-

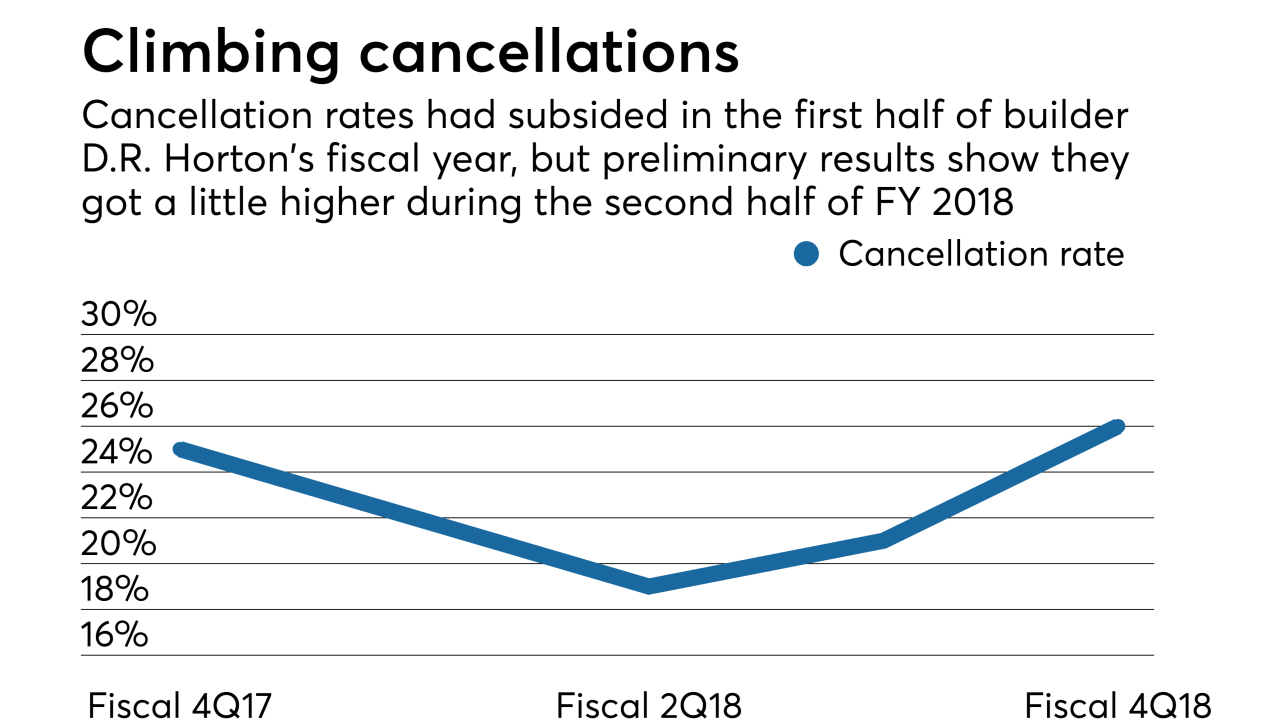

D.R. Horton Inc. fell the most in more than three years after executives at the builder said the market for homes is getting "choppy" and that the pace of order growth may slow next quarter.

November 8 -

Minnesota Housing will invest $87.5 million in 1,700 new and existing housing units for low-income Minnesotans this year.

November 8 -

Lennar Corp. is selling a portion of its Rialto business to Stone Point Capital for $340 million, adding to Stone Point's holdings in the real estate and financial industries.

October 30 -

After a massive fire gutted the Ice House townhome project in West Oakland recently — the latest in a series of suspicious blazes targeting residential construction projects — developers and housing experts say the fallout could ultimately hit the pockets of Oaklanders already struggling to rent or own homes in the city.

October 30 -

Despite rising mortgage rates and a dismal start to the fall, homebuilders in the Twin Cities are picking up the pace.

October 29 -

Purchases of new homes fell more than estimated in September to the weakest pace since December 2016, adding to signs that a lack of affordability is crimping demand, according to government data.

October 24 -

Builder M/I Homes set third-quarter records in four areas and recorded consistent levels of mortgages held for sale in its most recent earnings results.

