-

President Biden’s aspirations for aggressive forgiveness haven’t been fulfilled to date, but steps taken so far have lowered a key hurdle to entry-level homeownership.

January 14 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

The latest jobs and economic numbers pave the way for additional upward movement throughout 2022, analysts said.

January 13 -

The ruling overturns a summary judgment in a class action lawsuit filed by refinance customers between 2004 and 2009 in West Virginia over alleged inflated property values.

January 12 -

But the online real estate company is eliminating nearly half of the positions in its existing mortgage business as a result of the deal.

January 12 -

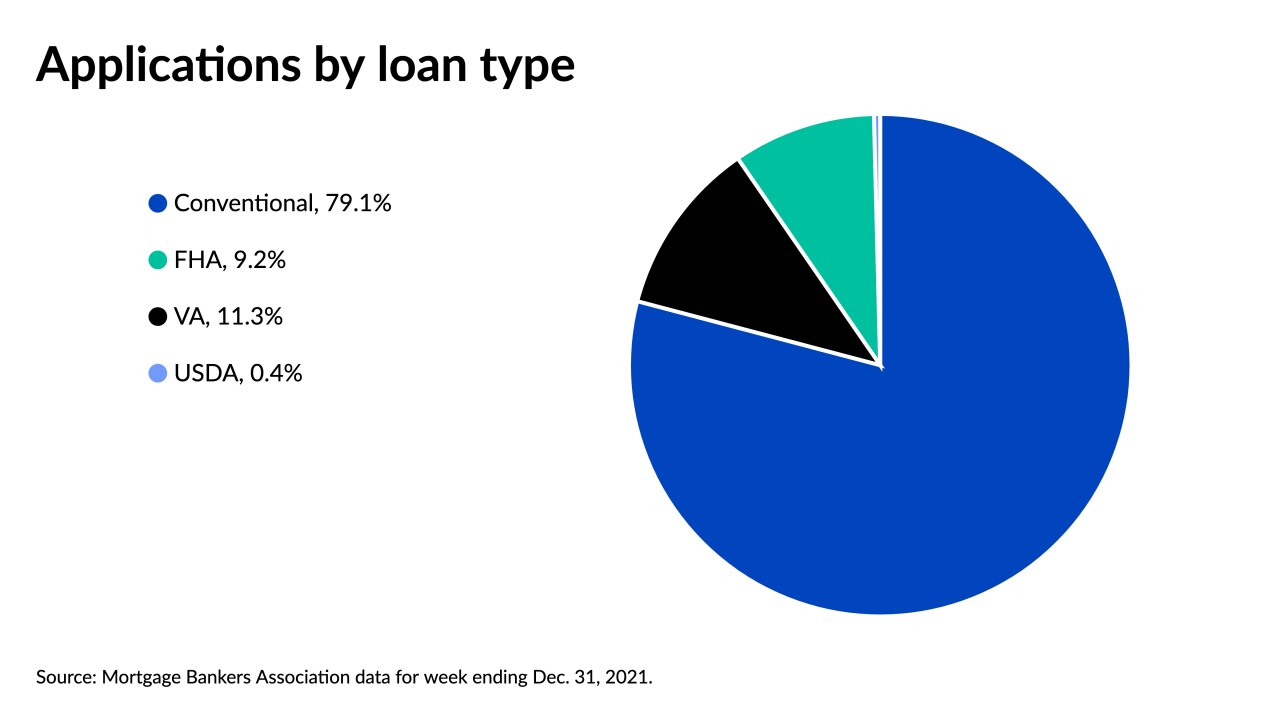

Increasing rates contributed to a sluggish pace for refinances, but the purchase market showed sustained strength.

