-

However, all but one company did less business in the most recent period than during the third quarter, and new insurance written was down across the board compared with one year prior.

February 23 -

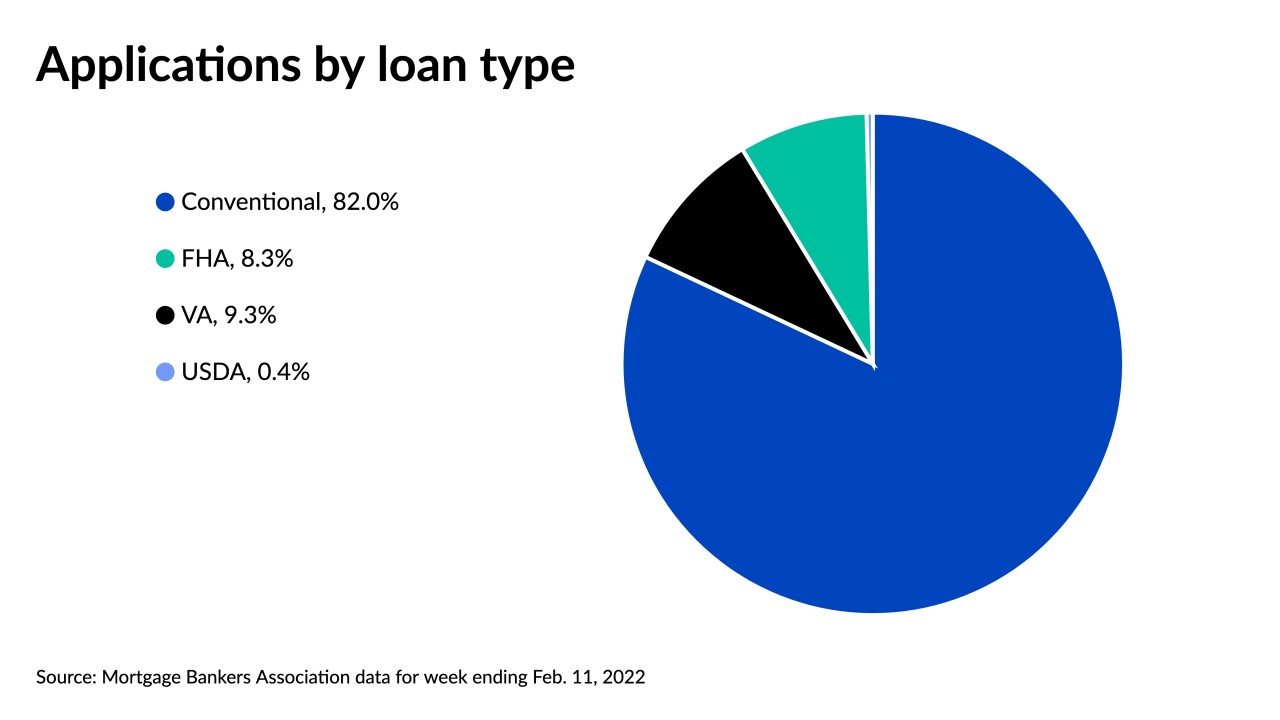

Overall application activity was down by more than 40% compared with one year ago, the Mortgage Bankers Association found.

February 23 -

Rising interest rates are likely to further slow the rate of appreciation, the Federal Housing Finance Agency said in its quarterly Home Price Index report.

February 22 -

The complaint seeks unspecified damages over the bank’s mortgage origination and underwriting practices, alleging minority homebuyers were excluded from affordable, low-risk loans.

February 22 -

Third-party originators could help government-related agencies surmount some of the hurdles facing borrowers if they had more access to lending programs, said Linda McCoy, president of an industry trade group.

February 21 -

The estimated rate of annual sales also dropped in January to its slowest pace since July.

February 18 -

The National Fair Housing Alliance's framework, named Purpose, Process and Monitoring, looks to examine the lifecycle of an artificial intelligence model in order to avoid unfairly discriminatory outcomes.

February 18 -

The 2022 origination outlook was dropped by $172 billion and for 2023, economists at the government-sponsored enterprise made a $226 billion reduction.

February 17 -

Despite a slowing in the private-label securitization market in January, lenders and investors are expecting a strong year for outside-the-box originations and their secondary market sales.

February 17 -

The 30-year average increased by 23 basis points on inflation, geopolitical news.

February 17 -

A rise in reverse occupancy fraud is contributing to the uptick, a CoreLogic report found.

February 16 -

Credit availability also tightened in January, contributing to early 2022’s lending slowdown, according to the Mortgage Bankers Association.

February 16 -

Current president Joe Nackashi will become CEO in place of Anthony Jabbour who will be taking the role of executive chairman.

February 15 -

Guidelines first eased during the coronavirus pandemic have been signed into law.

February 14 -

These cities offer lucrative tech job markets, affordable listings and rising real estate equity.

February 13 -

Danny Yen, owner of Real Estate Educational Services, received a permanent ban on conducting future related training and agreed to testify in any legal proceedings against originators he assisted.

February 11 -

The nation's second largest title insurer reported lower fourth quarter earnings, but the shift to purchase transactions pushed revenue higher.

February 10 -

Inflation data showing a 7.5% increase in consumer prices will likely lead to Federal Reserve moves that apply continued upward pressure.

February 10 -

The changes follow the company’s acquisition by Pretium in November of last year.

February 9 -

Steadily climbing rates have contributed to a 40% decline in loan activity from one year ago.

February 9