-

Mortgage delinquencies dropped to a 40-year low in the fourth quarter as strong employment bolstered borrowers' ability to make timely payments, the Mortgage Bankers Association said.

February 11 -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4 -

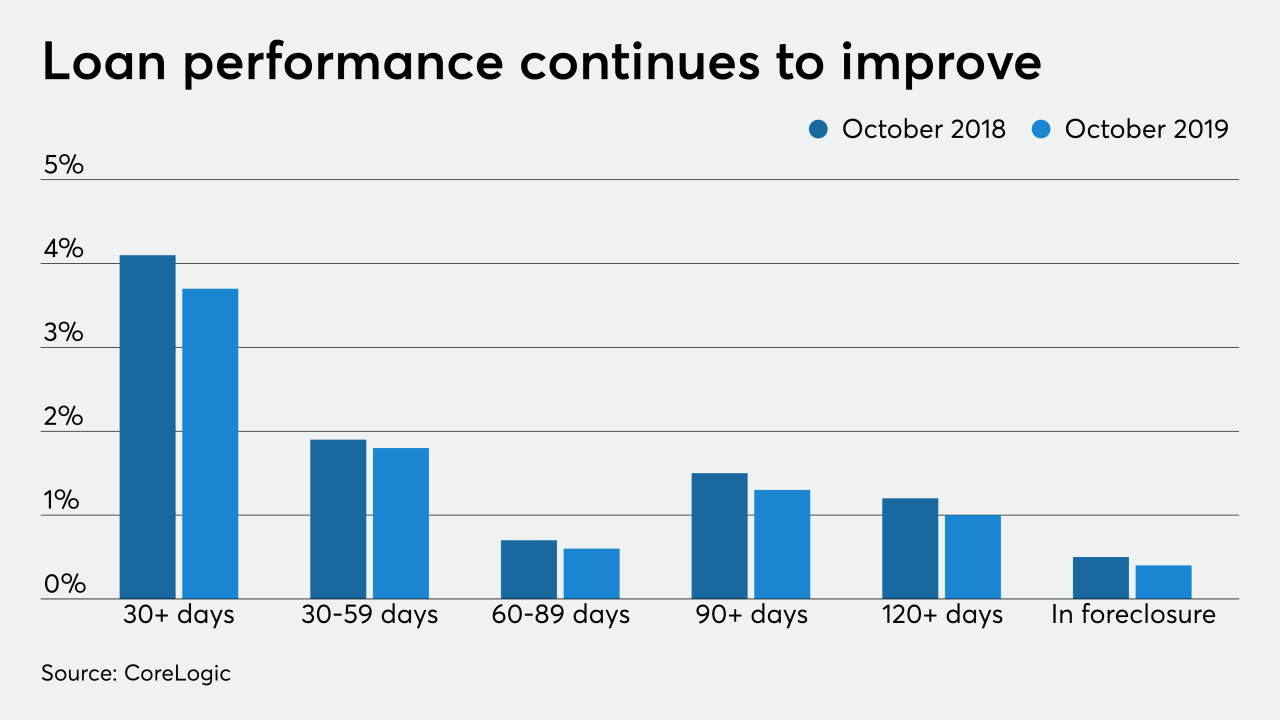

The number of large-scale natural disasters continued to proliferate in 2019, creating new situations where local mortgage delinquency rates could stay inflated for the following 12 months, according to CoreLogic.

