-

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

The Federal Housing Finance Agency is planning on finalizing its proposed capital requirements for the government-sponsored enterprises this summer, the agency's acting director said Wednesday.

March 28 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

As lawmakers discuss reform legislation, the president’s memo calls on agencies to draft both administrative and legislative reform options and deliver their reports “as soon as practicable.”

March 27 -

Senators dove into how to ensure housing finance reform serves lenders of all sizes, just as the Trump administration moved closer to crafting its own GSE plan.

March 27 -

Hugh Frater loses the "interim" title, taking full control of the government-sponsored enterprise as Congress begins debating (again) the future of Fannie as well as Freddie Mac.

March 27 -

The government-sponsored enterprises have continued to expand over the past decade, despite being in conservatorship. New leadership at the FHFA should reverse this trend.

March 26 American Enterprise Institute

American Enterprise Institute -

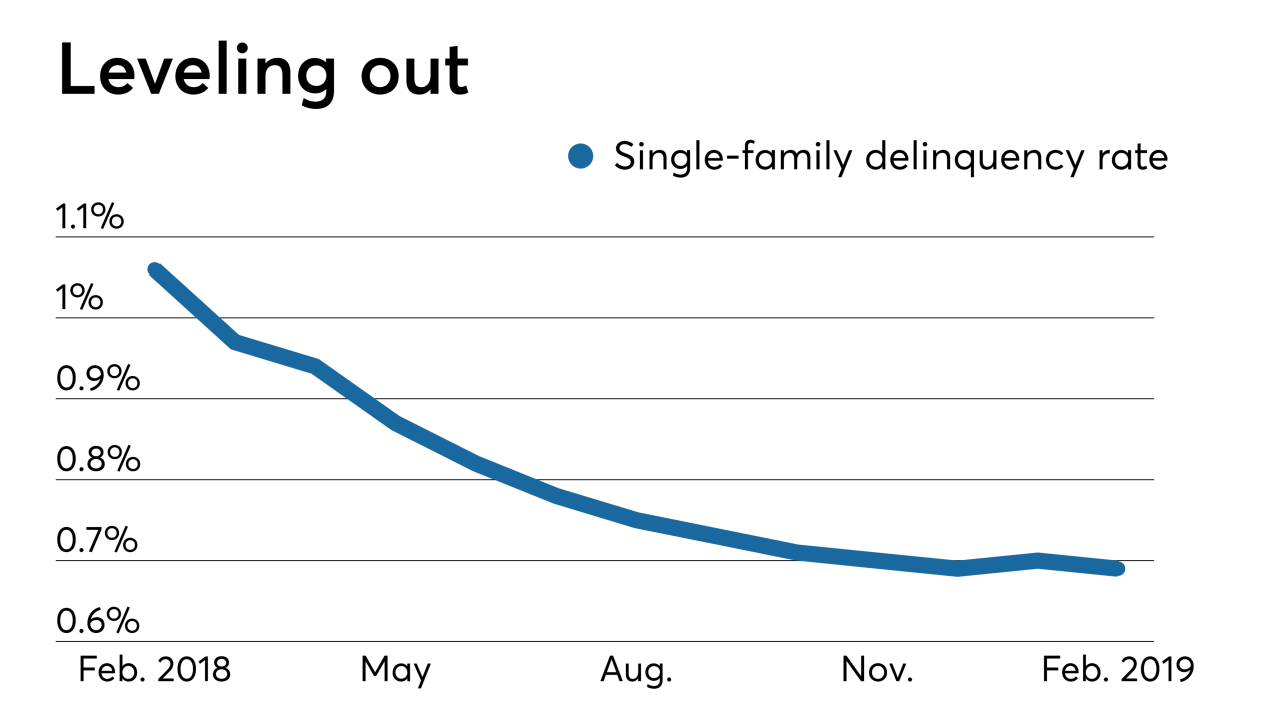

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

At $230 million, GSMBST 2019-PJ1 is notably smaller than recent transactions from JPMorgan and Redwood Trust; borrowers also have less equity in their homes.

March 25 -

The Federal Housing Finance Agency in recent years has required Fannie Mae and Freddie Mac to contribute to the funds every March, but has yet to make a 2019 request. Housing groups see the delay as a troubling sign.

March 25 -

If mortgage rates fall below 4%, it could more than double the dollar volume of agency mortgages exposed to refinancing incentive, analysts at Keefe, Bruyette & Woods found.

March 25 -

Starting March 26, Senate Banking Committee Chairman Mike Crapo will hold two days of hearings on his plan for returning Fannie Mae and Freddie Mac to private ownership.

March 25 -

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

Freddie Mac reduced its 2019 origination projection in its latest monthly forecast, but strong coinciding housing numbers could suggest a future upward revision.

March 22 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

The Senate Banking Committee will hold two hearings at the end of March on Chairman Mike Crapo’s most recent framework for housing finance reform.

March 15 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14