-

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Destiny USA, one of the largest malls in the nation, is struggling to pay its mortgage, according to a published report.

April 17 -

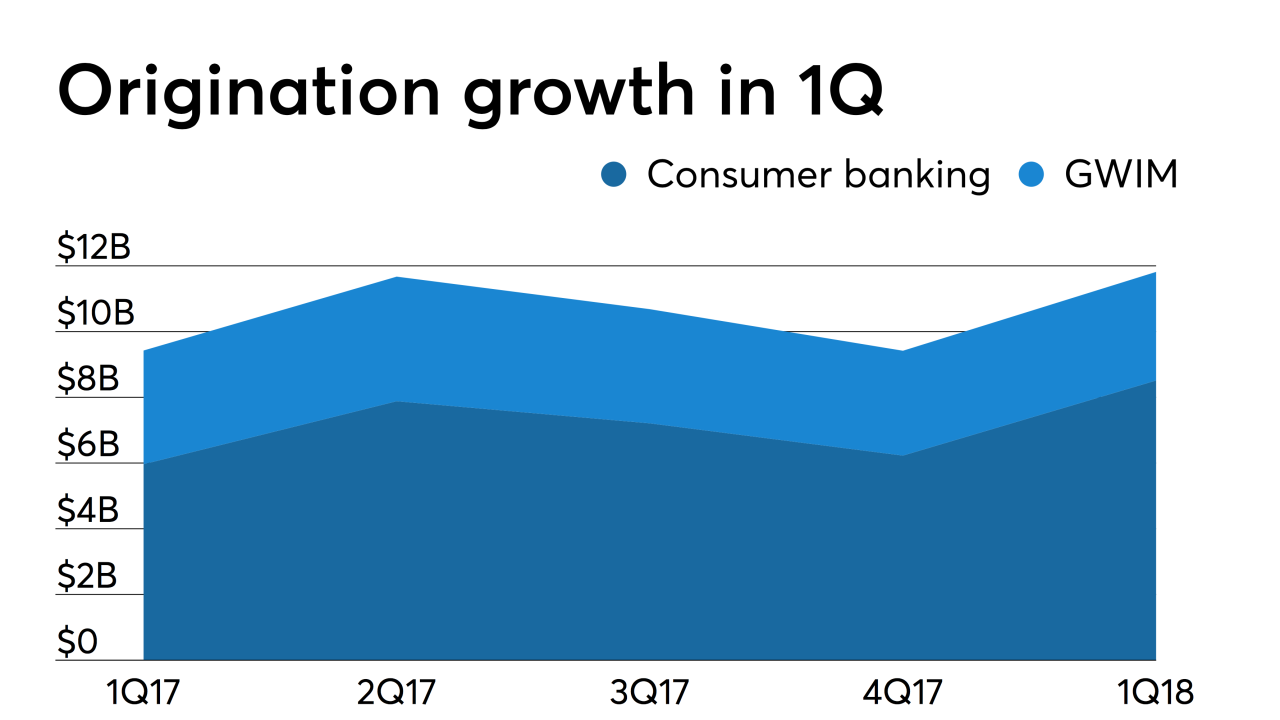

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

As the dangers of global warming lead to heightened natural disasters, those disasters result, at least temporarily, in a higher amount of mortgage defaults. From Texas to the nation's capital, these are the 12 most hazard-prone housing markets, according to Redfin.

April 15 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

The number of properties with foreclosure filings dropped to the lowest quarterly amount since the Great Recession, according to Attom Data Solutions.

April 11 -

An uncertain future confronts the development, which is located in the North San Pedro Square area of San Jose and was proposed by Z & L Properties.

April 10 -

With a strong job market and low interest rates, the mortgage delinquency rate fell to its lowest January level in at least 20 years.

April 9 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

Controlling classes of investors in commercial mortgage-backed securitizations can replace a special servicer, but before they do, they should make sure the long and potentially expensive process is worth it.

April 3 Alston & Bird

Alston & Bird -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

Fewer Hawaii property owners fell into foreclosure last year in continuation of a trend that began in 2014, according to state data.

March 14 -

The foreclosure rate in the Tampa Bay area was unchanged between 2017 and 2018 despite a drop in the percentage of homes that were seriously delinquent on their mortgages.

March 13 -

Strong loan performance continued into December as all delinquency stages fell annually behind equity gains and the sustained rise of home prices, according to CoreLogic.

March 12 -

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

Mortgage prepayment speeds fell to a 19-year trough despite recent interest rate declines, but could rise if those lower rates lead to an increase in home purchases, according to Black Knight.

February 25 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22