October 24 -

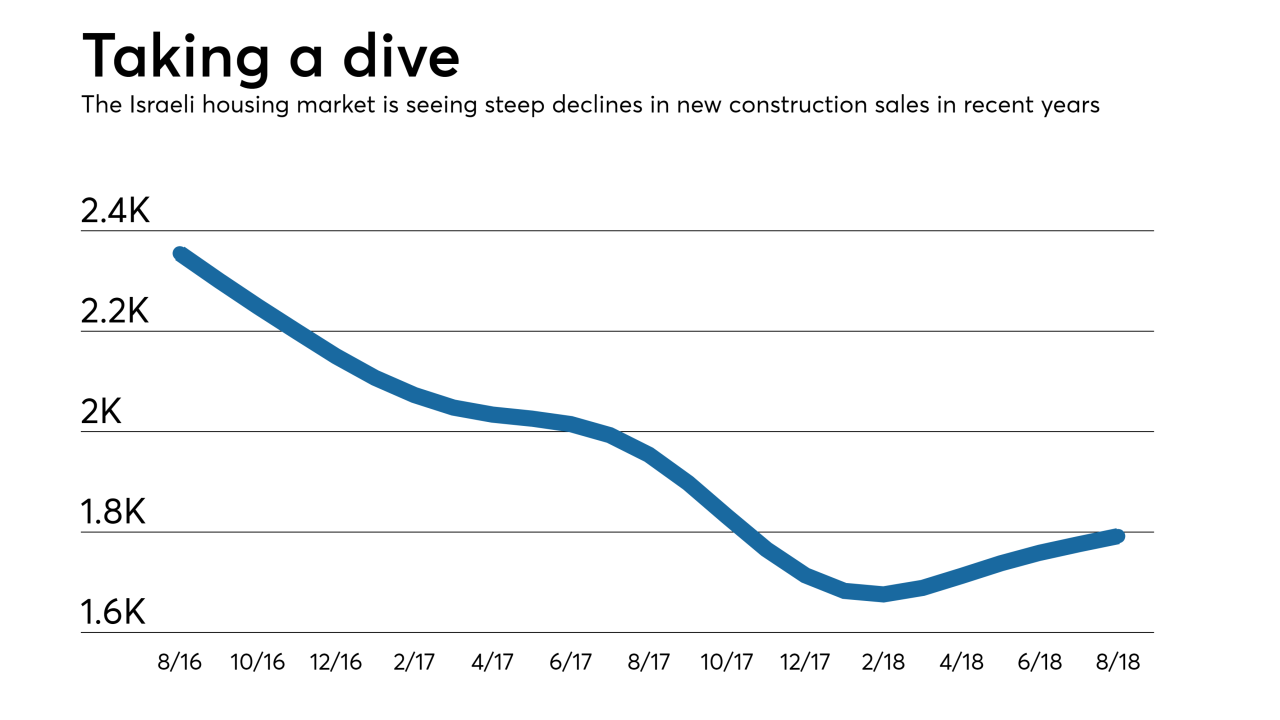

The Department of Housing and Urban Development and the Israeli Ministry of Finance are joining forces through a memorandum of cooperation to explore and share approaches on housing and mortgage finance issues plaguing their nations.

October 22 -

High-rise living, once a rarity in Southern California, is gaining new favor as reviving urban centers such as downtown L.A. and Hollywood attract thousands of new residents in search of neighborhoods with a big-city feel.

October 22 -

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

New-home construction fell in September on a decline in the South that may reflect disruptions from Hurricane Florence, government figures showed Wednesday.

October 17 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

Confidence among homebuilders unexpectedly rose in October, registering the first gain in five months amid falling lumber prices and solid demand.

October 16 -

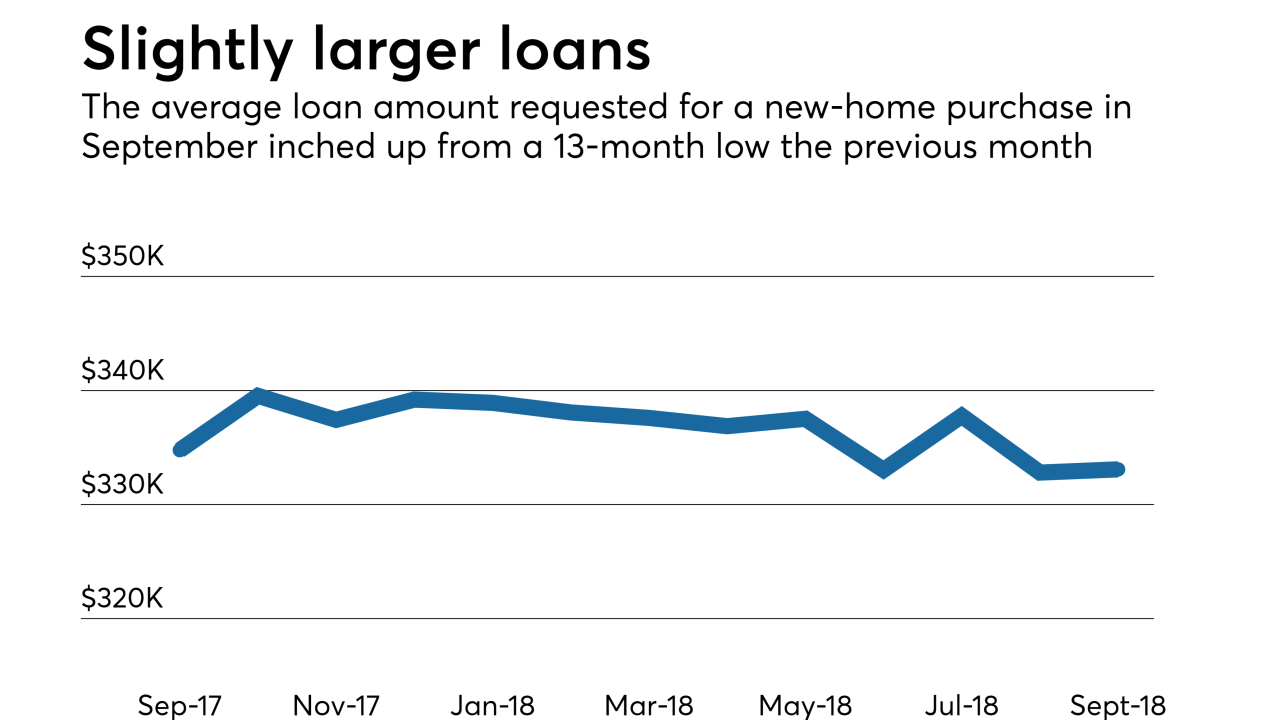

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

The Packers plan to build more than 200 homes, with as many as 150 rentals and 90 for sale, a block from legendary Lambeau Field.

October 4 -

Builder Lennar Corp.'s purchase of CalAtlantic's financial services operations boosted its mortgage segment's earnings in the third quarter as the acquisition offset declines in per-loan profits and refinancing.

October 3 -

Local home construction dipped again last month, though the year-to-date pace of building continues to surpass that of 2017 by a healthy margin.

October 2 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1