-

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

The decision is the latest development in an ongoing dispute between the shuttered company and its regulator.

September 1 -

The California Assembly is considering a bill that would require local governments to permit duplexes on parcels now largely restricted to one house, in effect eliminating single-family zoning that dominates in most suburban residential neighborhoods.

August 27 -

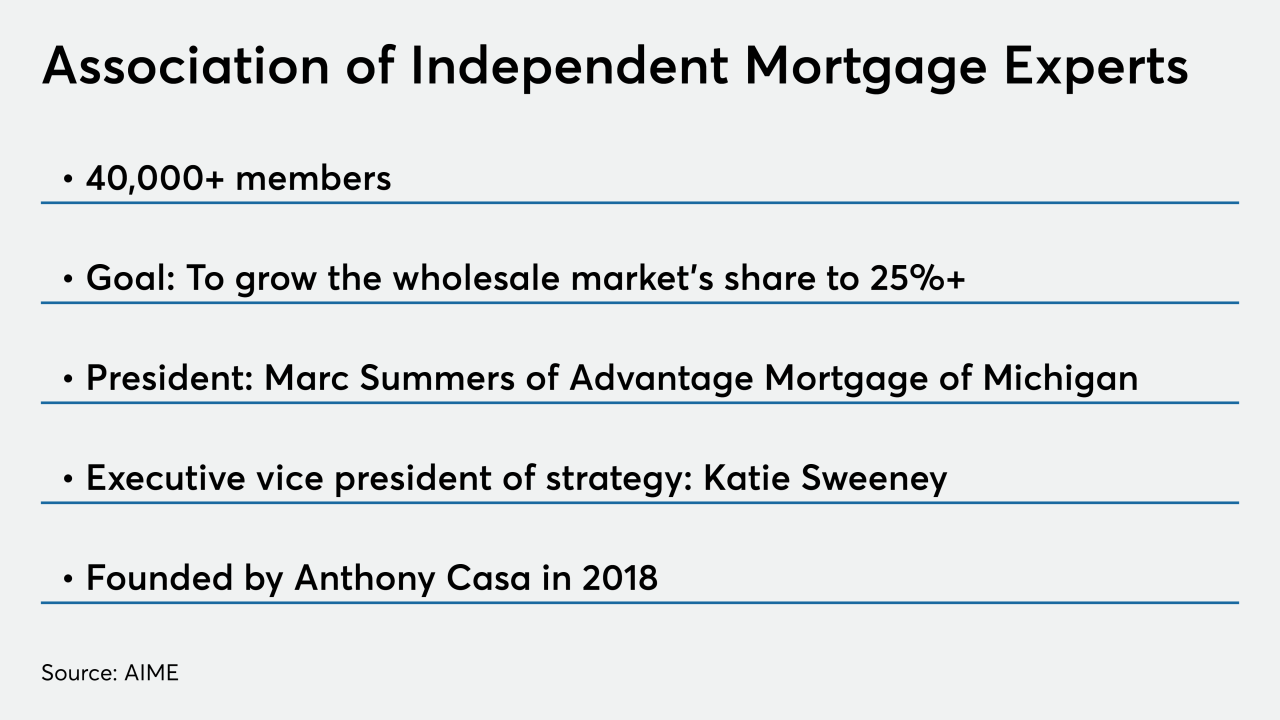

The chairman of the Association of Independent Mortgage Experts is distancing himself from the organization after a Quicken Loans executive's wife filed a defamation lawsuit against him for vulgar group texts.

July 17 -

Remarks that the head of the mortgage broker association made about a Quicken Loan executive's wife in a video text exchange led to a defamation lawsuit, and housing-finance companies are taking sides.

July 16 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

Future loss mitigation may be most effective if housing-finance industry stakeholders communicate clearly with consumers about these five aspects of the Coronavirus Aid, Relief and Economic Security Act.

April 21 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Almost all California foreclosures and evictions have been put on hold for the foreseeable future.

April 7 -

A statewide stay-at-home order by Gov. Kay Ivey means evictions and foreclosures are on hold for at least a month.

April 6 -

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

March 29 -

The regulation issued late on Tuesday directs state-regulated financial institutions to give mortgage borrowers at least 90 days of forbearance if they can show financial hardship resulting from the coronavirus pandemic. It also requires banks and credit unions to provide relief on ATM fees and credit card late payment fees.

March 24 -

Kansas Gov. Laura Kelly on Wednesday announced she was banning evictions and foreclosures for the next six weeks, adding to her administration's response to the unprecedented crisis caused by COVID-19.

March 19 -

Financial executives who visited the White House pledged to help small businesses and consumers get through any economic damage as the virus continues to spread. They also encouraged the government to support fiscal stimulus policies.

March 11 -

Corporations that own California properties could soon be fined for keeping homes vacant for more than three months under a proposed law to give tenants, nonprofits and cities more say over what happens to empty buildings.

February 21 -

Finance Minister Bill Morneau is relaxing mortgage qualification rules to make it easier for homebuyers to secure financing, a move that could give Canada's real estate market another boost.

February 19 -

The city's Residential Mortgage Foreclosure Diversion program, born out of the recession in 2008, has prevented nearly 14,000 foreclosures by working with lenders and homeowners to lower mortgage payments.

February 13 -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

A high-profile proposal to address California's housing crisis by compelling cities to build more homes failed to pass the Senate on Wednesday, but lawmakers left the bill's author one more chance to pass the measure.

January 30