-

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

Building timelines are finally stable enough for nonbank American Financial Resources to return to the conventional market following the pandemic-related disruption, according to a company executive.

April 23 -

Given the Biden Administration’s regulatory emphasis on the disparate impact of mortgage lender activity on protected classes, originators need to carefully monitor their loan price concessions, according to industry speakers at the Mortgage Bankers Association's Spring Conference.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

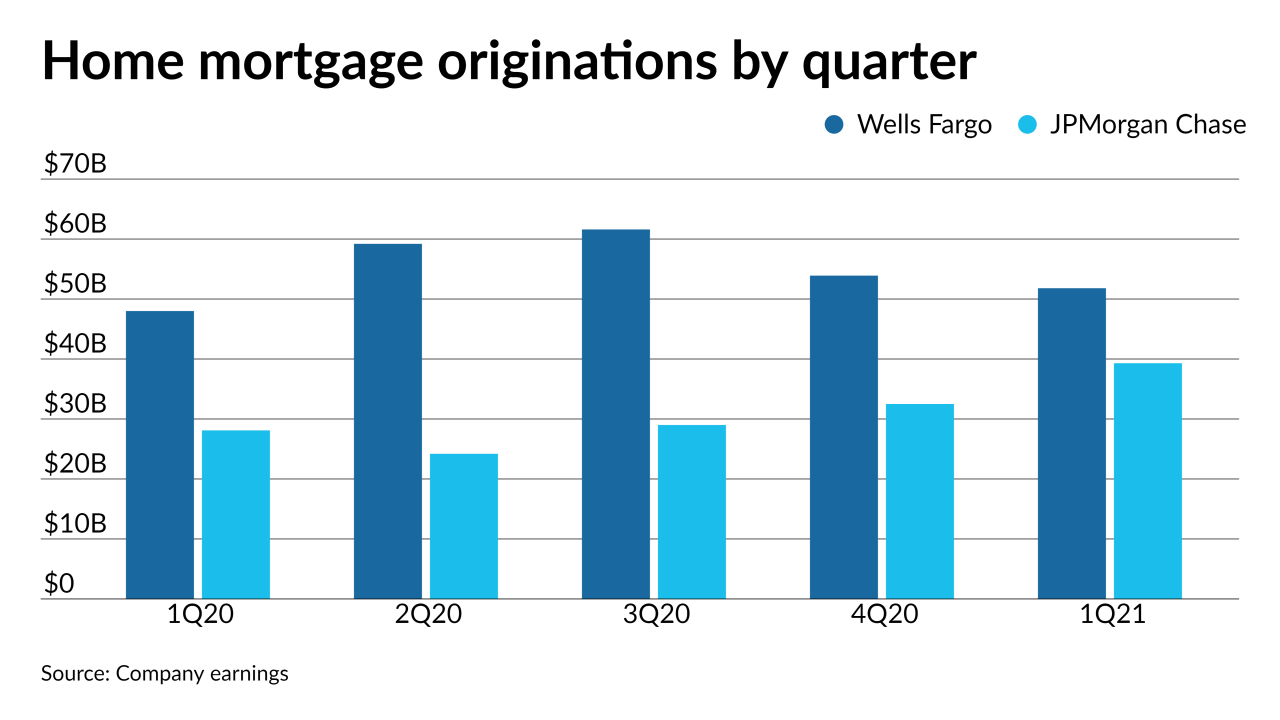

First quarter volume was up 3% among eight depositories that reported so far, compared with models that predicted industry-wide drops as large as 13%.

April 20 -

Long-term home-based operations are more likely than they were prior in March of last year, but some origination and servicing professionals will return to the office, a recent survey suggests.

