-

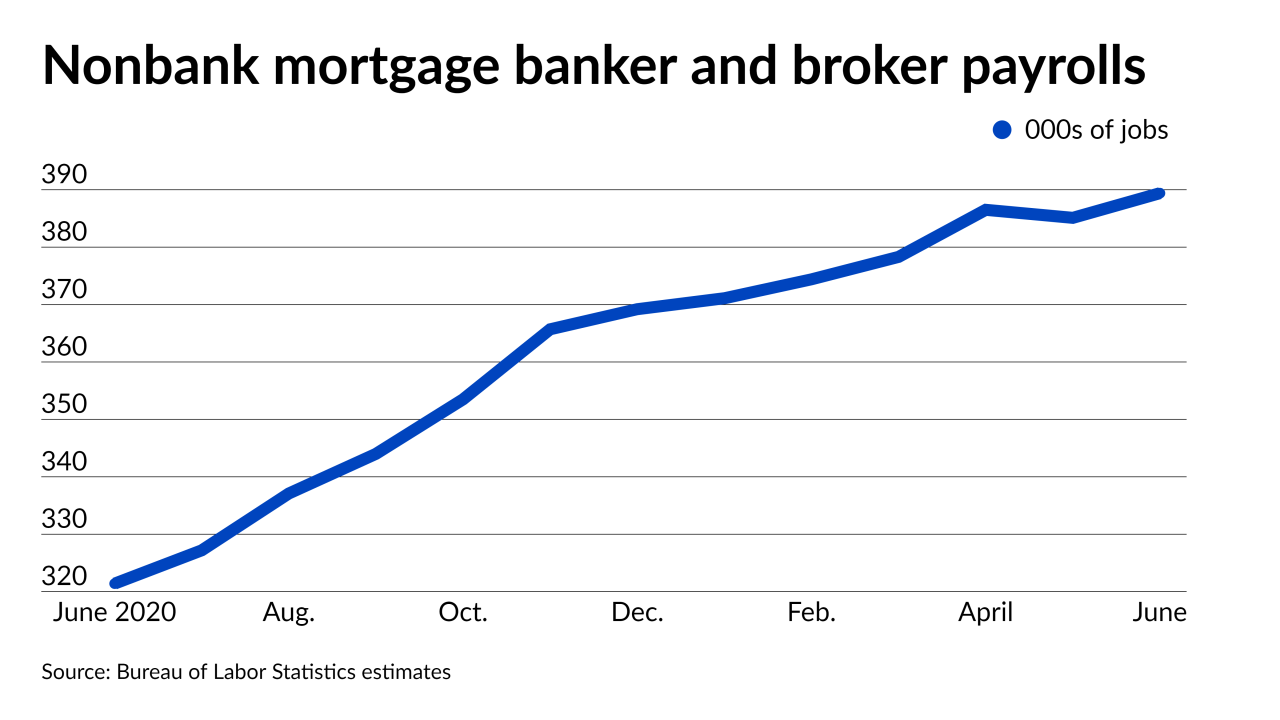

Nonbank brokers and lenders typically scale back after the spring homebuying season and the housing market could be particularly slow for the rest of this year.

August 4 -

The May uptick in nonbank housing-finance payrolls came almost entirely from lender hiring as loan broker numbers plateaued and construction demand persisted.

July 7 -

The GOP has launched multiple proposals with this aim and a trade group is specifically backing an expansive one from Rep. Warren Davidson, R.-Ohio.

June 7 -

Those thinking about entering this space should consider whether they can build a sustainable operation in scale, niche or relationship lending, a report by Stratmor Group argues.

May 31 -

The President of the National Association of Mortgage Brokers, Ernest Jones Jr., explains how consolidation in wholesale has impacted those he represents.

May 16 -

But the deal propels the four-year old buyer of its wholesale origination operation, The Loan Store, into the national spotlight.

April 10 -

The company wound down its wholesale production channel and is surrendering its Fannie Mae and Freddie Mac seller/servicer status.

March 9 -

-

The increases set to go into effect in February help some offset breaks for first-time buyers but also limit options for existing borrowers.

November 28 -

The wholesale channel tool will speed up mortgage processing time by as much as 40%, the lender claims.

October 6 -

The San Francisco-based company recently raised $14 million in Series A funding and closed more than $400 million in sales in the first quarter.

August 5 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The changes include a relationship tracking engine that details interactions between real estate agents and mortgage brokers.

October 20 -

The system is being rolled out to Motto Mortgage franchisees first and then to the broader mortgage broker market in January.

October 18 -

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The company, OriginPoint, brings together two enterprises active in the jumbo-homes space.

July 13 -

The New York-based lender projects it has a $3.6 trillion market opportunity outside of the U.S.

July 12 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4