-

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

Oaktree Re VI 2021-1 will market $531 million in CRT notes that will provide NMI with partial reinsurance on a $45B pool of GSE-eligible loans.

April 14 -

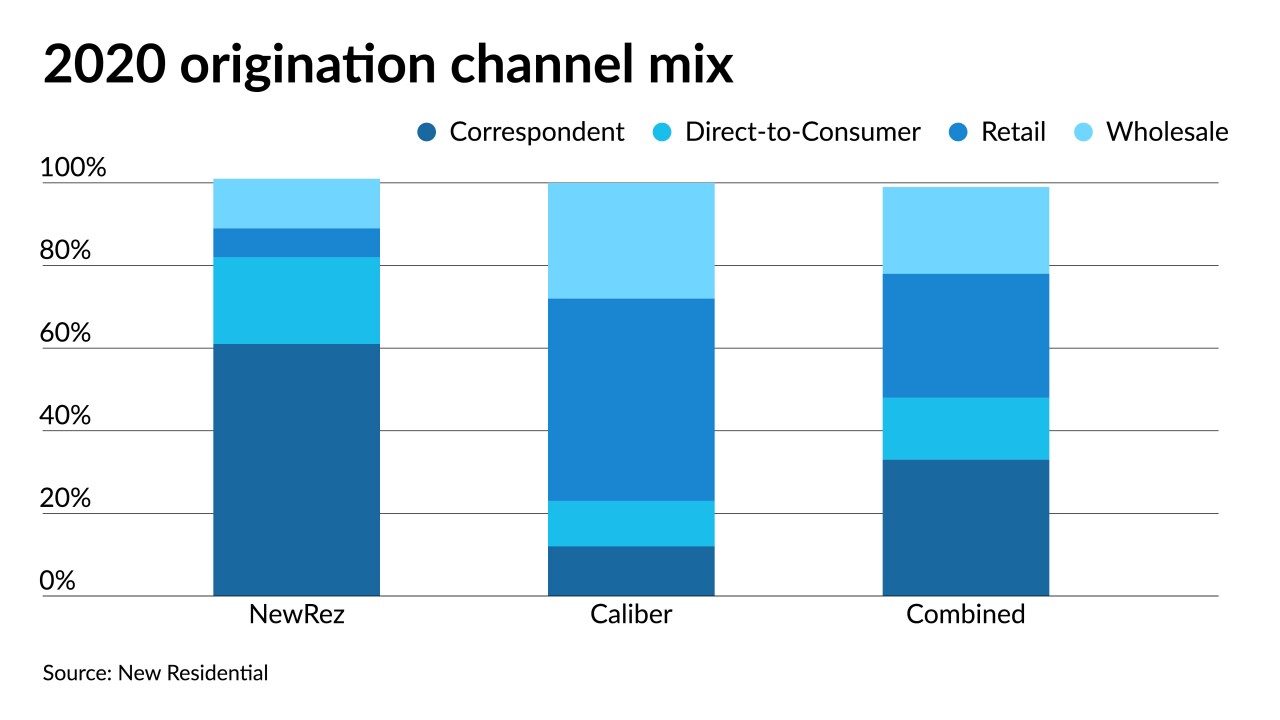

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

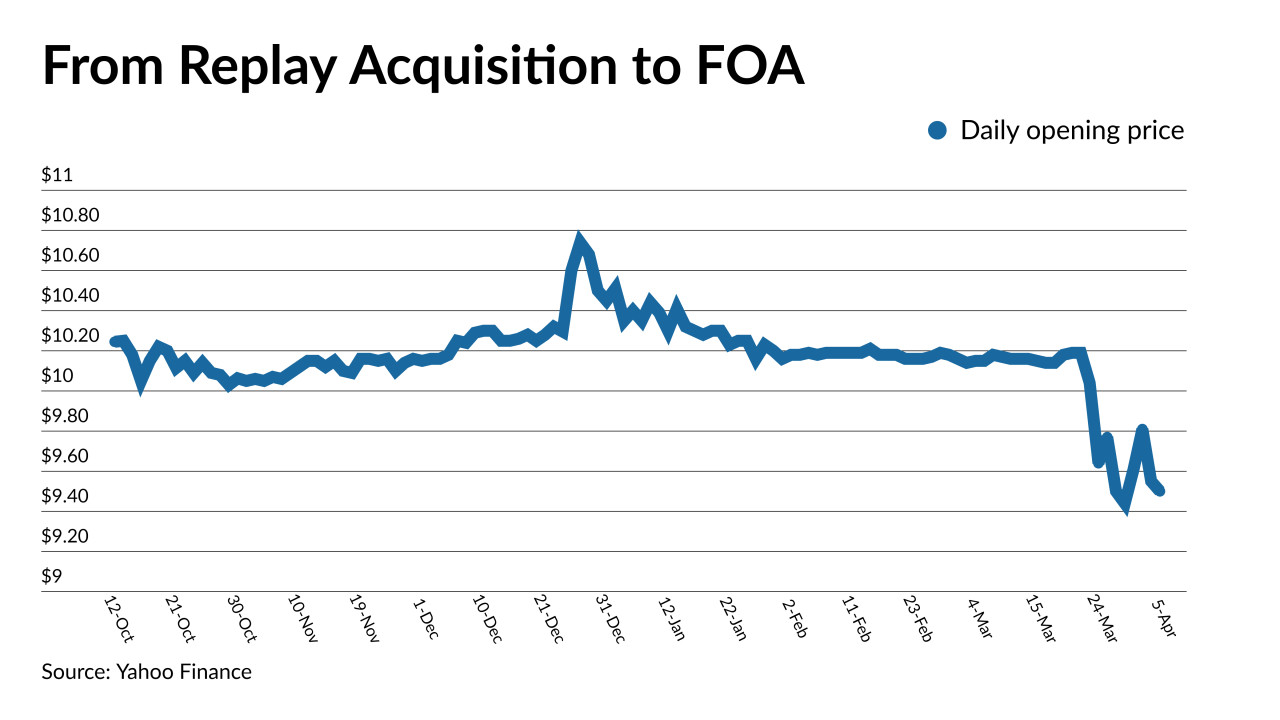

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 - LIBOR

A white paper released Monday by the Alternative Reference Rates Committee outlined how issuers could (and perhaps should) model new floating-rate transactions using a compounded version of the interbank overnight rate instead of Libor.

March 30 -

Sen. Pat Toomey, R-Pa., warned the regional Federal Reserve bank that its papers about environmental, social and corporate governance policies hurt its ability to stay neutral on partisan issues.

March 29 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

The 11-year-old company, which went public earlier this year, sold new junk-rated bonds on Tuesday to refinance debt and to pay its shareholders a $200 million special dividend, according to a copy of the debt documents

March 24 -

A PIMCO-sponsored HELOC securitzation, as well as a mortgage-insurance linked transaction, are the latest examples of issuers getting a head start on switching to an expected replacement benchmark for Libor.

March 22 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Relying on retained earnings alone, it would be until at least 2036, if not longer, before government control of Fannie Mae and Freddie Mae might end.

March 18 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4