M&A

M&A

-

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

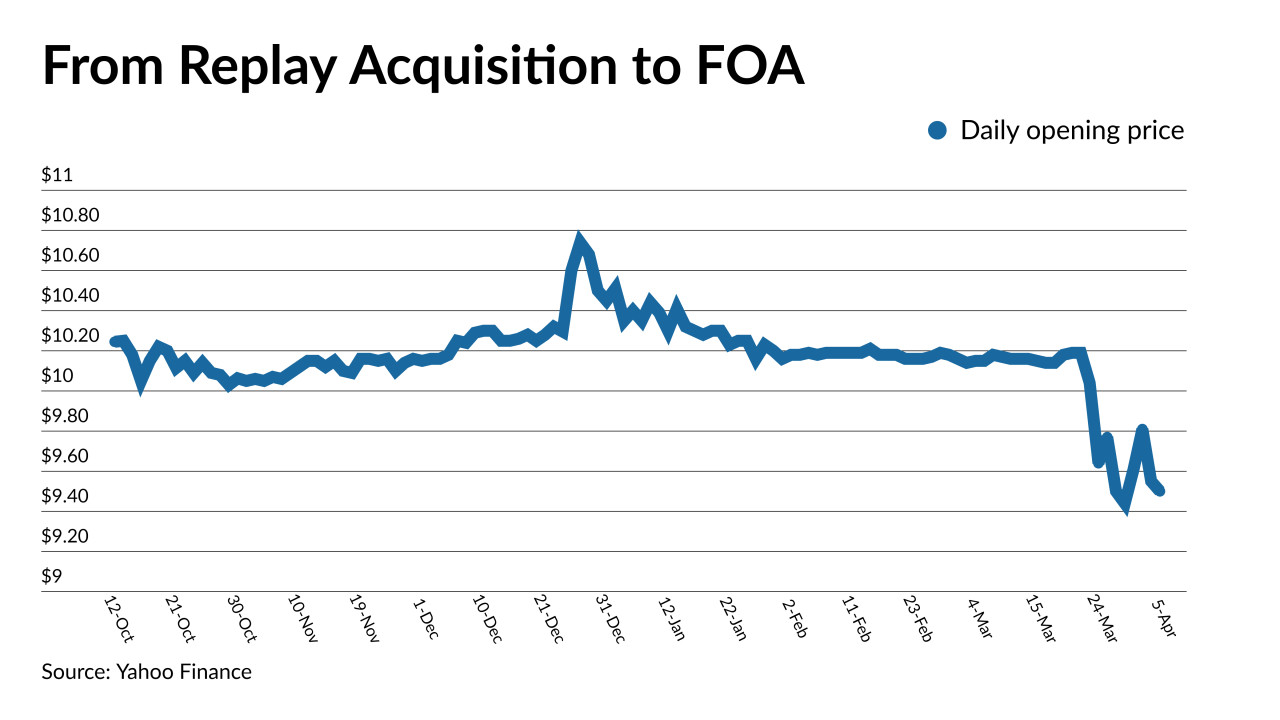

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The proceeds are expected to be reinvested into agency mortgage-backed securities, which already make up 93% of Annaly's portfolio.

March 26 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

After its three acquisitions since last August, the Philadelphia area-based credit data firm predicts more industry consolidation is on the way.

March 17 -

The acquisition, which has a $500 million enterprise value, will extend the technology vendor’s capabilities beyond the point of sale into the stubbornly manual electronic closing process.

March 15 -

The abrupt move paves the way for the $6 billion cash deal with Stone Point and Insight Partners to move forward unimpeded.

March 4 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

The acquisition of the mortgage fintech aligns with growing customer expectations surrounding a fully digital homebuying experience.

February 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

The Arizona company will pay $1 billion for the parent of AmeriHome Mortgage, which manages a $99 billion mortgage servicing portfolio.

February 16 -

Mike Cagney’s blockchain lending startup Figure Technologies plans to raise $250 million through a new blank-check company, according to an SEC filing.

February 12 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

Also, private money is expected to return to the mortgage securitization market, according to lenders who responded to an Altisource survey.

February 5 -

The deal definitively ends a monthslong war of words between the data provider and stakeholders who attempted a hostile takeover.

February 4 -

The acquiring company does business under the name Excelerate Capital and will extend that name to Castle in order to expand its footprint.

February 3