-

After years of expansion as a public company, Ellie Mae went private and cut 10% of its workforce. But new ways to grow lie ahead, according to CEO Jonathan Corr.

May 28 -

Mortgage technology company Ellie Mae, which was recently bought by private equity investor Thoma Bravo, underwent restructuring and reduced its staff by 10%.

May 17 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Sluggish growth in originations spurs consolidation. Keep in mind, there's more to M&A than just agreeing on a price.

April 8 -

Mortgage Builder is counting on its new ownership's backing to help it reach more lenders and servicers as technology advances compel more of its potential clients to consider changing their systems.

April 4 -

AI Foundry is aiming to further cut the time it takes to originate a mortgage by adding artificial intelligence tools designed to improve on optical character recognition.

March 5 -

CoreLogic's fourth-quarter earnings declined from the previous year because of the slower mortgage origination market and an $8 million impairment charge due to its restructuring plans.

February 27 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Black Knight reported lower net earnings, but higher revenue in the fourth quarter compared with the previous year, driven by growth in the company's software segment.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

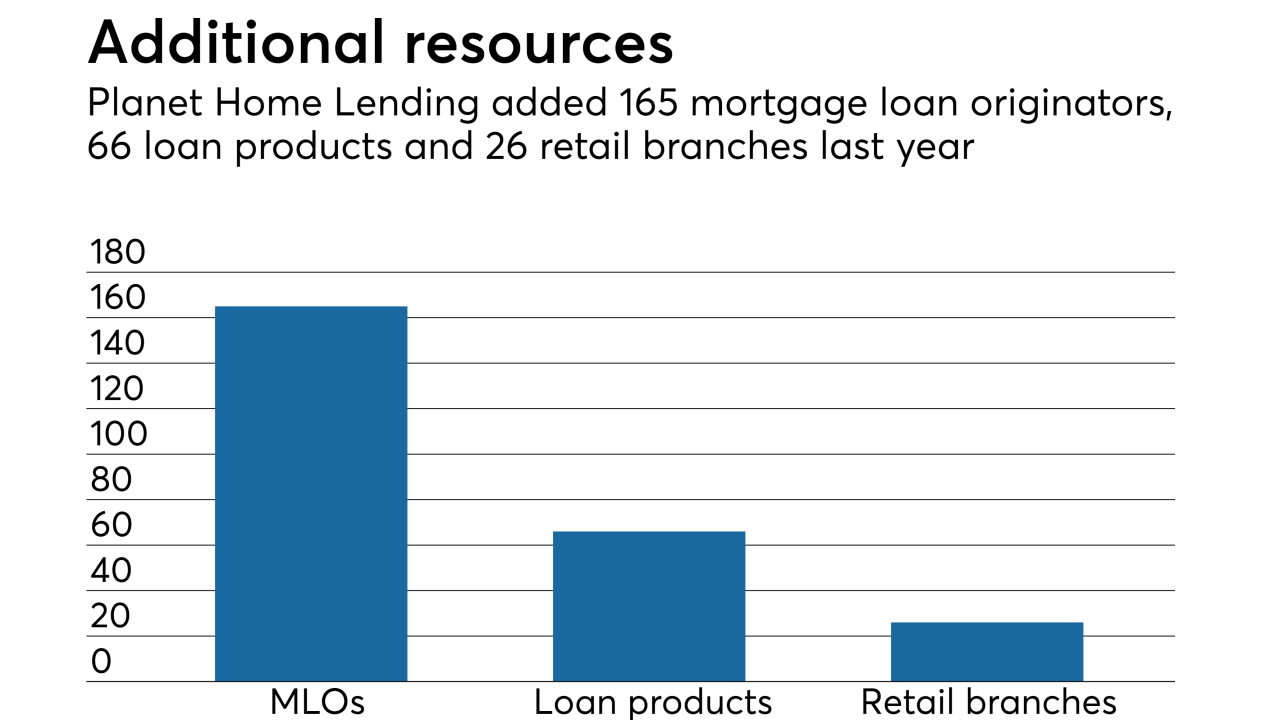

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

Mortgage technology is rapidly advancing, with incumbents and new entrants scrambling to take advantage of developments in artificial intelligence and automation. The goal? Beat the customer expectations set by Amazon and Uber, not just other lenders, says KPMG Managing Director Teresa Blake.

December 28 -

CoreLogic is exiting its loan origination software and default management operations over the next 24 months and instead accelerated plans to transform its appraisal management company unit.

December 21 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Ellie Mae plans to more quickly adapt to an evolving digital mortgage landscape with Amazon's help rebuilding from the inside-out.

November 26 -

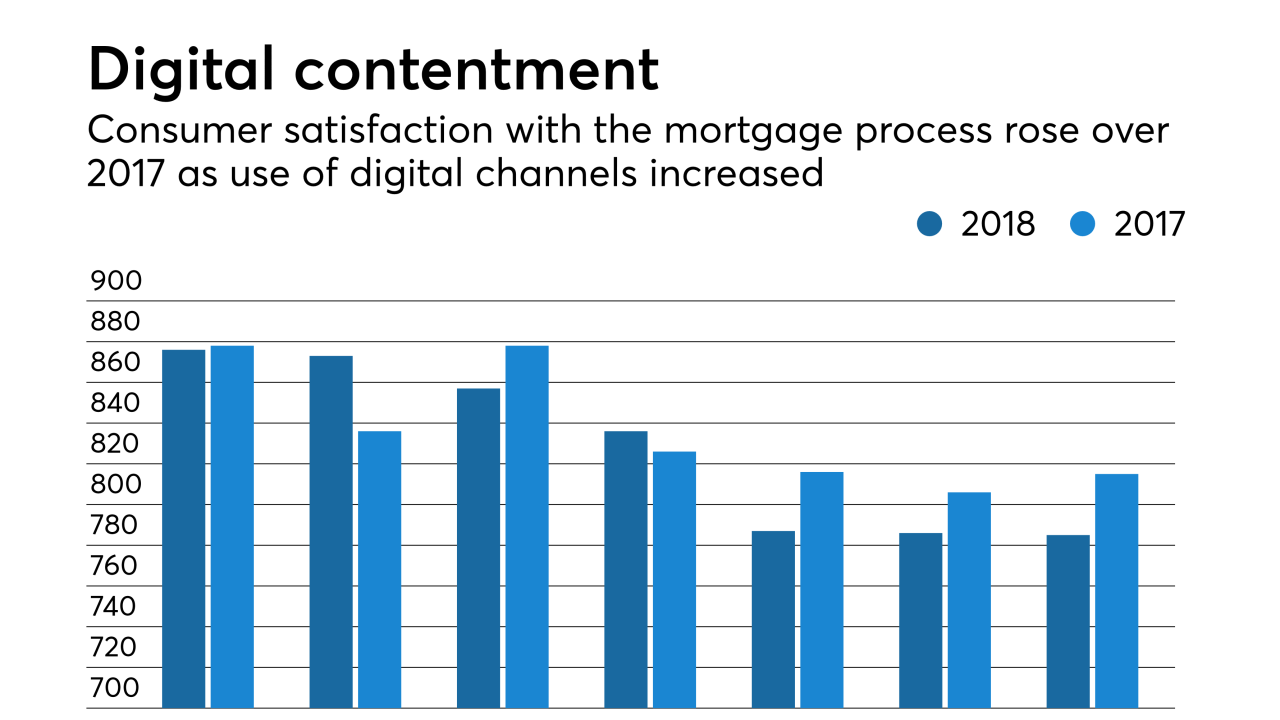

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7