-

On his 1.5-acre lot near Kincaid Park in Anchorage, Chris Herman wanted to build a detached garage with an apartment on top, as a future home for his aging parents.

June 29 -

The U.S. Supreme Court agreed to decide whether thousands of borrowers can invoke a federal debt-collection law when they are facing foreclosure.

June 28 -

Ocwen Financial is able to keep the answers to questions from the Consumer Financial Protection Bureau involving the improper handling of escrow accounts confidential, a federal magistrate ruled.

June 26 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Regulation imposed by all levels of government accounts for 32% of multifamily development costs, according to the National Association of Home Builders and the National Multifamily Housing Council.

June 15 -

New Orleans is falling further behind when it comes to providing affordable housing for its low-income residents, with fewer than 200 units added since last fall, and is unlikely to achieve the goals set by housing advocates and the city itself, according to a new report.

June 13 -

At least 38 projects totaling 3,337 units were proposed in Massachusetts in 2017, which is far more than the five projects totaling 391 units proposed in 2010, the basement of the Great Recession.

June 5 -

Gov. John Bel Edwards vetoed legislation that would have asserted state authority over local zoning efforts aimed at creating affordable housing in gentrifying neighborhoods.

June 1 -

A mix of escalating construction costs and changes to the federal tax code is hampering San Francisco's ability to finance and build affordable housing.

May 24 -

Attorney General Peter F. Kilmartin joined housing advocates — as well as the mayors of Providence, Pawtucket and Warwick — to urge the General Assembly to extend the state's Foreclosure Mediation Act, set to expire on July 1.

May 22 -

Although the Consumer Financial Protection Bureau is loosening certain mortgage rules, others such as restrictions on loan officer compensation and state-level regulation will likely persist, according to industry attorneys.

May 18 -

Many Florida communities are experiencing a renewed clamor for affordable housing options as rising home prices and rents squeeze budgets.

May 15 -

Requiring solar panels for all newly constructed residences is good news for investors who finance these systems, if only because it will help keep developers afloat, according to Moody’s Investors Service.

May 15 -

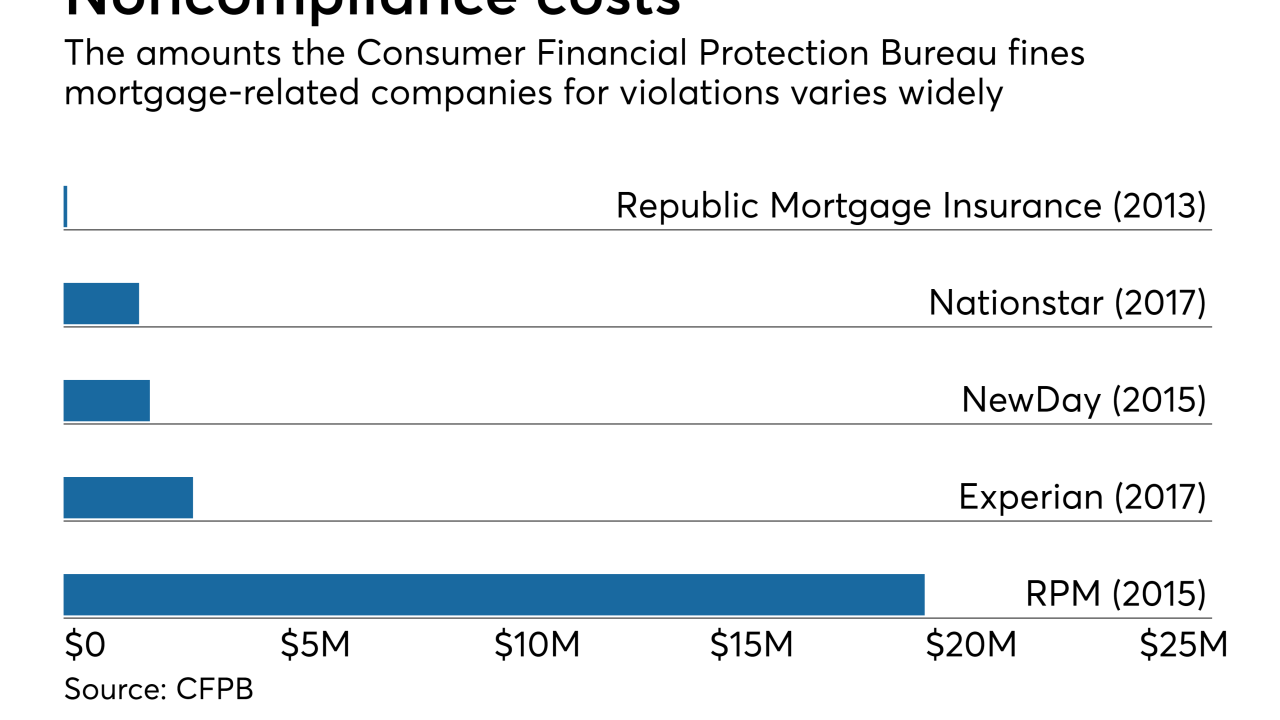

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

Despite having a qualified candidate ready to serve, Senate leadership on both sides of the aisle have ignored their responsibility to vote on Brian Montgomery's nomination as Federal Housing Administration commissioner.

May 2 National Reverse Mortgage Lenders Association

National Reverse Mortgage Lenders Association -

Mortgage companies should model cybersecurity protocols after their compliance strategies to avoid being underprepared in the event of a data breach.

April 19 -

A sweeping bill that would have given the state unprecedented power over local development failed in its first committee hearing, crushing the hopes of those who saw it as the key to making housing in the state more affordable.

April 18 -

As the state's costliest housing markets and high rents threaten to force all but the highest-paid workers into ever-longer commutes, California lawmakers have introduced a bill to help more teachers, firefighters and other middle-income workers live close to their jobs.

April 10 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

The investigation targeted 36 residential mortgage-backed securities deals involving $31 billion worth of loans, more than half of which defaulted, according to the Justice Department.

March 29