Damage from Hurricane Dorian's storm surge has the potential to affect 668,052 homes, according to

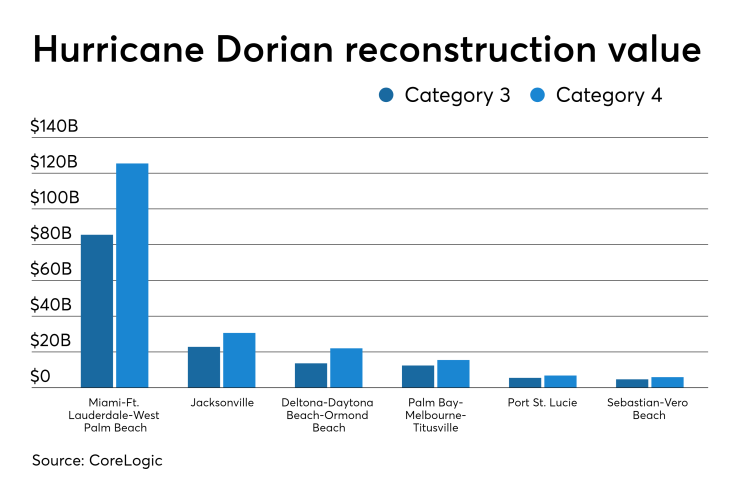

Dorian is expected to hit Florida's Atlantic Coast late Monday at the earliest and projects as a Category 3 storm with the possibility of escalating to Category 4 at landfall. The upgrade to a Category 4 increases the worst-case scenario estimates to 972,787 homes worth $206.3 billion in reconstruction value.

Foreclosure activity

The Miami-Fort Lauderdale-West Palm Beach metro area has the most at-risk to surge damage with 411,119 properties and $85.6 billion in value in the case of a Category 3. Jacksonville, Fla., follows with 93,651 properties worth $22.8 billion, and then Deltona-Daytona Beach-Ormond Beach Fla., market's 61,050 and $13.6 billion.

In preparation of the storm hitting, the

"Today we take another important step to help families with FHA-insured mortgages recover from the impact of a major disaster and to avoid foreclosure," said Federal Housing Commissioner Brian Montgomery in a press release. "The changes we’re making to our policy will help individuals and families with an FHA-insured mortgage to cure their delinquencies while protecting our insurance fund in the process."

Both government-sponsored enterprises are offering options for mortgage disaster assistance.

"We are monitoring the situation, and we urge those in the path of the storm to focus on their safety first as they prepare for the potential impact of Hurricane Dorian," Malloy Evans, senior vice president and single-family chief credit officer at Fannie Mae, said in a separate press release. "Along with our lending and servicing partners, Fannie Mae is committed to ensuring assistance is available to homeowners and renters in need. We encourage residents whose homes, employment or income are affected by the storm to seek available assistance as soon as possible."

"As Hurricane Dorian approaches, we stand ready to ensure mortgage relief is made available to affected borrowers in eligible disaster areas," said Yvette Gilmore, Freddie Mac’s vice president of single-family servicer performance management. "Once safely out of harm’s way, we strongly encourage homeowners whose homes or places of employment are impacted by the hurricane damage to call their mortgage servicer—the company borrowers send their monthly mortgage payments to— so they can learn about available relief options."