April 20 -

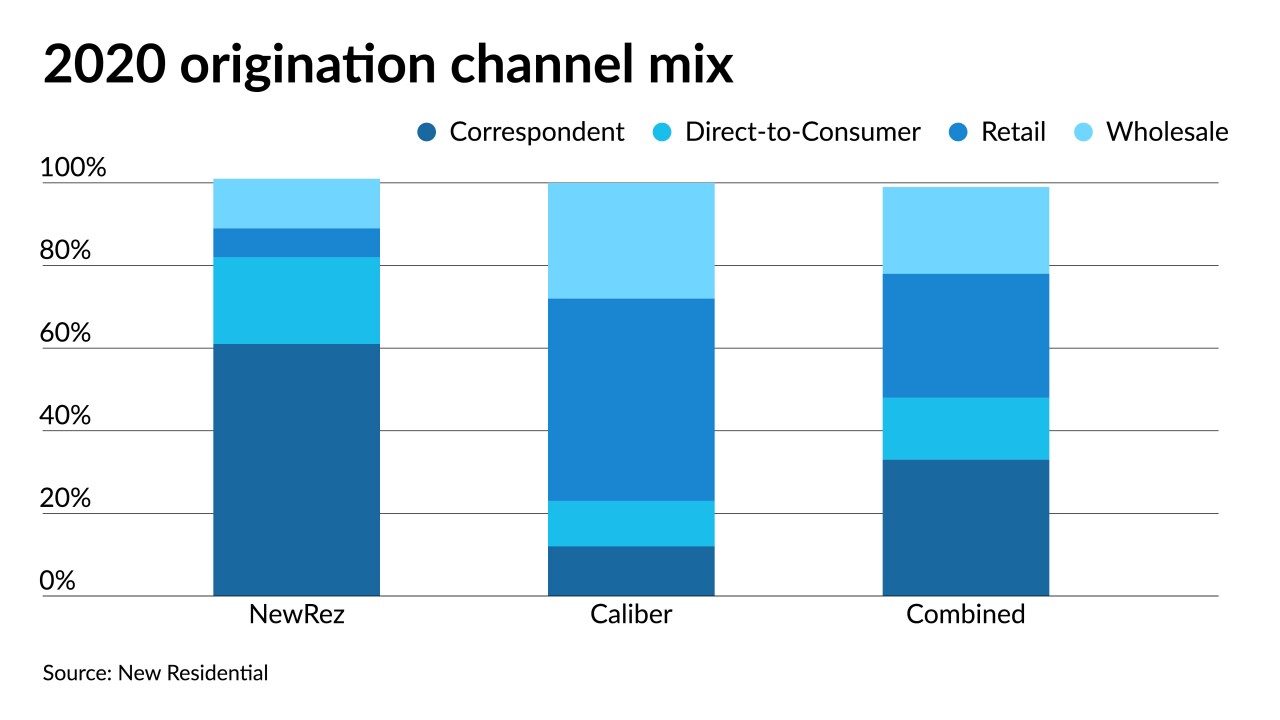

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

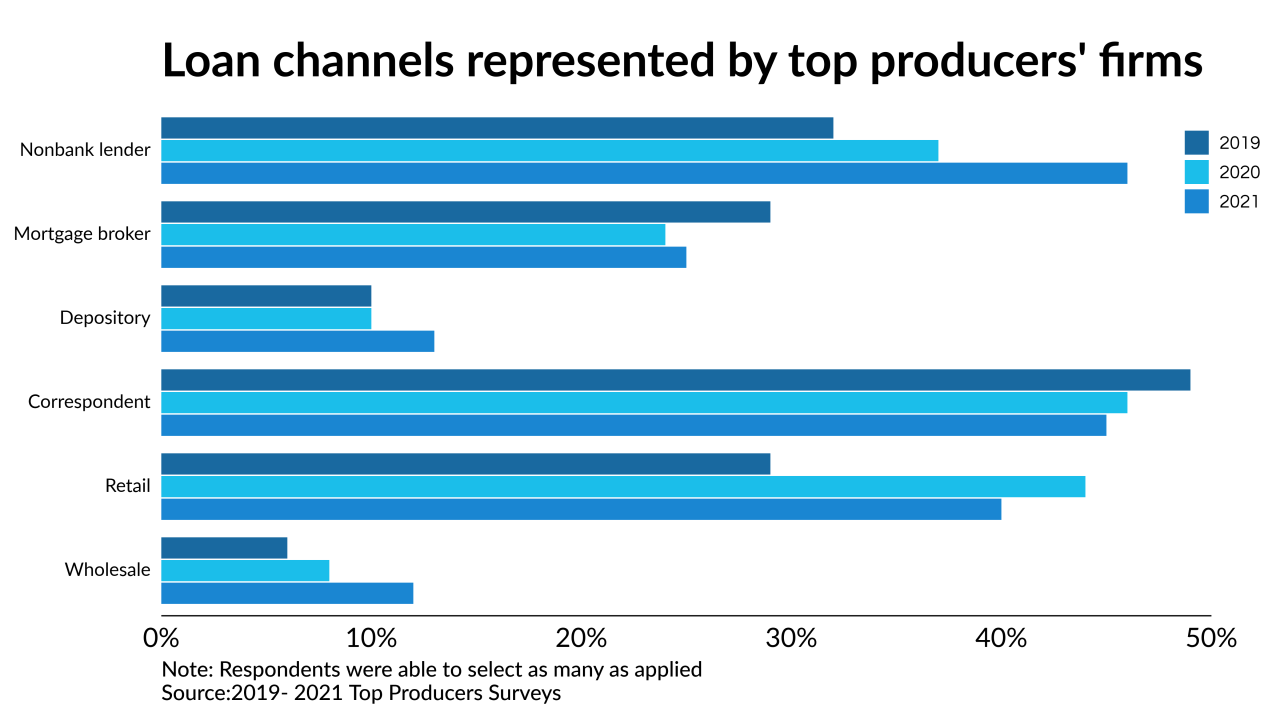

The market appears to be undergoing a shift away from refinances and remote operations, but the top producers interviewed for this article don’t plan to abandon either any time soon.

April 16 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

Gene Thompson goes to deciding what the company's next steps are, rather than implementing them.

April 16 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

The loan officers who brought in the highest volumes last year offer their perspectives on social media, the GSEs, loan channels and more.

April 15 -

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14