January 12 -

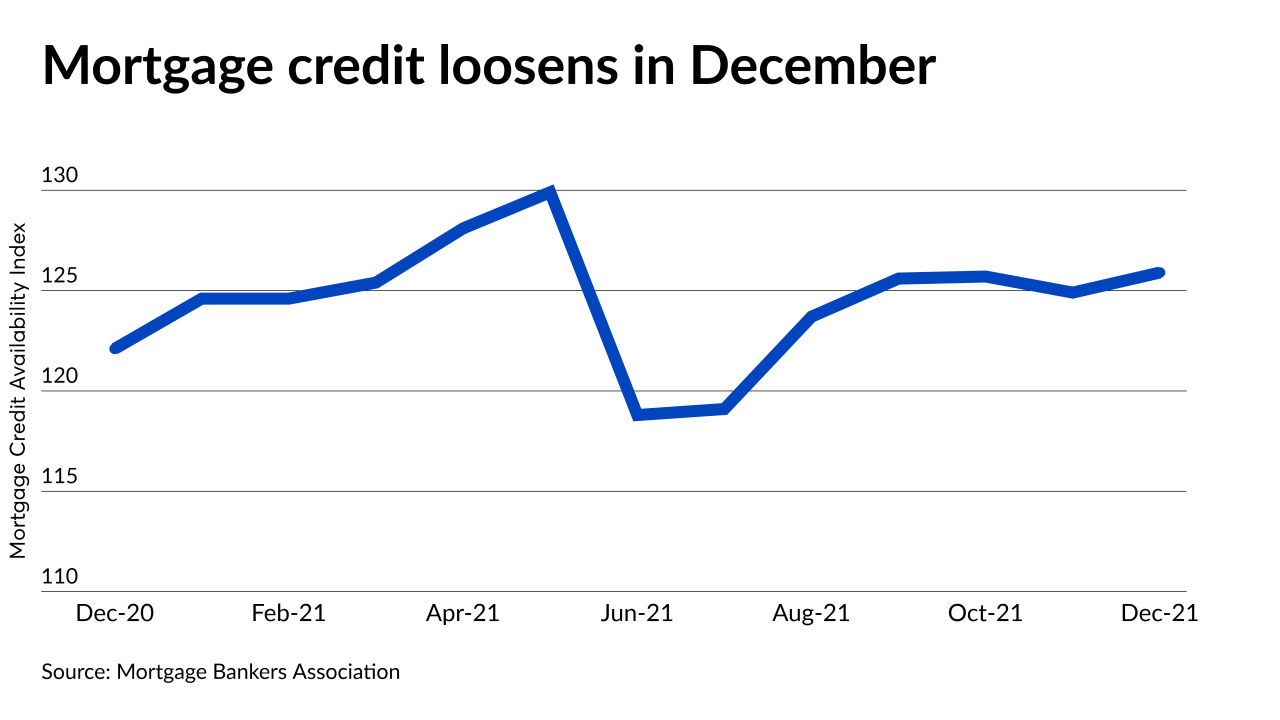

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

December's activity was down 18% from November, led by a 23% drop in purchase volume and a 17% decline in rate-and-term refinancings, Black Knight said.

January 10 -

Nearly half of likely buyers said they feel more urgency to act if the 30-year FRM reached 3.5%, a Redfin survey found.

January 7 -

Total U.S. jobs came in below consensus estimates in December, according to the Bureau of Labor Statistics.

January 7 -

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

While some in the industry support the change, mortgage broker trade group AIME called on the agency to reconsider it.

January 5 -

Refinances also decreased, with rising rates contributing to the slowdown.

January 5 -

Originations of home equity conversion mortgages surged nationwide at the end of the year, with December numbers near a 4-year high.

January 4 -

For the past five months, single-family house prices were up by at least 18% compared to monthly averages in 2020, but by next November, increases should sink below 3%, CoreLogic said.

January 4 -

But low mortgage rates and higher wages are allowing borrowers to meet conforming loan underwriting terms — at least for now.

December 30 -

The 30-year average climbed six basis points after falling to a monthly low a week earlier.

December 30 -

When finalized, the sections to the Single Family Housing Policy Handbook 4000.1 will replace some 150 Mortgage Letters issued over the years.

December 29 -

About 40% of likely purchasers are delaying or cancelling their activity, a Redfin survey found.

December 29 -

The past year was noteworthy for many reasons — and within the mortgage industry, some might even argue that 2021 was even more momentous than the 12 months preceding it. What all can agree on, though, is that the ongoing pandemic continued to reshape the lending landscape. As 2022 approaches, we look back on a few of this year’s running themes.

December 29