-

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30 -

The New Jersey megamall owners' missed mortgage payments for another property compound investor concerns.

July 29 -

The investors seeking to take over CoreLogic plan to solicit support from fellow shareholders to replace nine directors, after the company refused to engage in talks over their $7 billion proposal to take it private.

July 29 -

CEO Douglas Gordon credited the relationship between Waterstone Financial and the mortgage subsidiary for the boost in net income.

July 28 -

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Rocket Cos., the parent of the mortgage giant founded by billionaire Dan Gilbert, is seeking to raise as much as $3.3 billion in a U.S. initial public offering.

July 28 -

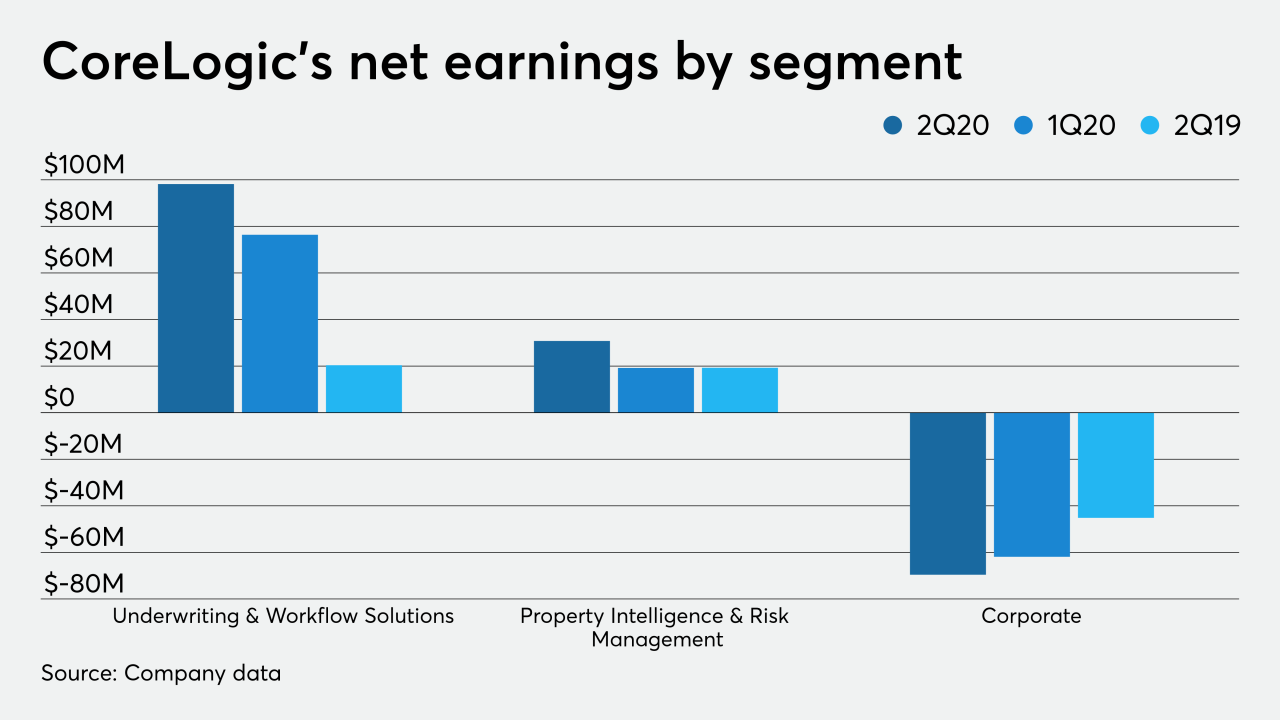

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

The mortgage REIT's external manager responded by filing a new lawsuit against it, calling the move "baseless and retaliatory."

July 23 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Fannie Mae could be worthless to public shareholders, according to its newest analyst.

July 22 -

The domestic mortgage insurer could have a portion of its equity sold as an initial public offering if the China Oceanwide transaction were to be terminated.

July 21 -

The technology company reiterated its call for the hostile bidders to raise their $65 per share offer.

July 20 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

The Detroit lender disclosed that the consumer bureau had sent a civil investigative demand to Rocket Homes Real Estate for potential violations of the Real Estate Settlement Procedures Act.

July 16 -

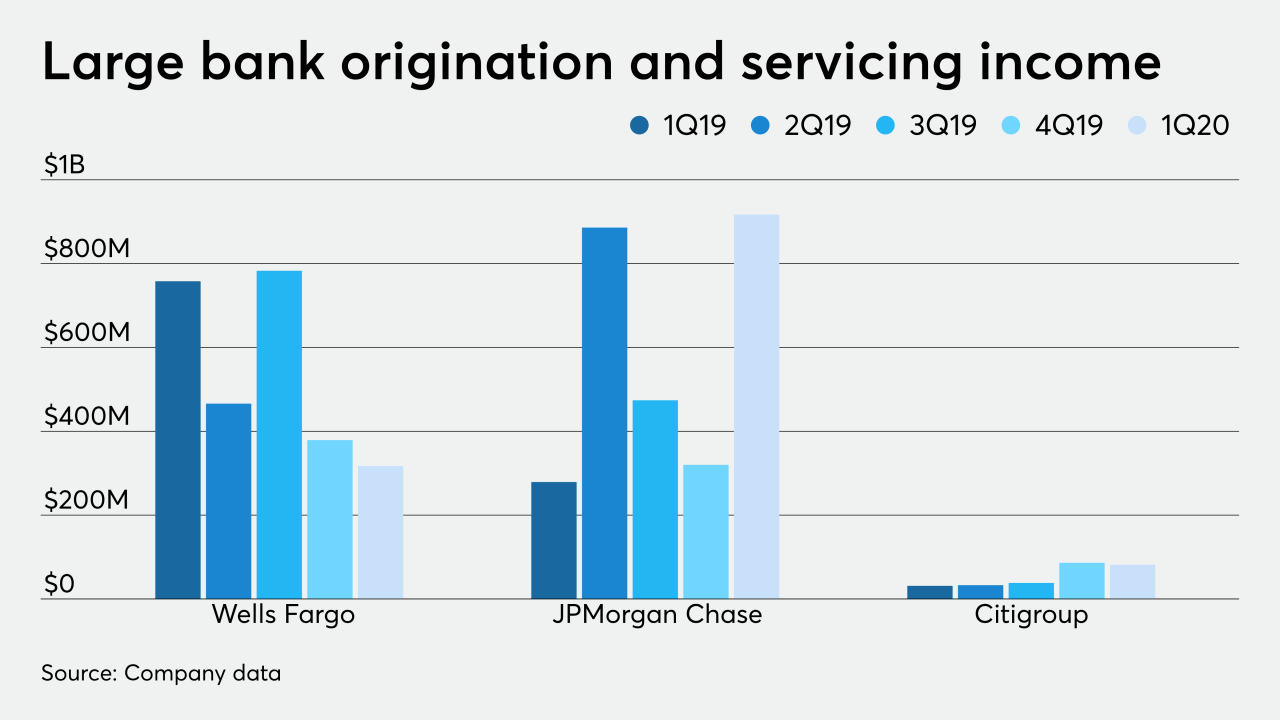

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14