-

The company also let go of staff in its Chicago-area office, with one account estimating "hundreds of employees" lost their jobs there.

November 24 -

Sales of new U.S. homes edged up in October, reflecting stabilizing demand even as builders face supply-chain disruptions and buyers grapple with rising prices.

November 24 -

Purchase and refinance numbers both came in higher, while average loan sizes also recorded an uptick.

November 24 -

But in November, home buyer demand reached its highest level since RedFin began compiling the data in 2017.

November 23 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

Once the news of the delayed sale was announced, the mortgage wholesaler opened trading on Nov. 17 at $1.17 per share higher than its previous close.

November 19 -

The likelihood that inflation remains above the Fed's 2% target contributed to the government-sponsored agency’s decision to dial back its 2022 outlook.

November 18 -

Fed moves, inflation and retail sales applied upward pressure, contributing to the increase.

November 18 -

Announcements from Paramount Residential Mortgage Group and LodeStar Software Solutions are early indications that the company’s aggressive investment in diversified business lines could pay off.

November 17 -

Borrowers who make at least a 10.01% down payment will not be required to obtain this form of credit enhancement, as these loans are not being sold to Fannie or Freddie.

November 17 -

Refinance numbers declined for the seventh time in eight weeks, leading to an overall weekly decrease.

November 17 -

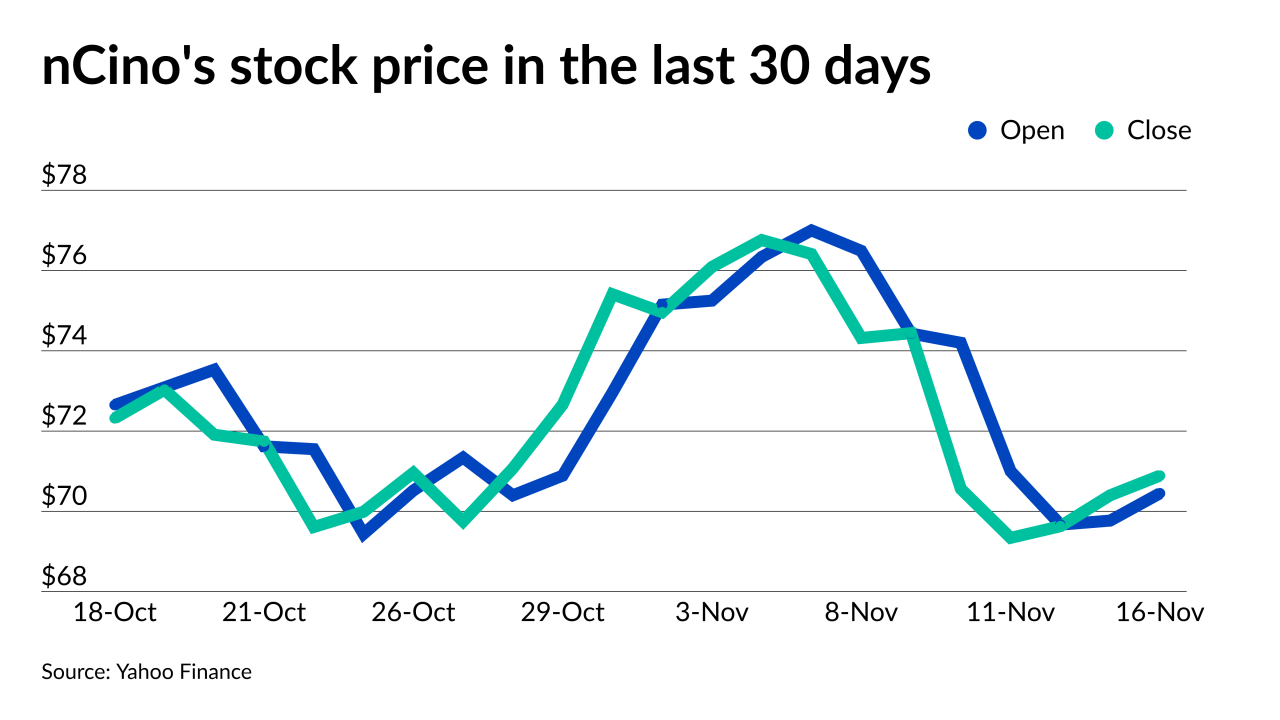

The transaction takes depository-focused nCino into the independent mortgage banking side of the lending business.

November 16 -

Despite elevated prices and supply-chain bottlenecks, October application activity was up for the second time in three months and pushed the average loan size to a record high.

November 16 -

A pilot conducted with a handful of independent financial advisors has transitioned to a full roll-out, with the lender offering a discount of up to $5,000 to potential borrowers through the broker-dealer.

November 15 -

The company was able to generate a relatively higher margin than the previous quarter, in contrast to broader industry trends, bringing its bottom line back into the black.

November 12 -

Even though one aspect of these lending standards is becoming more flexible, some say they still don’t always meet the needs of borrowers like delivery workers employed on a contract basis.

November 12 -

The company’s servicing operations also reported a quarterly profit, with its portfolio increasing by 20% annually.

November 11 -

The weekly gain was the largest since July, but overall activity still remains close to early 2020 lows.

November 10 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

The Federal Housing Administration’s changes seek to bring guidelines for specialized Title I programs in line with current borrower and market needs.

November 9