-

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28 -

Home sales hit a 15-year high in Duluth, Minn., this summer even as inventory hit a 15-year low.

September 25 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25 -

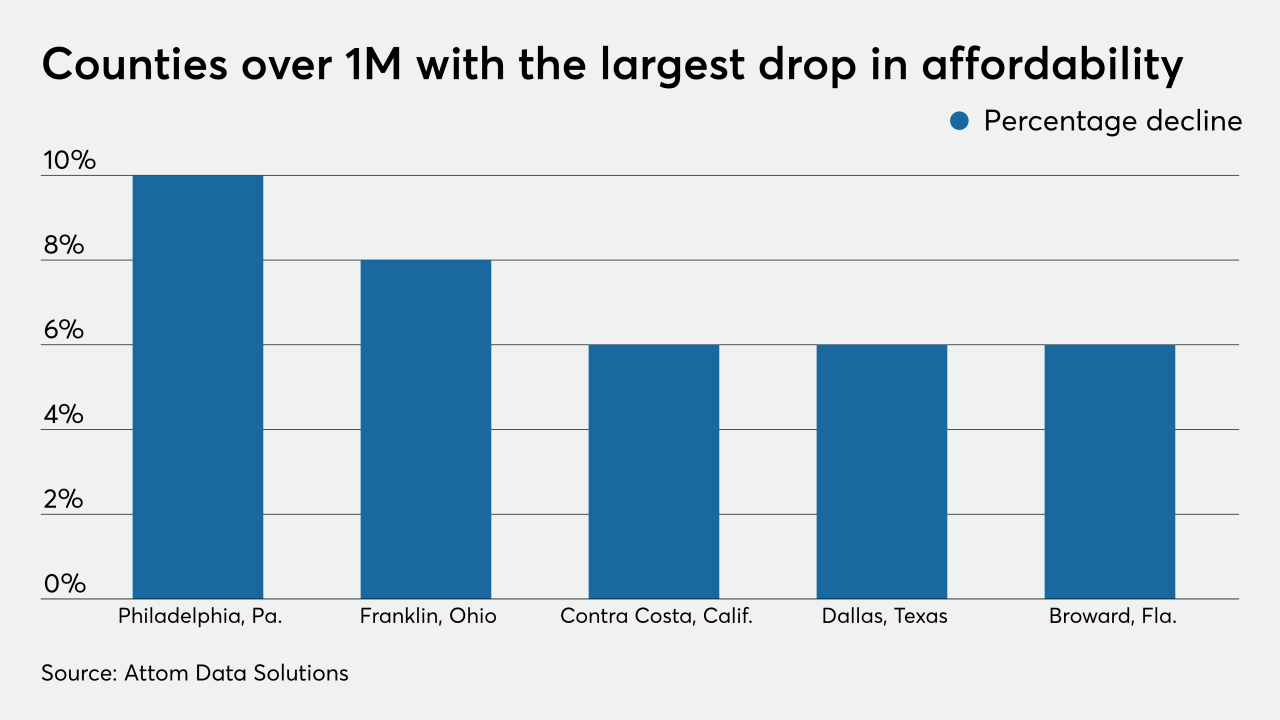

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

A summer resurgence of home buying stretched into August, defying the pandemic to set record home prices and drive sales to a near two-year high, new housing figures show.

September 24 -

Chattanooga, Tenn., home sales continued last month to rebound from the coronavirus-spurred slump in the spring, boosting the median price of homes sold during August to an all-time high.

September 23 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

Outside the densely populated coastal hubs, annual home sales grew by leaps and bounds, as buying patterns shifted toward more space with less emphasis on proximity to urban centers, according to Redfin.

September 22 -

Sales of previously owned homes remained brisk in August as low mortgage rates and demand for space in the suburbs sustained strength in a housing market that’s a bright spot for the economy.

September 22 -

The number of pending sales in Sonoma County, Calif., was up 27% from June through August 2020 versus the same period in 2019 and the percentage of properties that went off the market within two weeks was up 8% in the same period in 2020 versus 2019.

September 22 -

The song remains the same: There still aren't enough houses to keep up with all the people trying to buy them in Missoula, Mont., so that means prices keep shooting up.

September 22 -

As the summer home-selling season came to a close, median sale prices — both across Central Texas and within the Austin city limits — reached all-time highs in August, the Austin Board of Realtors said.

September 18 -

A combination of pent-up demand, low inventory and rock bottom interest rates is making it extra tough for homebuyers with government-backed loans.

September 18 -

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

The median sales price for a single-family house in Rhode Island hit an all-time high of $333,164 in August, according to the Rhode Island Association of Realtors.

September 17 -

Nowhere is the widening gap between real estate and the real economy more apparent than in Las Vegas, where tourism is in ruins, wages are plunging and home prices just keep rocketing higher.

September 17 -

The median housing prices in Merced County, Calif., have increased in each of the last five months.

September 17 -

The number of homes sold in metro Baton Rouge, La., was 11.2% higher in August than the year before, continuing a hot streak triggered by low interest rates.

September 16 -

The North Texas housing market continued to thumb its nose at the pandemic in August, with home sales up 11% from a year ago.

September 15 -

Listing prices in California have risen 34% since January as inventory shriveled amid the pandemic.

September 15