-

While sales increased 24% over August, they were still down 78% from the prior year, Auction.com reported.

November 24 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 23 -

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 9 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

To continue providing liquidity for lenders, Fannie Mae lengthened the period in which it would continue the purchase of forborne mortgages and pools of mortgage-backed securities into 2021.

October 22 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

The agreement with Florida ends the saga that began in April 2017, when several states sued the company. However, the CFPB's case filed at the same time remains active.

October 15 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

But most borrowers who have exited forbearance plans are back on track when it comes to paying, and the incidence of loss mitigation plans is high among those who aren't.

October 5 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

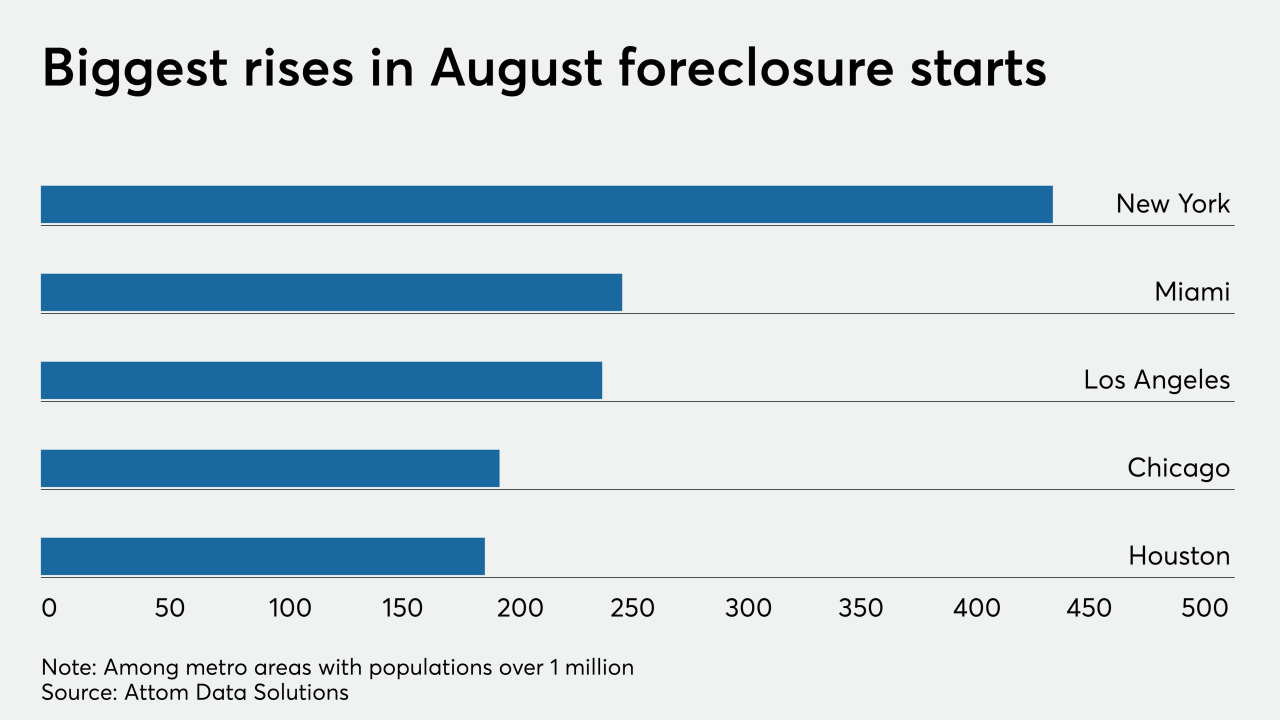

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17