-

The San Francisco-based company recently raised $14 million in Series A funding and closed more than $400 million in sales in the first quarter.

August 5 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The changes include a relationship tracking engine that details interactions between real estate agents and mortgage brokers.

October 20 -

The system is being rolled out to Motto Mortgage franchisees first and then to the broader mortgage broker market in January.

October 18 -

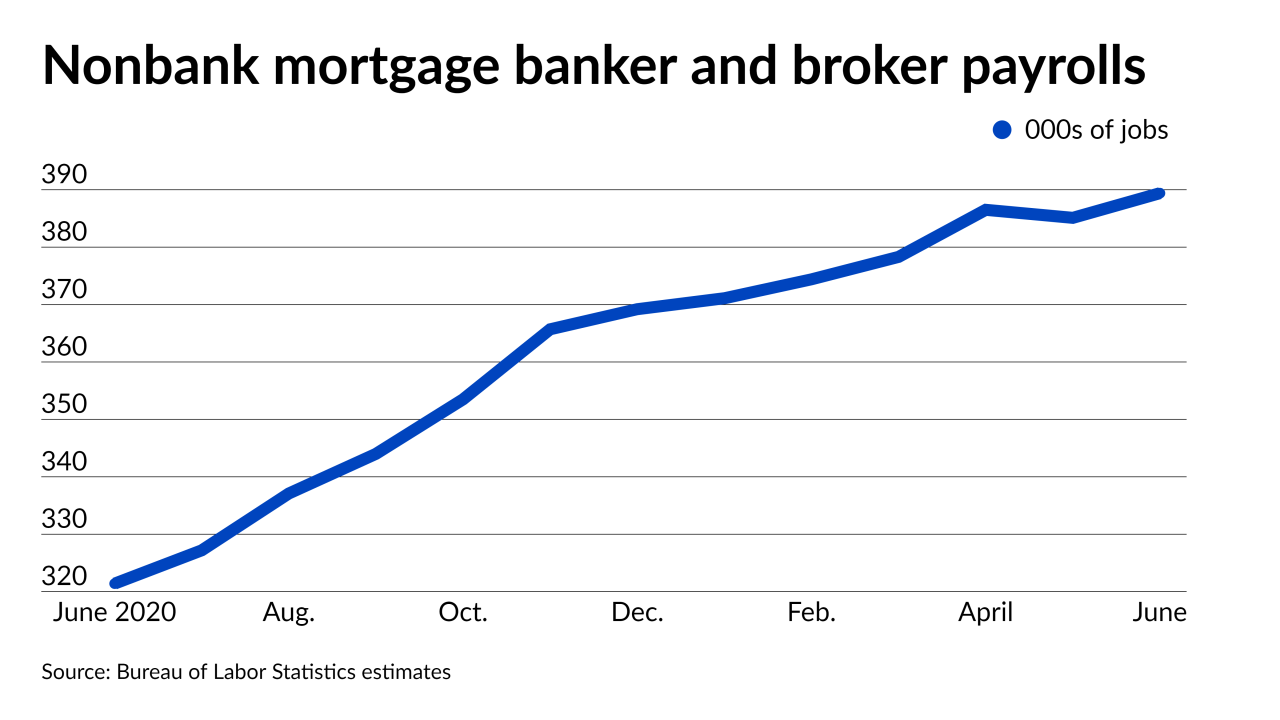

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The company, OriginPoint, brings together two enterprises active in the jumbo-homes space.

July 13 -

The New York-based lender projects it has a $3.6 trillion market opportunity outside of the U.S.

July 12 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

Despite a 1Q decline in origination volume, Chairman Mat Ishbia is optimistic for the second quarter, saying the company received 17,000 more submissions in April's higher interest rate environment than it had in February.

May 11 -

What may be a victory in UWM founder Mat Ishbia's eyes is a loss for borrowers, brokers and the free market in the long term, writes the co-founder of CASE, Consumer Action for a Strong Economy.

May 10

-

While the product was hard to find after the start of the pandemic, the Consumer Financial Protection Bureau’s recent changes to Appendix Q are giving a pair of large wholesalers the chance to offer it as a qualified mortgage.

May 10 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

The company touted its investments in the wholesale channel while also reporting a slight quarterly drop in overall originations and gains on sale during an earnings call this week.

May 6 -

Fluctuating rules are redirecting some government-related loans to a disparate private market.

May 6 -

United Wholesale Mortgage set off a brawl in the press when it forbade brokers from doing business with Rocket and Fairway. As a small group of brokers pursue legal action over the ultimatum, experts weigh in on whether the spat is benefiting the wholesale channel.

May 5 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

The suit, filed in the U.S. District Court for the Middle District of Florida, seeks class action status.

April 27 -

Building timelines are finally stable enough for nonbank American Financial Resources to return to the conventional market following the pandemic-related disruption, according to a company executive.

April 23