-

Real estate investor Tom Barrack said predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep commercial mortgage borrowers from defaulting.

March 23 -

As financial hardships mount with the COVID-19 outbreak, Fannie Mae and Freddie Mac released their plans for mortgage borrowers impacted by the pandemic.

March 19 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

While the overall foreclosure rate fell, the share of zombie properties grew in the first quarter of 2020, according to Attom Data Solutions.

February 28 -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

The number of new foreclosure lawsuits filed in Hawaii declined in 2019 to mark a sixth consecutive year of fewer cases mostly against homeowners struggling with mortgage debt.

February 24 -

Equifax has released a series of bundled services aimed at helping financial institutions use data and analytics to manage tasks associated with the process of servicing mortgage loans.

February 24 -

For the first time in 15 years, fewer than 2 million mortgaged properties lie in default or foreclosure status as of the end of January, according to Black Knight.

February 20 -

Despite a healthy economy and booming real estate market, 2.2% of Orange County, Calif., mortgages were "seriously underwater" at year's end, Attom Data Solutions says.

February 14 -

Mortgage delinquencies dropped to a 40-year low in the fourth quarter as strong employment bolstered borrowers' ability to make timely payments, the Mortgage Bankers Association said.

February 11 -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4 -

The number of large-scale natural disasters continued to proliferate in 2019, creating new situations where local mortgage delinquency rates could stay inflated for the following 12 months, according to CoreLogic.

