-

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

March 6 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2 -

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

February 27 LodeStar Software Solutions

LodeStar Software Solutions -

Franchisees of Remax Holdings' Motto Mortgage combined to originate over $1 billion in loans in the organization's third year of operations.

February 21 -

The CEO of Freedom Mortgage, Stanley Middleman, provides his take on trends affecting independent mortgage bankers as well as the residential real estate finance industry at large.

February 20 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. -

Unexpected rate drops and other factors drove a surprising rebound in nonbank mortgage hiring during what is usually a slow season.

February 7 -

The estimated number of mortgage professionals employed by nondepository institutions inched down in November 2019 following a surge in the previous month.

January 10 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

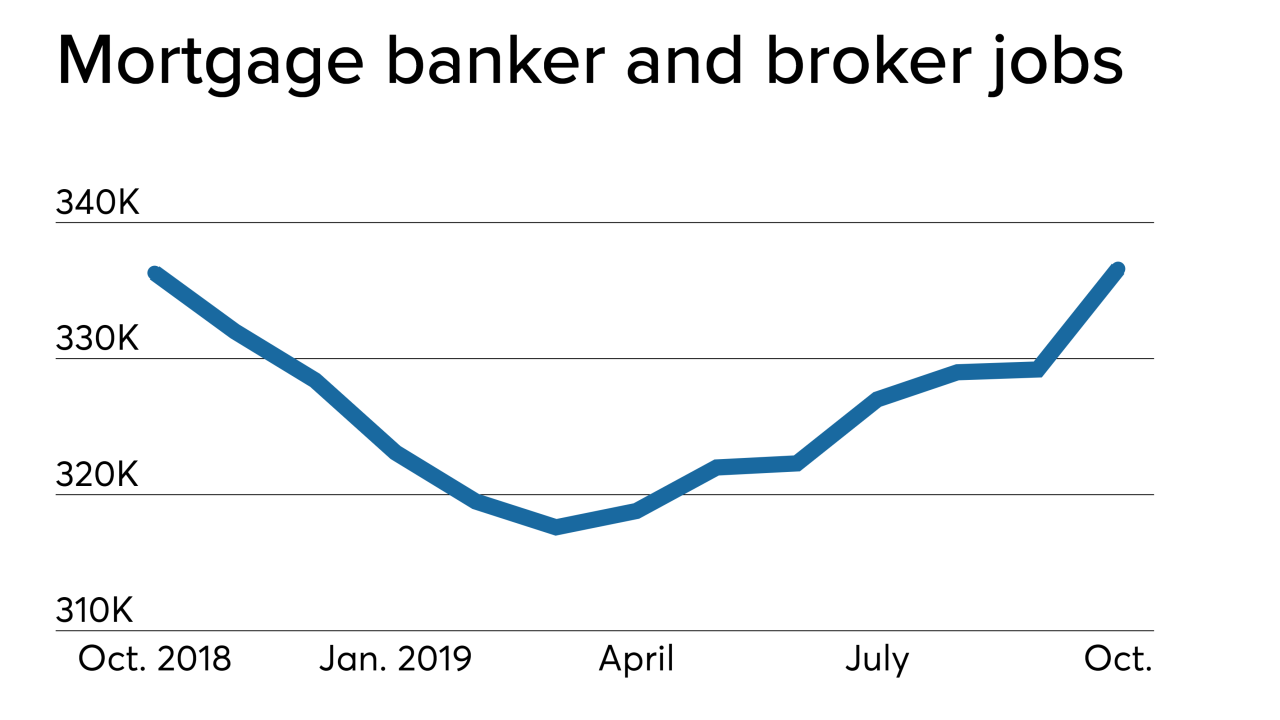

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 4 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

In a recent interview, Plaza Home Loans CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Quicken Loans is now able to perform an electronic mortgage closing in all 50 states, claiming to be the first lender to have this capability.

October 7 -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Although they still lag behind the rest of the mortgage industry, brokers are embracing advancements in technology in ways that could help build their business.

September 25 -

A new company called Simplist is brokering mortgages using a mix of data, analytics and processes designed to help render quick, cost-effective decisions on a wide range of loans.

September 11