-

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies' regulator executes plans for their release into the private sector.

December 27 -

Freddie Mac reduced its origination forecast for 2020 to under $2 trillion, now projecting $184 billion less in refinance volume compared with its November outlook.

December 24 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

Democrats on the Senate Banking Committee are pressuring Federal Housing Finance Agency Director Mark Calabria and Treasury Secretary Steven Mnuch to provide more details on administration plans to end the conservatorships of Fannie Mae and Freddie Mac.

December 17 -

The Federal Housing Finance Agency has proposed a plan that would exempt the Federal Home Loan Banks from conducting stress tests.

December 16 -

Freddie Mac launched a groundbreaking multifamily structured pass-through deal that includes a class of floating rate bonds indexed to the Secured Overnight Financing Rate for the first time ever.

December 13 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

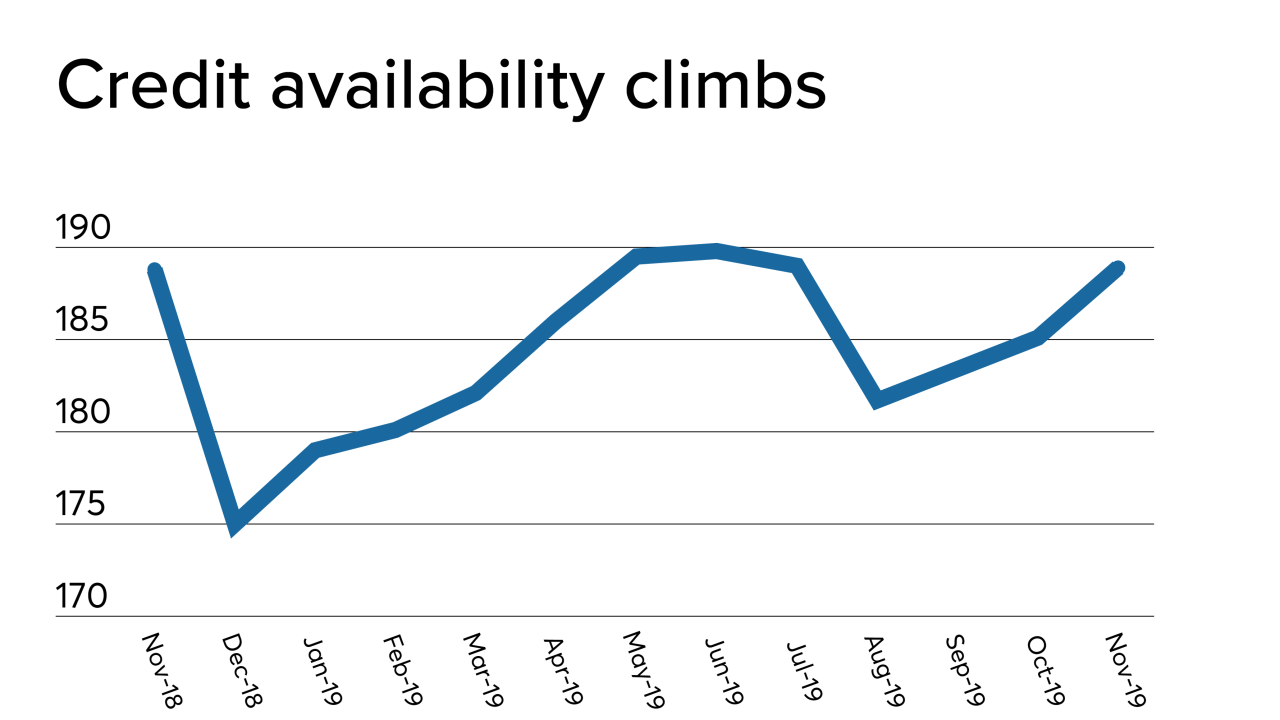

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

Private mortgage insurance now has almost matched the government's Federal Housing Administration program in market share, having gained approximately eight percentage points in the past five years, Keefe, Bruyette & Woods found.

November 26 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15