January 29 -

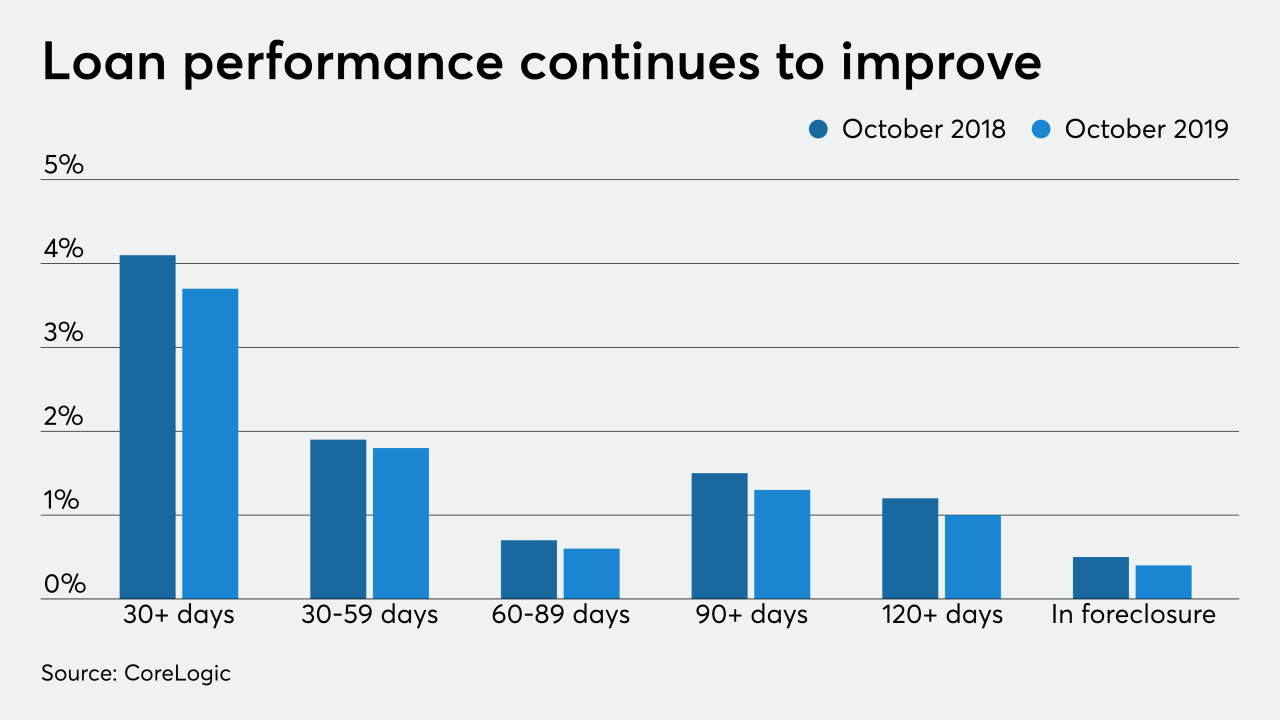

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

A bankruptcy court judge denied a lender's motion to foreclose on properties controlled by an Austin real estate investor. But the judge then issued a warning, saying an exit plan better be ready by Feb. 2.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

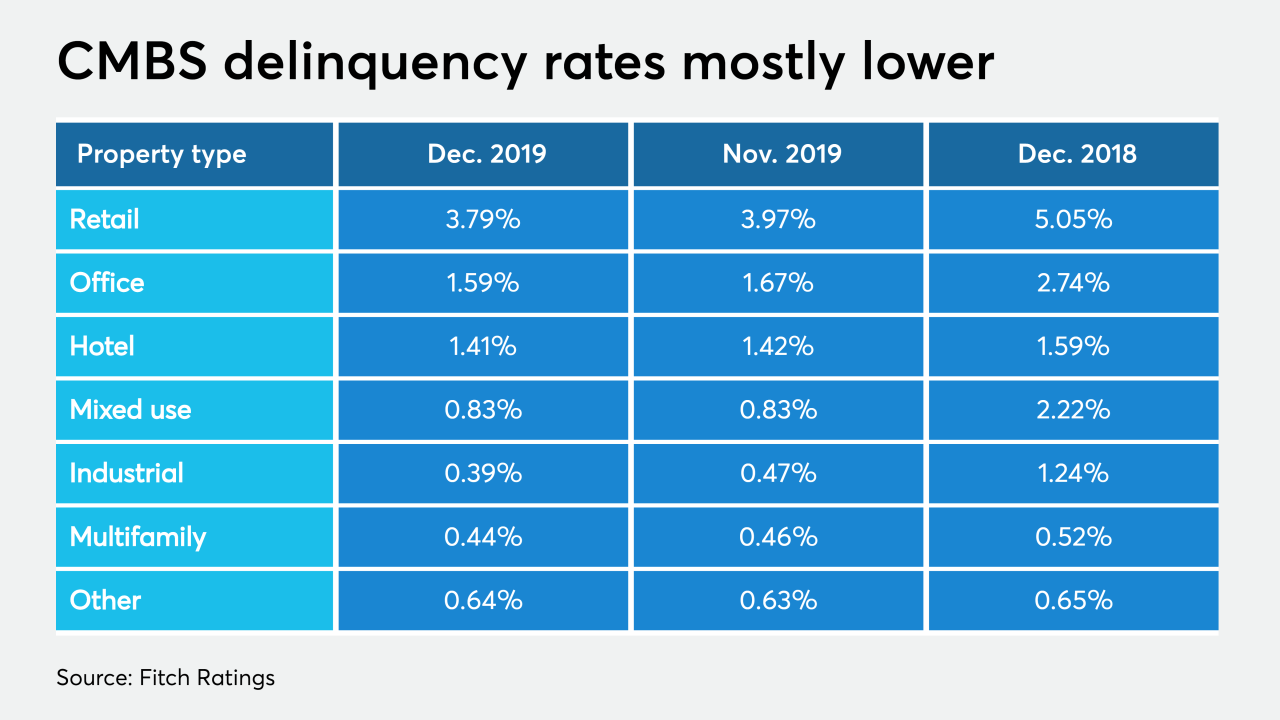

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

November's foreclosure starts hit their lowest level since Black Knight started tracking this data in 2000, while the foreclosure rate reached a 14-year low.

January 2 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14