-

Two Memphis agencies heavily reliant on Department of Housing and Urban Development funding could face deep, far-reaching cuts if the Trump administration slices $6 billion from HUD's budget.

March 10 -

Small investors, not first-time homebuyers, are driving home prices to unaffordable highs, according to a new report from Attom Data Solutions and Clear Capital.

February 24 -

U.S. Treasury Secretary Steven Mnuchin's seriousness about overhauling the nation's $10 trillion mortgage market will soon be tested.

February 23 -

Senate Banking Committee Chairman Mike Crapo said Wednesday that although he plans to begin working on housing finance reform and changes to the Dodd-Frank Act, the poor relationship between Democrats and Republicans will slow any progress.

February 15 -

The government-sponsored enterprises should target their affordable housing efforts to strengthening the single-family market, rather than investing in private equity giants.

February 15 Center for American Progress

Center for American Progress -

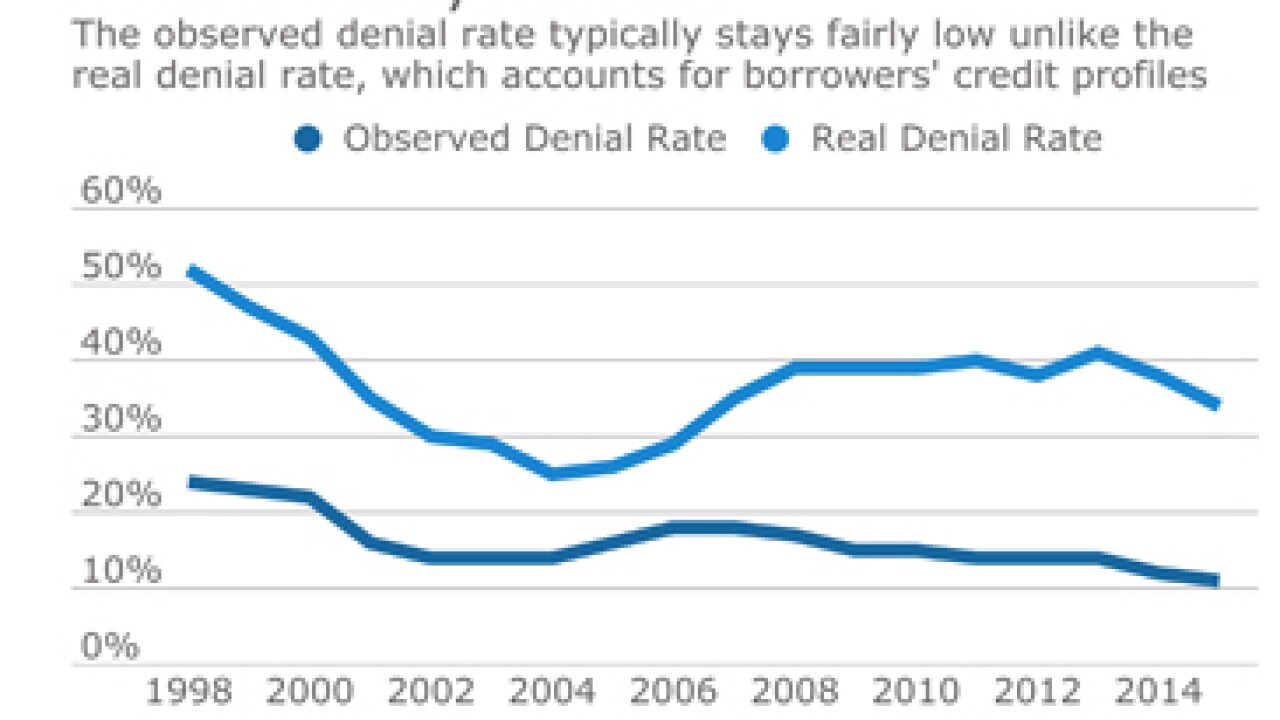

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

The Fannie Mae Home Purchase Sentiment Index rose two percentage points to 82.7 in January, reflecting the more positive consumer outlook following November's presidential election.

February 7 -

A homeowner's equity position is one of the many factors that drive property transitions between owner-occupied and rental status, according to a study from the Mortgage Bankers Association's Research Institute for Housing America.

February 7 -

A shortage of appraisers, combined with soaring demand for housing, is causing lengthy delays in Seattle and surrounding markets.

January 27 -

The Senate Banking Committee voted unanimously on Tuesday to approve the nomination of Ben Carson as the next Housing and Urban Development secretary.

January 24 -

The Department of Housing and Urban Development announced Friday that the reduction in mortgage insurance premiums "has been suspended indefinitely."

January 20 -

In his confirmation hearing, Treasury Secretary-designate Steven Mnuchin said he wanted to work with both parties to find a "bipartisan fix" for the housing finance system.

January 19 -

In a candid, in-depth exit interview, Ted Tozer discusses Ginnie Mae's growth during his seven years at the agency's helm, the need for comprehensive housing finance reform, big banks' retreat from mortgages, counterparty risk management and more.

January 18 -

The Justice Department claims the bank, which has received "satisfactory" ratings in its last four CRA exams, is failing to serve minority neighborhoods around Minneapolis.

January 18 -

And the next HUD chief might eventually rescind it altogether.

January 18 -

The Office of the Comptroller of the Currency could make the Community Reinvestment Acts spirit relevant in a digital age so long as it builds the right framework for chartered fintech companies.

January 18

-

The Department of Housing and Urban Development's proposed guidance has stirred up a debate on elevation standards as flooding occurs more frequently and in more unexpected places.

January 17 -

The Federal Housing Administration program could see a $50 billion increase in single-family loan endorsements this year if a planned 25-basis-point annual premium cut goes into effect on Jan. 27.

January 13 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits as expectations of a Trump tax cut surge, slowing down some projects already and threatening developers with heavier financing burdens.

January 13 -

Housing and Urban Development Secretary-designate Ben Carson is open to finding alternatives to the 30-year fixed-rate mortgage, but believes there must be some government backstop to the housing market.

January 12