January 29 -

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

A bankruptcy court judge denied a lender's motion to foreclose on properties controlled by an Austin real estate investor. But the judge then issued a warning, saying an exit plan better be ready by Feb. 2.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

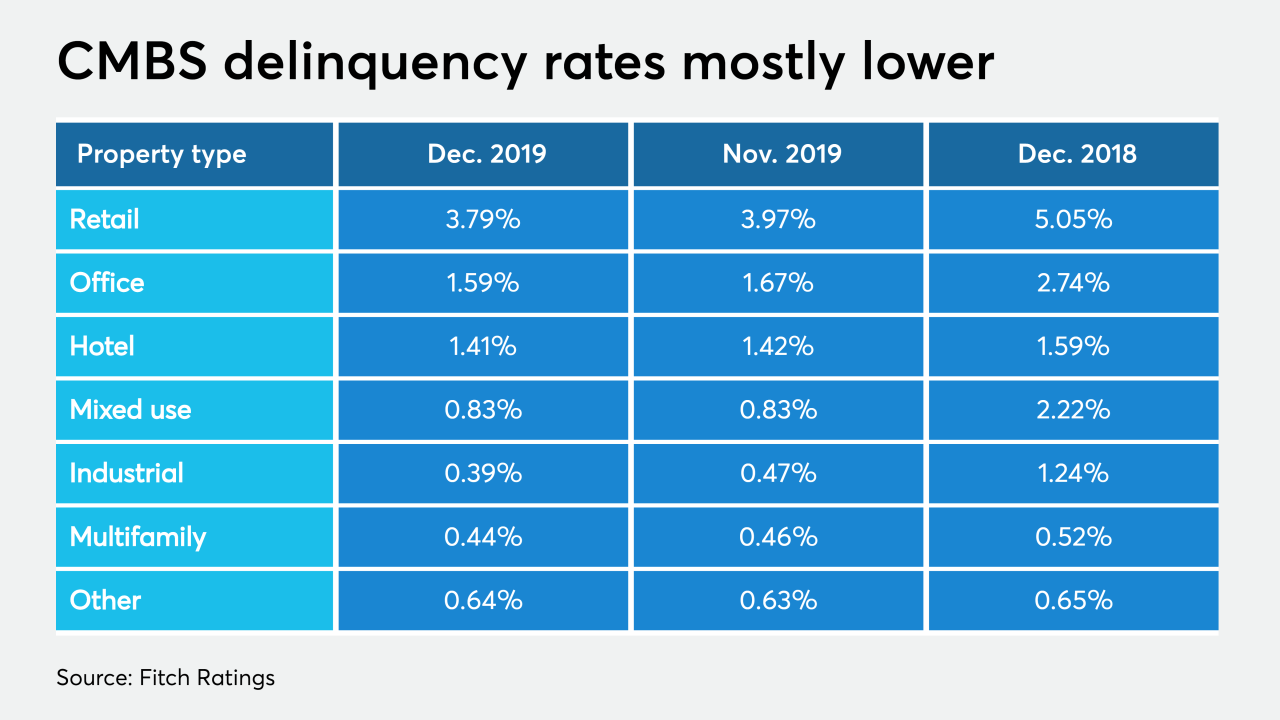

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

November's foreclosure starts hit their lowest level since Black Knight started tracking this data in 2000, while the foreclosure rate reached a 14-year low.

January 2 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14 -

It was long believed down payment assistant programs were recipes for poor loan performance and future delinquencies, but that's not the case, according to a new report.

November 12 -

The share of severely underwater mortgages shrunk by over two percentage points compared with a year ago, as these borrowers benefited from the rise in equity levels, Attom Data Solutions said.

November 7 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

While foreclosures and distressed mortgages continue to descend overall, trends are moving in the opposite direction in a handful of states, according to Attom Data Solutions.

October 18 -

As global warming contributes to the spread of wildfires, those fires lead to the destruction of homes, mortgage delinquencies and defects. From Texas to California, these are the 15 housing markets with the highest wildfire reconstruction costs, according to CoreLogic.

October 15 -

National Cooperative Bank is starting a conduit to purchase Federal Housing Administration-insured mortgages that are at least 60 days' delinquent with the aim of turning them back into performing loans.

October 15 -

The Chateau Hotel and Conference Center in Bloomington, Ill., is under new ownership after a judge agreed to enter a foreclosure judgment.

October 7 -

The Federal Housing Administration should monitor reverse mortgage servicers more closely and track related data that would shed light on a rise in defaults, according to a Government Accountability Office report.

September 26