-

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

Recent offerings come with lower age-eligibility requirements compared to traditional government-backed home equity conversion mortgages.

November 1 -

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

If lenders build this technology, data suggests that borrowers will come walking out of the cornfields for it — but Congress needs to pass the SECURE Act first.

October 29 NotaryCam

NotaryCam -

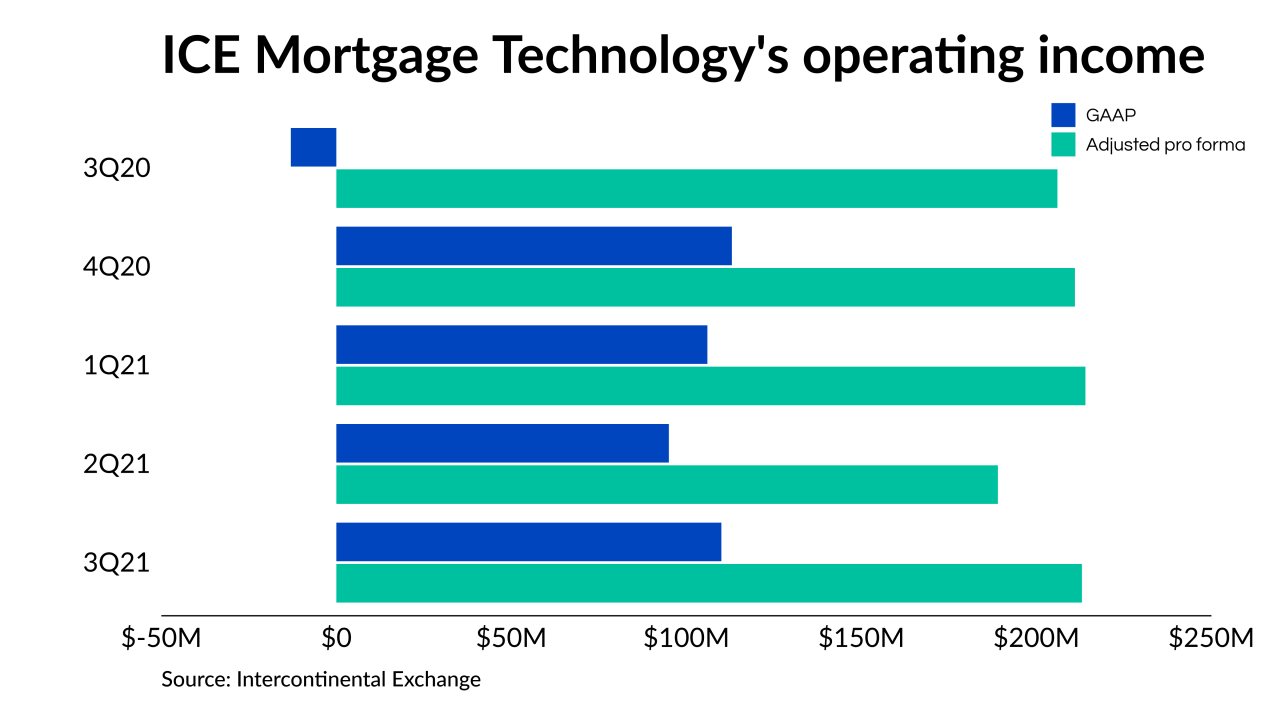

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

Application for loans to buy a home are a quarter more likely to contain misrepresentations than other loans in the market, CoreLogic said.

October 27 -

Purchases picked up, but refinances slowed for a fifth straight week, as rising interest rates took steam out of the market.

October 27 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

The MI Estimated Rate Quote application programming interface is built upon the JSON standard, used in server-to-mobile communications.

October 26 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25 -

Secretary Marcia Fudge’s statement has implications for other tribal nations in Oklahoma and may be watched closely by other government officials, housing and civil rights advocacy groups.

October 25 -

The Series B investment round for the power buyer comes at a time when all-cash purchases account for almost a quarter of the market.

October 22 -

Seasonal patterns are also playing a part in the slowdown in buyer demand, the company said.

October 22 -

Several housing groups wrote a letter calling for “substantially improved written proposals” for the period starting in 2022, and support for chattel manufactured-home loans.

October 21 -

The median selling price of an existing house rose 13.3% in September from a year ago, the smallest annual price increase since the end of 2020.

October 21 -

The 30-year average stayed above 3% for the second straight seven-day period, with improved retail sales data helping drive the uptick.

October 21 -

The two fintechs’ venture looks to solve the long-standing problem of connectivity as the barrier to full lending digitization.

October 21 -

The deal is the investment company’s second since it launched on Sept. 28.

October 20 -

The changes include a relationship tracking engine that details interactions between real estate agents and mortgage brokers.

October 20