-

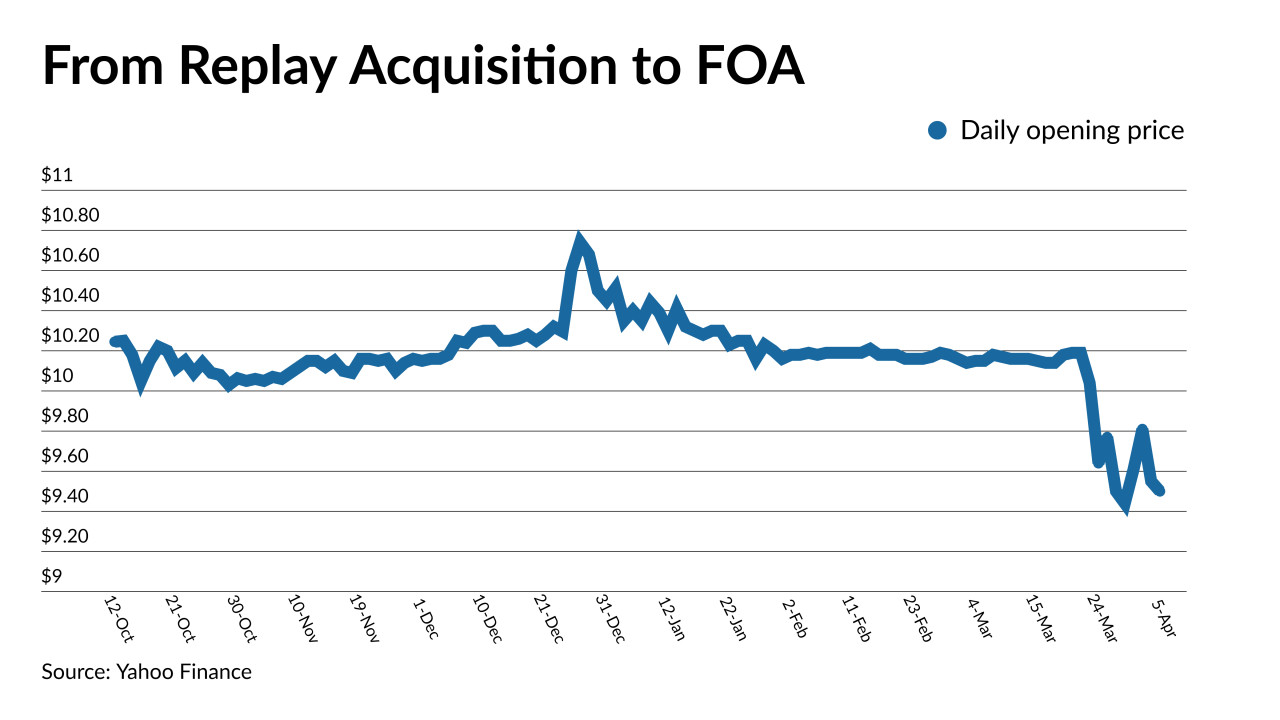

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 - LIBOR

A white paper released Monday by the Alternative Reference Rates Committee outlined how issuers could (and perhaps should) model new floating-rate transactions using a compounded version of the interbank overnight rate instead of Libor.

March 30 -

Sen. Pat Toomey, R-Pa., warned the regional Federal Reserve bank that its papers about environmental, social and corporate governance policies hurt its ability to stay neutral on partisan issues.

March 29 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

The 11-year-old company, which went public earlier this year, sold new junk-rated bonds on Tuesday to refinance debt and to pay its shareholders a $200 million special dividend, according to a copy of the debt documents

March 24 -

A PIMCO-sponsored HELOC securitzation, as well as a mortgage-insurance linked transaction, are the latest examples of issuers getting a head start on switching to an expected replacement benchmark for Libor.

March 22 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Relying on retained earnings alone, it would be until at least 2036, if not longer, before government control of Fannie Mae and Freddie Mae might end.

March 18 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

Rocket Cos. fell premarket, halting a three-day rally driven by sentiment that the home-loan provider was the latest retail-trader favorite for its high short interest.

March 3 -

The $16.9 billion in issuance marked the biggest annual number seen since the government-sponsored enterprise reconstituted its risk sharing program in 2013.

February 23 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

Bond bears appear to be having more than just a moment here at the start of 2021, with Treasury yields finally busting out of long-held ranges to levels last seen in the early days of the pandemic.

February 22 -

Just because the Fed is staying put doesn’t mean that mortgage rates, and prices of MBS, are staying put as well, writes Vice Capital Markets Principal Chris Bennett.

February 19 Vice Capital Markets

Vice Capital Markets -

Today, the mortgage players who most actively hedged — Fannie and Freddie, real estate investment trusts and large bank servicers — have significantly reduced their need to to do so, analysts said.

February 19 -

After they reopened on Tuesday, Treasury 10-year yields rose four basis points to touch 1.25% — the highest since last March — while the 30-year equivalent pushed above 2%.

February 16 -

The best mortgage bonds to buy now may be the ones the Federal Reserve is purchasing, because the securities might benefit the most if macro optimism fades.

February 12 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11