-

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

Reverse mortgages are surging in Canada as more older people join the country's debt bandwagon.

September 16 -

While there was a slight rise in foreclosure filings in August over July, there was a decline when compared with the previous year for the 14th consecutive month, according to Attom Data Solutions.

September 13 -

The nationwide mortgage delinquency rate keeps descending lower, with June marking the 18th consecutive month of annual drops, according to CoreLogic.

September 10 -

Borrowers recovering from foreclosure might not be in as much hot water as perceived, with many maintaining healthy credit scores within a year, according to LendingTree.

September 10 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Damage from Hurricane Dorian's storm surge has the potential to affect 668,052 homes, according to CoreLogic's latest analysis. Reports estimate a worst-case total of $144.6 billion in reconstruction cost value.

August 30 -

Foreclosure activity fell 21% in July compared to a year ago and rose 6% from June after twelve consecutive months of declines, according to Attom Data Solutions.

August 26 -

Mortgage debt hit an all-time high, but the share of homeowners with financing has fallen to a low not seen in 13 years, according to the Urban Institute.

August 21 -

Better.com has added new capital to support its growth and, in a separate deal, New Residential has agreed to use some its funds to buy property management firm DGG RE Investments.

August 19 -

The share of abandoned homes by their owners continues to drop at a faster pace than the overall foreclosure rate, totaling half of what they were three years ago, Attom Data Solutions said.

August 16 -

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

Bucking a national trend, the Tampa Bay area saw an increase in new foreclosure filings in the first half of the year.

August 14 -

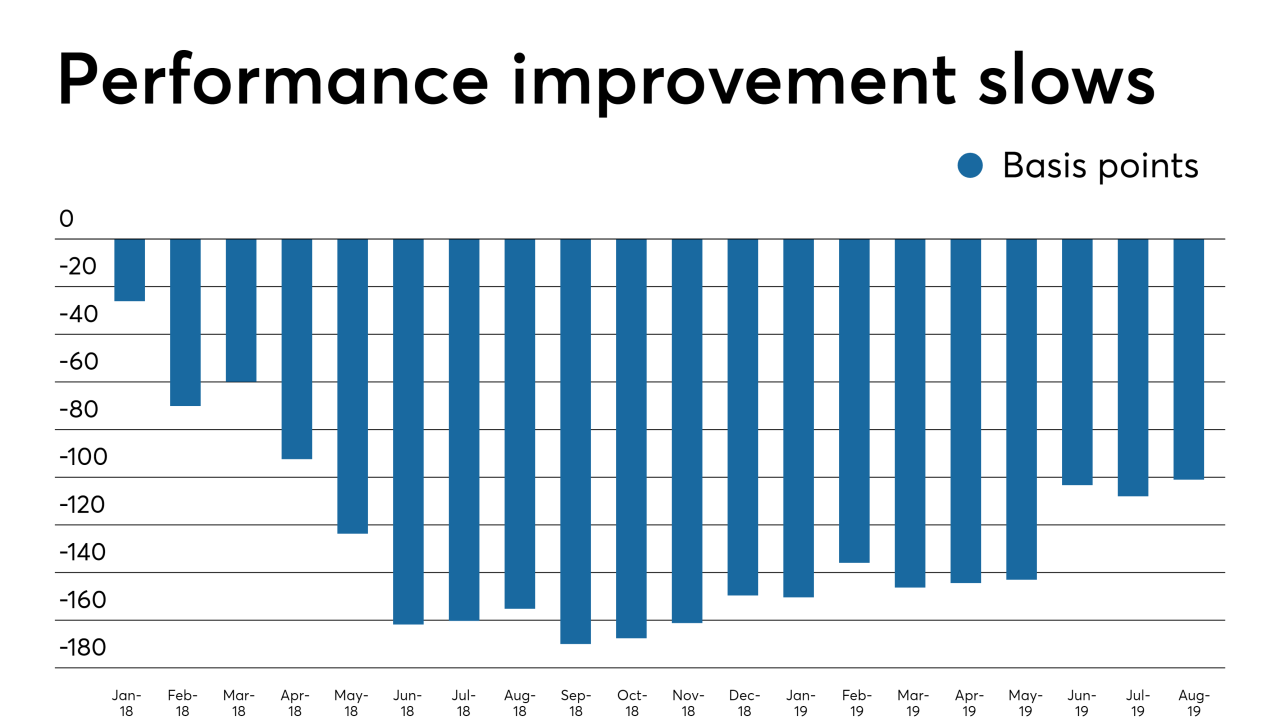

The mortgage delinquency rate sits at its lowest point in over 20 years after descending annually for 17 straight months through May, according to CoreLogic. But a broader look at this year's figures could signal a shift in the narrative.

August 13 -

Foreclosure activity dropped 18% in the first half of 2019 compared to a year ago, continuing an 11-quarter streak of sitting below prerecession levels, according to Attom Data Solutions.

August 8 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

Mortgages auctioned off through a HUD distressed loan sale program perform worse than those unsold and are more likely to result in foreclosure, according to a new Government Accountability Office report.

August 2 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Mortgage servicers are getting better at helping borrowers avoid foreclosure, as evidenced by a declining auction rate, which was also supported by healthy home equity levels, according to Auction.com.

July 30 -

While seasonal factors were attributed to the monthly rise in mortgage delinquencies for June, the jump was still much higher than last year's fairly steady increase, according to Black Knight.

July 23