-

The Federal Trade Commission became able to distribute more than $1.2 million after a legal battle in which a Supreme Court decision came into play.

January 11 -

One in every 123 purchase applications showed indications of fraud in the second quarter, outpacing the first, the report found.

October 6 -

Cases increased at an average of 14.5% from 2021 to 2022, a LexisNexis survey found.

May 17 -

Grand View Financial promised vulnerable homeowners debt payoff assistance, but its clients all ended up losing their properties.

May 16 -

One man had paid bribes and kickbacks for improper sales of foreclosure properties, and another had engaged in ownership and wire fraud in a loan relief scheme, the courts determined.

October 13 -

The businesses, like other victims of such incidents, have not identified the culprit nor type of attack.

September 9 -

The Minnesota woman altered documents and failed to file documents as promised in cheating multiple investors between 2018 and 2020.

June 17 -

A Salem, Massachusetts, man was found guilty by a federal jury in Boston of a scheme that led to more than $3.8 million in losses to lenders, the U.S. Attorney's Office announced.

June 3 -

Fraud experts are concerned that credit washing, in which borrowers make false claims about being victims of identity theft, is making its way into mortgages from other forms of lending.

May 9 -

Eleven other defendants participated in the elaborate scam, which led to approval of unqualified buyers and numerous defaults of FHA-backed mortgages.

January 24 -

From 2016 to 2019, the Long Island man stole from Home Point Financial, LoanDepot and United Wholesale Mortgage, and faces 30 years in prison.

September 2 -

Increased purchase lending and added pressure from Fannie Mae and Freddie Mac’s new loan limits should drive the likelihood of borrower misrepresentation.

August 6 -

The cloud IT provider for settlement services companies has no timeline on when services will be restored following its shutdown Friday.

July 20 -

The defendant faces seven criminal counts — ranging from stolen property to falsifying business records — for two Harlem brownstones he paid just $20 for in 2012, according to tax filings.

July 9 -

Errors created in the loan manufacturing process were partly responsible for the increase in 2020, according to an analysis by Aces Quality Management.

June 22 -

The scheme's victims included an elderly woman and a local title agency that lost $230,000 in the fraudulent property transfer.

June 21 -

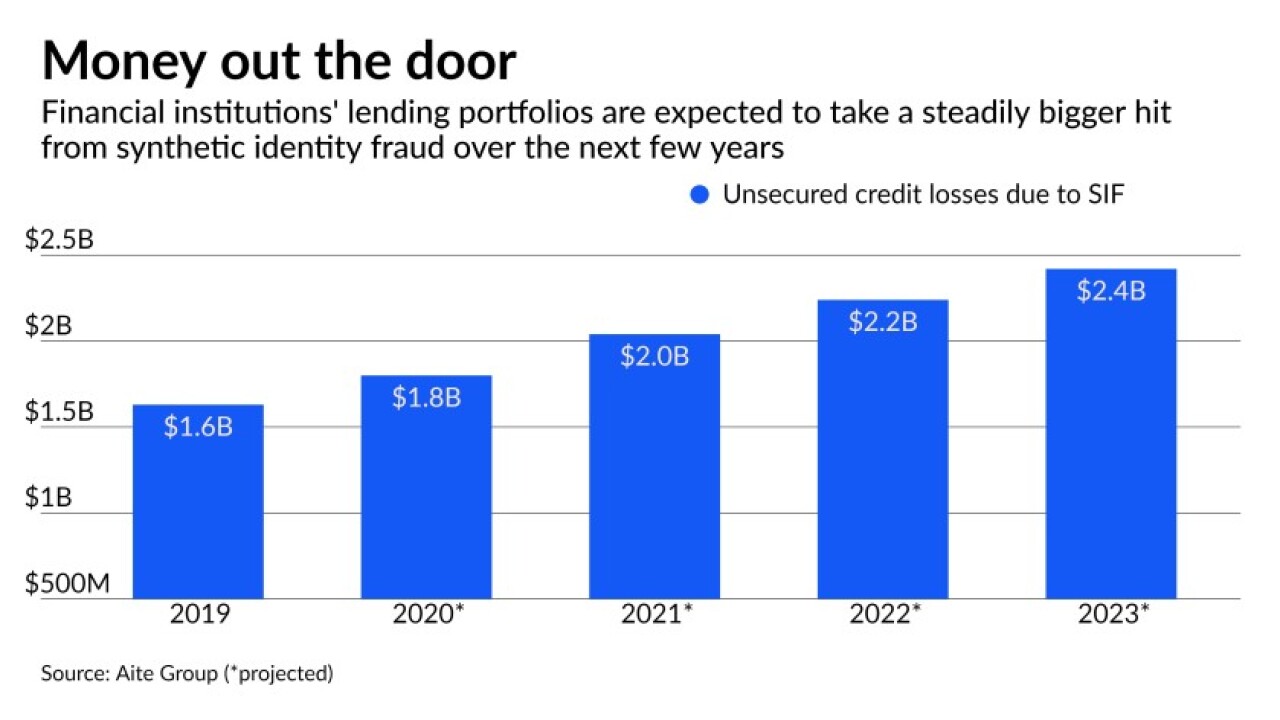

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

The individuals allegedly defrauded Freddie Mac and CBRE Capital Markets by misrepresenting information used to refinance a small-balance loan.

May 20 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7 -

The complaint exemplifies the Department of Housing and Urban Development’s focus on “fair servicing” in addition to fair lending.

May 1