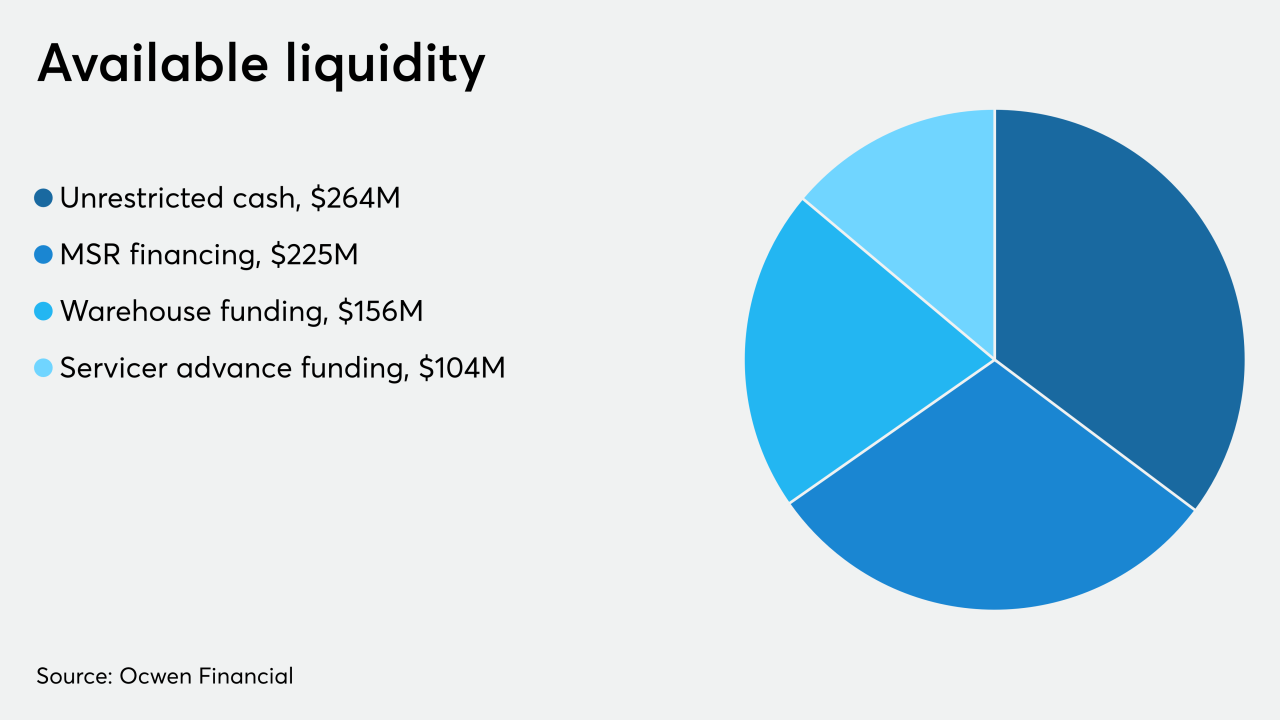

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Simply stated, the federal forbearance of mortgage payments is perhaps the largest unfunded public mandate in American history.

April 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The latest deadline for Genworth Financial's acquisition by China Oceanwide is June 30, but the parties are looking to get the transaction completed by the end of next month.

April 1