-

Come away better prepared for what’s ahead after hearing Satish Kini and David Sewell of Debevoise & Plimpton and Darin Jarrett, Deputy BSA/AML Officer at American Express, in conversation with Bonnie McGeer, Executive Editor of American Banker, as they explore: •How the new administration might change the BSA/AML Act •Are there easy wins in relieving the burden of suspicious activity reports without undermining effectiveness? •New ways that companies are innovating within AML compliance and risk •What banks are doing to drive next-gen efficiency and effectiveness of risk and compliance

-

The former executive at Lend America, who has remained out of prison since his 2011 guilty plea, will not be incarcerated for his acts.

January 20 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

If enacted, the rule will bring the agency into compliance with the GSEs and the Biggert-Waters Flood Insurance Reform Act.

November 10 -

The CrossState Credit Union Association continues to work with lawmakers in neighboring New Jersey to get similar legislation passed there.

October 30 -

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

Taylor, Bean & Whitaker's former chairman and CEO, Lee Farkas, led a $2.9 billion mortgage fraud scheme during the housing crash but was released early from prison due to susceptibility of COVID-19 transmission.

September 18 -

The proposals offer lenders both cause for celebration and for concern.

September 15 Promontory MortgagePath

Promontory MortgagePath -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

The decision is the latest development in an ongoing dispute between the shuttered company and its regulator.

September 1 -

The California Assembly is considering a bill that would require local governments to permit duplexes on parcels now largely restricted to one house, in effect eliminating single-family zoning that dominates in most suburban residential neighborhoods.

August 27 -

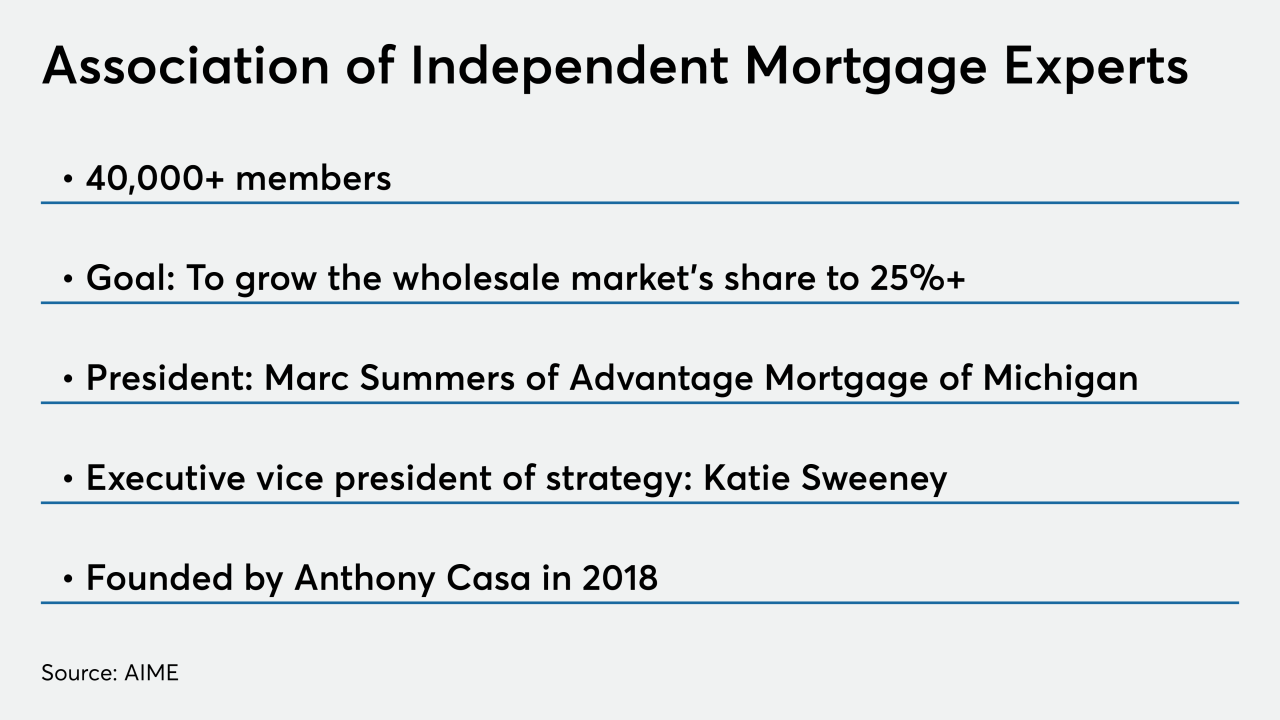

The chairman of the Association of Independent Mortgage Experts is distancing himself from the organization after a Quicken Loans executive's wife filed a defamation lawsuit against him for vulgar group texts.

July 17 -

Remarks that the head of the mortgage broker association made about a Quicken Loan executive's wife in a video text exchange led to a defamation lawsuit, and housing-finance companies are taking sides.

July 16 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

Future loss mitigation may be most effective if housing-finance industry stakeholders communicate clearly with consumers about these five aspects of the Coronavirus Aid, Relief and Economic Security Act.

April 21 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Almost all California foreclosures and evictions have been put on hold for the foreseeable future.

April 7 -

A statewide stay-at-home order by Gov. Kay Ivey means evictions and foreclosures are on hold for at least a month.

April 6