-

The mortgage market shift to purchase lending has arrived. Test your knowledge of these key real estate industry terms.

September 1 -

As Downtown Boise's popularity as a residential neighborhood grows, housing prices are climbing beyond the affordable range for many people who want to live there.

August 29 -

California's high housing costs are driving poor and middle income people out of their housing like never before. While some are fleeing coastal areas for cheaper living inland, others are leaving the state altogether.

August 21 -

The USDA recently announced its rural housing program, which has been around for decades, would increase the amount buyers can borrow, a sign of rising housing costs across the nation.

August 18 -

Apparently, the finance department of the San Francisco Housing Authority can't balance its own checkbook.

August 11 -

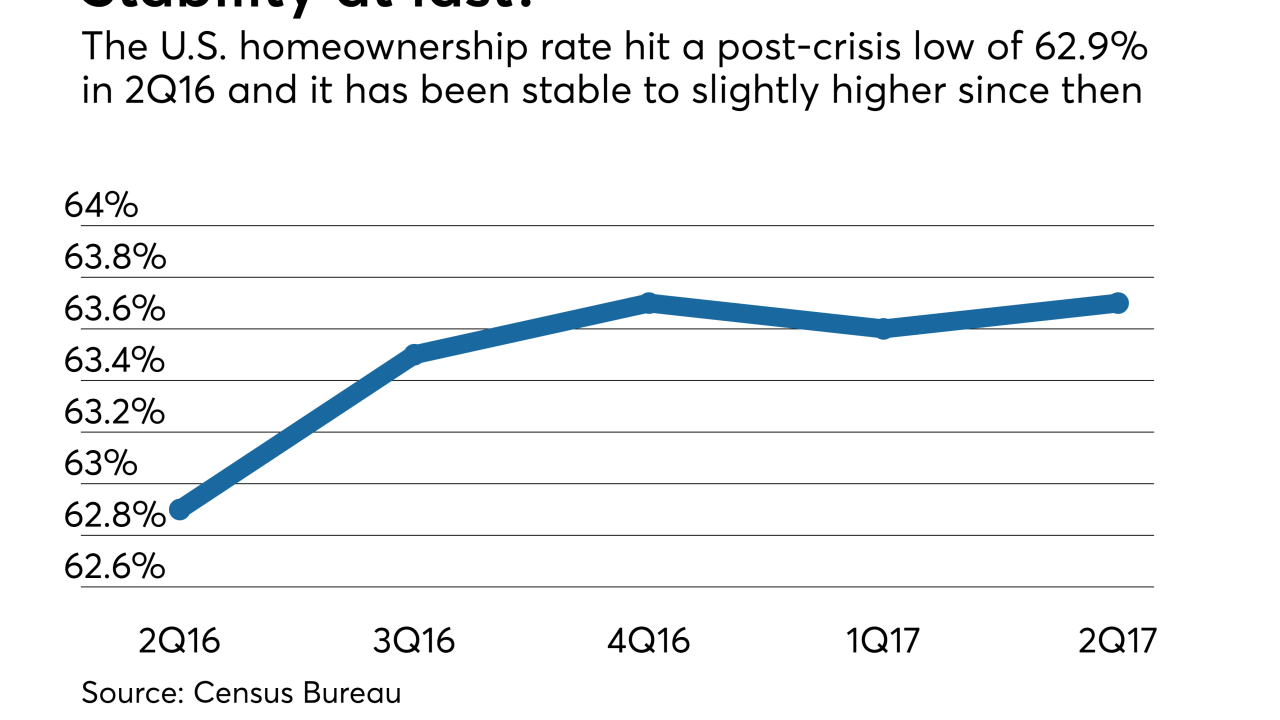

The U.S. homeownership rate remains slightly above a post-crisis low it set during the second quarter of last year.

August 1 -

Mayor Byron W. Brown is overhauling the board that oversees Buffalo's public housing for 10,000 residents, an initial step toward tackling ongoing problems at the agency.

July 24 -

When market prices rise faster than comparable home sales values it is imperative for lenders to ensure property valuations are accurate, support the sales price and completed in a timely fashion to keep deals from falling through. (Part four in a four-part series on the mortgage industry's response to the housing inventory shortage.)

July 20 -

California Gov. Jerry Brown and legislative leaders announced that the state's housing crisis will be at the top of their agenda when lawmakers return in August from a month-long break.

July 19 -

New data shows that large commercial banks are increasing their originations of single-family construction loans, but these loans still represent a small percentage of their total assets.

