-

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

Delinquencies in U.S. commercial mortgage-backed securities jumped in April, with the economy battered by the coronavirus pandemic.

April 30 -

FHFA Director Mark Calabria stated that he was directing the GSEs to "add liquidity" to the markets, but the actions of the FHFA say precisely the opposite.

April 24 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Due to COVID-19's economic impact, the number of mortgaged properties in default or foreclosure rose in March for the first time since the turn of the century, according to Black Knight.

April 23 -

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14 -

Researchers predict that the rate will rise in step with unemployment rate projections.

April 13 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

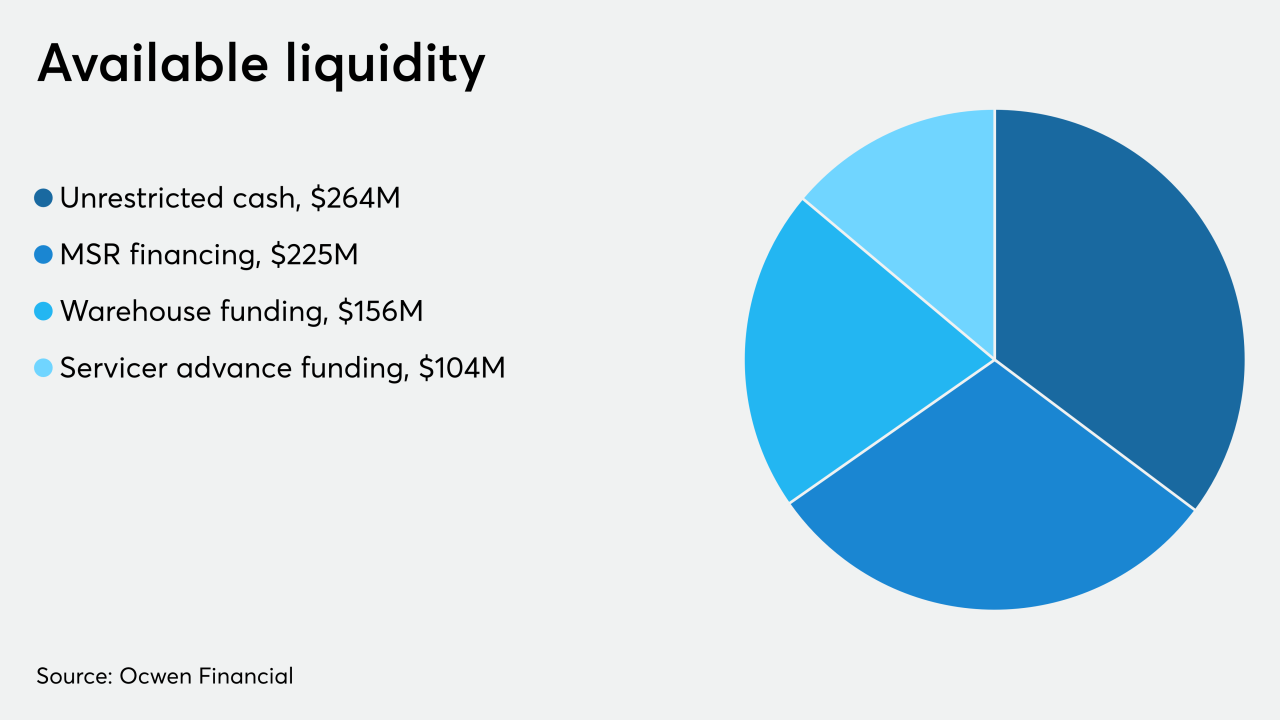

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

Simply stated, the federal forbearance of mortgage payments is perhaps the largest unfunded public mandate in American history.

April 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A top U.S. regulator is exploring whether to throw a lifeline to mortgage servicers stressed by the coronavirus pandemic by tapping a program meant to address natural disasters.

March 27 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

March 27 Community Home Lenders of America

Community Home Lenders of America -

As real estate prices soared in recent years, working-class adults everywhere have increasingly relied on mortgages backed by the Federal Housing Administration — and U.S. taxpayers.

March 25 -

The Department of Housing and Urban Development's 60-day foreclosure halt for Federal Housing Administration borrowers is too short to help reverse mortgage borrowers, a letter from consumer groups stated.

March 25 -

The percentage of mortgages underwater — when a mortgage exceeds value — has decreased dramatically in South Florida since the Great Recession, meaning the region may be better prepared to weather COVID-19 than the downturn a decade ago.

March 24