-

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 -

PIMCO Mortgage Income Trust tabled plans to launch an initial public offering this week following a steep stock market decline Monday.

May 15 -

Zillow's mortgage division experienced better customer demand in the first quarter than it expected, but its revenue was outweighed by expenses that led to a pretax loss of $9.6 million.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Moody's Investors Service downgraded tax-exempt bonds issued for a Syracuse, New York, shopping mall expansion to the last rung above junk.

May 10 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Intercontinental Exchange's proposed acquisition of Simplifile will enhance its MERS unit's growing presence in handling electronic notes.

May 2 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Fannie Mae is considering sharing more risk with the private sector to reduce future strain on its earnings from the implementation of the Current Expected Credit Loss accounting standard next year.

May 1 -

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

Historically, rising interest rates have enabled banks to earn more, but this time around in the banking industry, like much else, things are a little different.

April 23 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Homebuilder stocks are slipping after sales of previously owned homes fell more than forecast in March and KBW cut its rating on D.R. Horton shares.

April 23 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

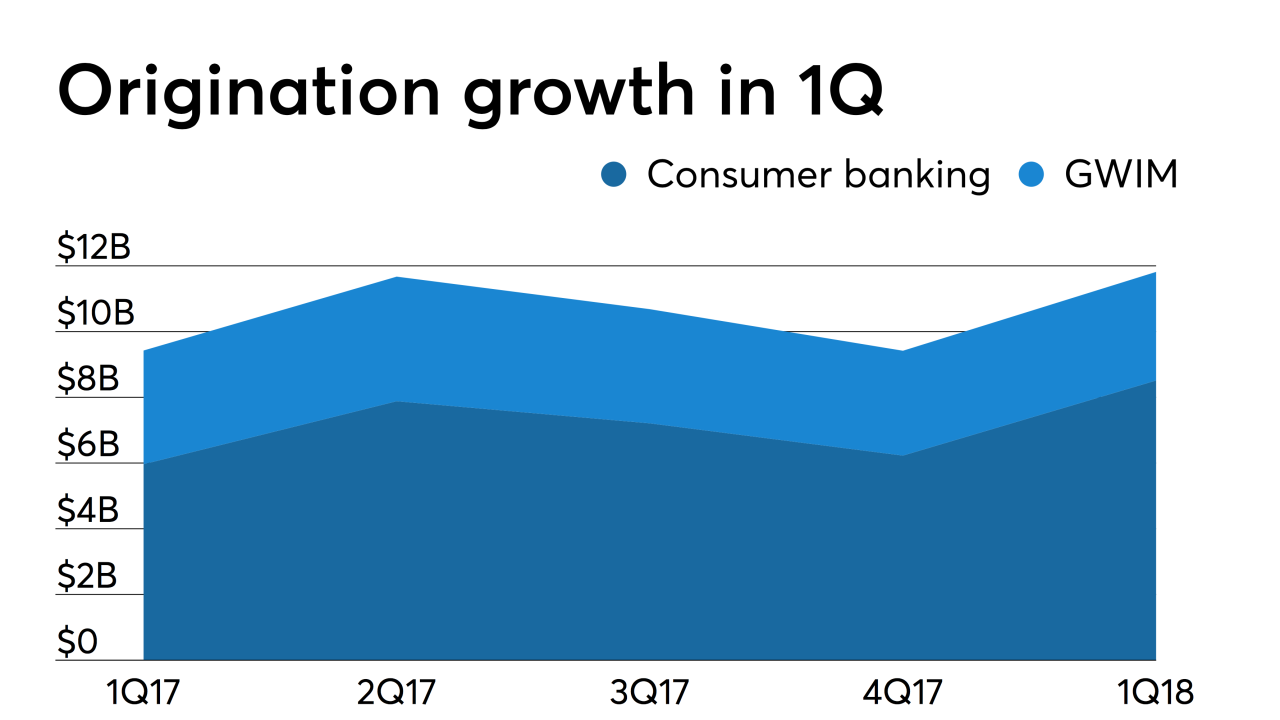

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16