-

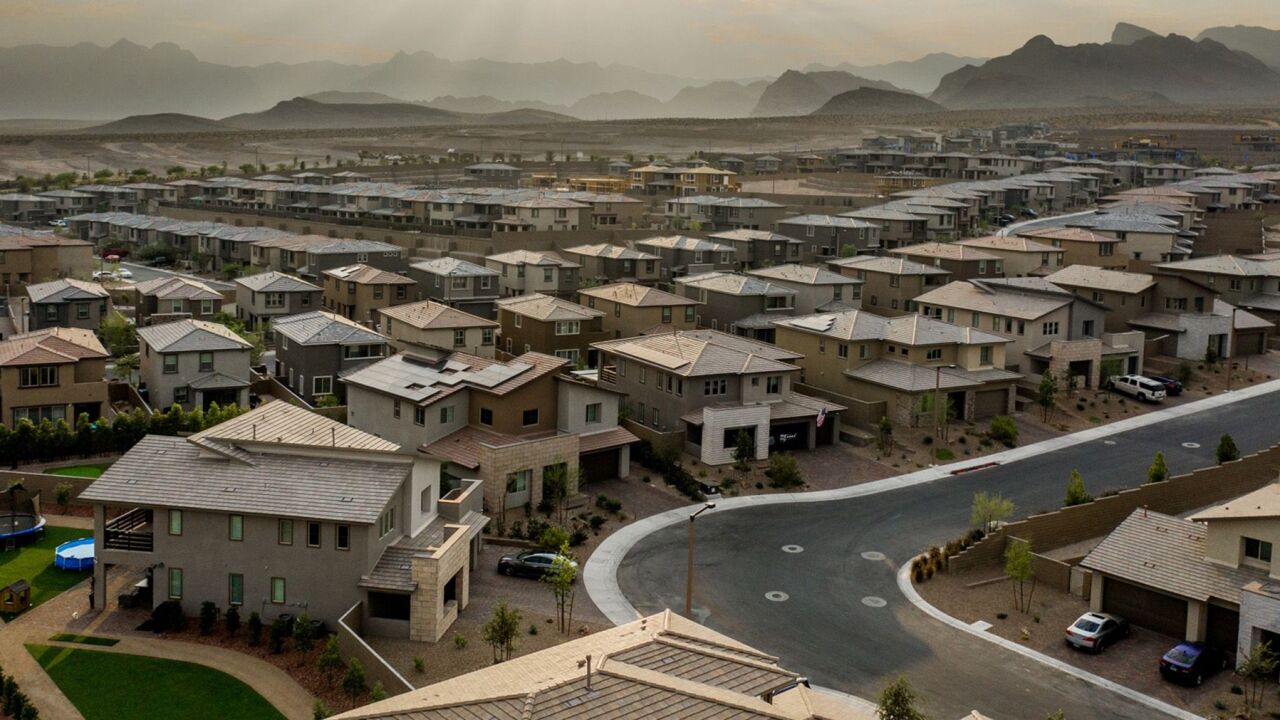

Purchases of new single-family homes increased 9.6% to an annualized 683,000 pace last month from a downwardly revised 623,000 rate in February, government data showed Tuesday.

April 25 -

This and other issues related to measures that manage risk challenge participation, stakeholders told the Federal Housing Administration.

April 25 -

This and other issues related to measures that manage risk challenge participation, stakeholders told the Federal Housing Administration.

April 25 -

In an amicus brief, the trade group voiced concern over a statement recently provided by government agencies in a lawsuit involving loanDepot.

April 24 -

Here are the 50 most prolific mortgage originators by the number of loans they produced during 2022.

April 24 -

Sluggish sales, high mortgage rates and the exit of iBuyers all contributed to the larger share of properties going for less than original purchase value last month.

April 21 -

Stronger than expected demand and home prices drove the latest forecast.

April 21 -

Revised guidelines permit playing two roles in an FHA transaction, but if its not properly set up, this arrangement can violate RESPA Section 8 legal experts say.

April 21 -

A Consumer Financial Protection Bureau case against the lender involved is still pending and could have broader implications for compliance issues.

April 20 -

Other positions are being eliminated nationwide, with just 50 to 60 people remaining to manage the company's mortgage servicing rights.

April 20 -

Uncertainty about the economy and inflation drove the increase

April 20 -

The proposed legislation proposes to amend the Fair Credit Reporting Act to prohibit the creation and sale of contacts used for marketing.

April 19 -

The U.S. economy stalled in recent weeks, with hiring and inflation slowing and access to credit narrowing, the Federal Reserve said in its survey of regional business contacts.

April 19 -

Home loan applications dropped for the second time in three weeks, with the 30-year conforming interest rate ticking up 13 basis points, according to data from the Mortgage Bankers Association.

April 19 -

Fannie Mae researchers found housing costs decelerating for the fourth straight quarter, but limited inventory may be driving hopeful buyers to look for opportunities in the new-construction market.

April 18 -

Hispanics will make the majority of homeowners by 2030. How can lenders meet their needs now, and what strategies can they employ in today's lending landscape?

-

The agency has been using the Freddie Mac weekly rate survey, but a methodology change by the GSE is the catalyst for the revision to determine the Average Prime Offer Rate for high-cost mortgages.

April 18 -

Victimized consumers made up nearly three-quarters of the requests for help received by CertifID last year.

April 18 -

Mauro Guzzo, who operates in both the U.S. and Mexico, is looking to build an international financial brand.

April 18 -

The top five lenders have a combined total volume of more than $40 billion at the end of Q4 2022.

April 18