July 12 -

With traditional mortgage lending opportunities becoming increasingly scarce, banks in Seattle and Portland are loading up on jumbos, diving into multifamily and reviving dormant bridge loan programs.

July 6 -

President Trump's immigration policies are prompting more than half of Arabs, Asians and Latinos to reconsider their plans to buy or sell a home, according to a Redfin survey.

June 30 -

Workers across Washington and the Seattle area finally got a good pay hike last year, and yet it didn't amount to much compared with the state's soaring cost of housing, which led the nation last year.

June 30 -

The young adult homeownership rate should increase by 1.5 percentage points over the next two decades as education attainment among racial and ethnic minorities continues to rise.

June 20 -

While home prices have increased sharply in expensive coastal cities, plenty of urban centers are lagging behind.

June 19 -

Comerica Bank will invest up to $5 million in Detroit Home Mortgage, which provides second mortgages to buyers so they can get past the city's appraisal gap problem.

June 19 -

Louisiana landlords with rental houses walloped by 2005's Hurricanes Katrina and Rita were eventually promised state help to rebuild: If they could get loans to rehab their properties, the state government would later reimburse them.

June 19 -

Odd though it may seem, Los Angeles is too lucky for its own good.

June 19 -

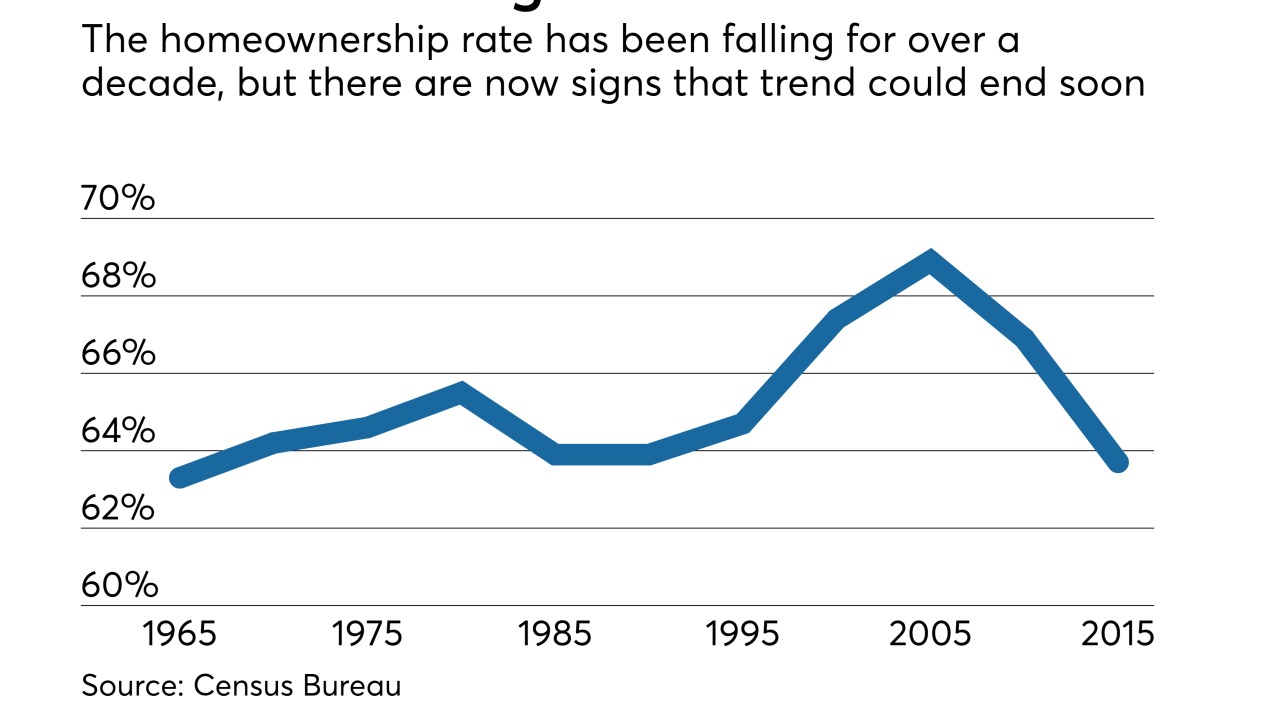

The homeownership rate has been falling for over a decade, but there are now signs that the decline is decelerating and could end soon, according to researchers at Harvard University.

June 16 -

An Ames family will finally be able to call themselves homeowners, thanks to Habitat for Humanity of Central Iowa and a $50,000 grant from the Iowa Finance Authority Board of Directors.

June 15